A) $16,000.

B) $2 per unit.

C) $20,000.

D) None of these answers is correct.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An important disadvantage of decentralization is that managers may engage in suboptimal behavior.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When using residual income as a project-screening tool, management should accept a project if the residual income is:

A) positive.

B) negative.

C) equals the ROI.

D) greater than net income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Select the correct statement regarding flexible budgets.

A) A flexible budget can only be prepared for a single level of activity.

B) A flexible budget is not used for planning.

C) A flexible budget shows expected revenues and costs at a variety of activity levels.

D) A flexible budget is also known as the master budget.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Management by exception means that only unfavorable cost variances are investigated.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Clear lines of authority and responsibility are essential to establishing a responsibility accounting system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Select the incorrect statement regarding flexible budgets.

A) Flexible budgets often show the estimated revenues and costs at multiple volume levels.

B) A flexible budget is used to compare actual to budgeted amounts.

C) A flexible budget is also known as a master budget.

D) Standard prices and costs are used in preparing a flexible budget.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Contribution margin would be the most important variable in evaluating the performance of:

A) A cost center.

B) A production center.

C) An investment center.

D) A profit center.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In an optimal responsibility accounting system, managers are evaluated on only the revenues and costs that are under their control.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When would a variance be labeled as favorable?

A) When actual costs are less than standard costs

B) When standard costs are equal to actual costs

C) When standard costs are less than actual costs

D) When estimated costs are greater than actual costs

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The general formula for return on investment is revenue divided by investment in assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A restaurant that is part of a retail store and managed by the retail manager would most likely be classified as a cost center.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The sales volume variance is favorable if actual sales volume is higher than the budgeted.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An organizational unit of a business that incurs costs and generates revenues is known as a(n) :

A) Cost center.

B) Sales center.

C) Profit center.

D) Investment center.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about residual income is true?

A) Residual income = Operating Income − Sales

B) Residual income = Operating Income − Operating Assets

C) Residual income is the amount of income in excess of a target or desired return on investment

D) None of these.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brookings Company evaluates its managers on the basis of return on investment. Division Three has a return on investment (ROI) of 15% while the company as a whole has an ROI of only 10%. Which of the following performance measures will motivate the manager of Division Three to accept a project earning a 12% return?

A) ROI

B) Residual income

C) Both ROI and residual income will motivate the manager to accept the project.

D) Neither ROI nor residual income will motivate the manager to accept the project.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

An investment opportunity with a residual income that equals or exceeds the company's required rate of return should be accepted.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

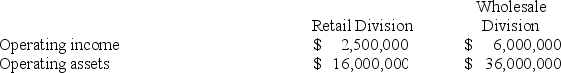

Terra Company has two divisions, the Retail Division and the Wholesale Division. The following information was gathered for the two divisions for the current year:  Terra Company has set a target return on investment (ROI) of 15% for both divisions. Based on ROI, which division appears to have performed better?

Terra Company has set a target return on investment (ROI) of 15% for both divisions. Based on ROI, which division appears to have performed better?

A) Retail division.

B) Wholesale division.

C) Both divisions have the same results.

D) The answer cannot be determined using the information provided.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

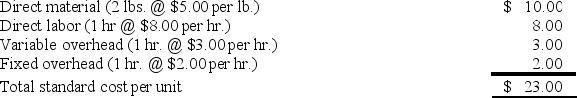

The following standard cost card is provided for Navid Company's Product A:  The fixed overhead rate is based on total budgeted fixed overhead of $12,000. During the period, the company produced and sold 5,800 units at the following costs:

Direct material 12,200 pounds @ $4.80 per pound

Direct labor 5,950 hours @ $8.00 per hour

Overhead $29,920

The standard manufacturing cost per unit is $23.00. What is the actual manufacturing cost per unit? (Do not round intermediate calculations.)

The fixed overhead rate is based on total budgeted fixed overhead of $12,000. During the period, the company produced and sold 5,800 units at the following costs:

Direct material 12,200 pounds @ $4.80 per pound

Direct labor 5,950 hours @ $8.00 per hour

Overhead $29,920

The standard manufacturing cost per unit is $23.00. What is the actual manufacturing cost per unit? (Do not round intermediate calculations.)

A) $23.46.

B) $36.16.

C) $17.96.

D) Cannot be determined from the information provided.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not typically found in a decentralized organization?

A) Cost center

B) Decision center

C) Investment center

D) Profit center

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 116

Related Exams