B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

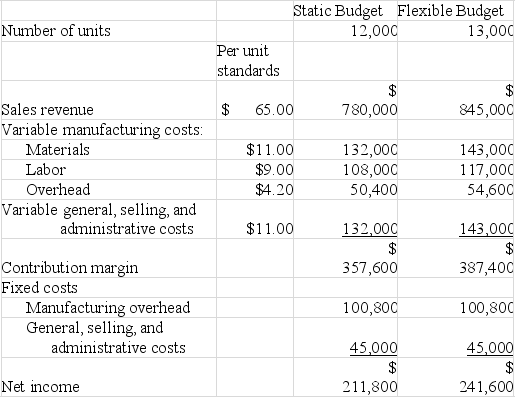

Timberlake Company planned for a production and sales volume of 12,000 units. However, the company actually made and sold 13,000 units.  What was the total variable cost volume variance?

What was the total variable cost volume variance?

A) $29,800 unfavorable

B) $29,800 favorable

C) $35,200 unfavorable

D) $35,200 favorable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a difference between a static and a flexible budget?

A) Static budgets use the same fixed cost amounts, whereas flexible budgets change the amount of fixed costs at different levels of activity.

B) Static budgets are based on the same per unit variable amount, whereas flexible budgets are based on multiple per unit variable amounts.

C) Static budgets are based on single estimate of volume, whereas flexible budgets show estimated costs and revenues at a variety of activity levels.

D) None of these answers is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Flexible budget amounts for variable costs and revenues come from multiplying standard per unit amounts by the planned volume of production.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In responsibility accounting systems, managers never are held responsible for items over which they have less than absolute control.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

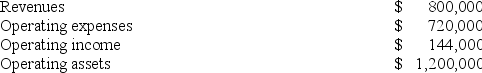

The Electronics Division of Anton Company reports the following results for the current year:  Anton Company has set a target return on investment (ROI) of 11% for the Electronics Division. The Electronic Division's turnover (asset utilization) is:

Anton Company has set a target return on investment (ROI) of 11% for the Electronics Division. The Electronic Division's turnover (asset utilization) is:

A) 0.1125.

B) 0.12.

C) 0.667.

D) 0.18.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept that says managers should be evaluated on the basis of revenues and/or expenses they can control is known as the:

A) Management by exception concept.

B) Controllability concept.

C) Responsibility concept.

D) None of these.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Delegating authority and responsibility throughout an organization is known as:

A) centralization.

B) decentralization.

C) management by exception.

D) suboptimization.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Suboptimization refers to actions taken by a manager that are in the best interest of the firm as a whole but not in his/her own best interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jacob is a department manager who recently instituted a new recognition program for his employees. He budgeted the cost of the new program at $10 per employee, but actual costs were $15 per employee. The cost associated with the recognition program would be considered which of the following kinds of cost?

A) Controllable cost

B) Opportunity cost

C) Fixed cost

D) Product cost

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

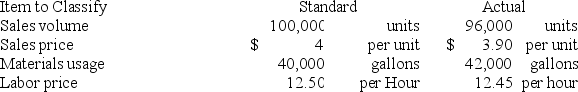

The sales volume variance was:

The sales volume variance was:

A) $16,000 favorable.

B) $16,000 unfavorable.

C) $25,000 unfavorable.

D) $25,000 favorable.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which manager is generally held responsible for the sales volume variance?

A) Purchasing agent

B) Marketing manager

C) Plant manager

D) Production manager

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The kind of responsibility center that would be evaluated by comparing income on assets to the amount of assets invested is:

A) An investment center.

B) An asset center.

C) A cost center.

D) A profit center.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Joseph Company has an investment in assets of $450,000, operating income that is 10% of sales, and an ROI of 18%. From this information the amount of operating income would be:

A) $81,000.

B) $45,000.

C) $2,500,000.

D) Impossible to determine from the information given.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The New Products Division of Testar Company, had operating income of $8,000,000 and operating assets of $44,800,000 during the current year. The New Products Division has developed a potential new product that would require $8,500,000 in operating assets and would be expected to provide $1,400,000 in operating income each year. Testar has set a target return on investment (ROI) of 16% for each of its divisions. Assuming that the new product is put into production, calculate the division's ROI.

A) 17.6%

B) 17.9%

C) 16.5%

D) The answer cannot be determined using the information provided.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is incorrect?

A) ROI is calculated as revenue divided by operating assets.

B) Operating assets are assets that are actually used to generate revenue.

C) Non-operating assets are not included in the calculation of return on investment.

D) Operating assets include both current and long-term assets.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Liam manages a division that is part of a large, decentralized business. He has a substantial degree of control over the division's costs, revenues, and investment in assets. Based on this information, the division would be classified as a profit center.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under all circumstances, unfavorable variances are bad; favorable variances are good.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

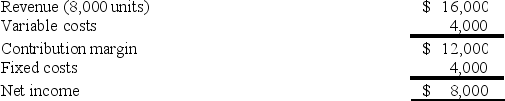

Jones Company developed the following static budget at the beginning of the company's accounting period:  If actual production totals 8,200 units, the flexible budget would show total costs of:

If actual production totals 8,200 units, the flexible budget would show total costs of:

A) $8,000.

B) $8,100.

C) $8,200.

D) None of these is correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sales volume variance is the difference between the:

A) static budget (based on actual volume) and the flexible budget (based on planned volume) .

B) static budget (based on planned volume) and the flexible budget (based on actual volume) .

C) static budget (based on planned volume) and actual revenue or cost.

D) flexible budget (based on actual volume) and actual or revenue or cost.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 116

Related Exams