A) Falling interest rates

B) Price stability

C) Price volatility

D) Unexpected events

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1973,trading of standardized options on a national exchange started on the _________.

A) AMEX

B) CBOE

C) NYSE

D) CFTC

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At contract maturity the value of a call option is ___________ where X equals the option's strike price and ST is the stock price at contract expiration.

A) Max(0, ST - X)

B) Min(0, ST - X)

C) Max(0, X - ST)

D) Min(0, X - ST)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The value of a listed call option on a stock is lower when _______________. I.the exercise price is higher II.the contract approaches maturity III.the stock decreases in value IV.a stock split occurs

A) II, III and IV only

B) I, III and IV only

C) I, II and III only

D) I, II, III and IV

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchase one IBM July 120 call contract for a premium of $5.You hold the option until the expiration date when IBM stock sells for $123 per share.You will realize a ______ on the investment.

A) $200 profit

B) $200 loss

C) $300 profit

D) $300 loss

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The maximum loss a buyer of a stock call option can suffer is the _________.

A) call premium

B) stock price

C) stock price minus the value of the call

D) strike price minus the stock price

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

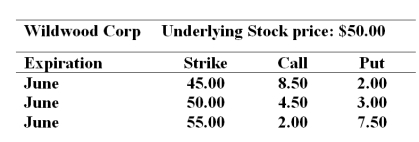

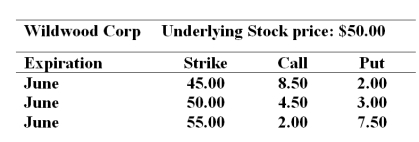

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:  -Ignoring commissions,the cost to establish the bull money spread with calls would be _______.

-Ignoring commissions,the cost to establish the bull money spread with calls would be _______.

A) $1,050

B) $650

C) $400

D) $400 income rather than cost

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A "bet" option is also called a ____ option.

A) barrier

B) lookback

C) digital

D) foreign exchange

F) C) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

You own $75,000 worth of stock and you are worried the price may fall by year end in 6 months.You are considering either using puts or calls to hedge this position.Given this,which of the following statements is/are correct? I.One way to hedge your position would be to buy puts. II.One way to hedge your position would be to write calls. III.If major stock price declines are likely the hedging with puts is probably better than hedging with short calls.

A) I only

B) II only

C) I and III only

D) I, II and III

F) All of the above

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

An option with a payoff that depends on the average price of the underlying asset during at least some portion of the life of the option is called an ______ option.

A) American

B) European

C) Asian

D) Australian

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A quanto provides its holder with ______________.

A) the right to participate in the payoffs from a portfolio of gambling casino stocks

B) the right to exchange a fixed amount of a foreign currency for dollars at a specified exchange rate

C) the right to participate in the investment performance of a foreign security

D) the right to exchange the payoff from a foreign investment for dollars at a fixed exchange rate

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is a correct statement?

A) Exercise of warrants results in more outstanding shares of stock, while exercise of listed call options does not.

B) A convertible bond consists of a straight bond plus a specified number of detachable warrants.

C) Call options always have an initial maturity greater than one year while warrants have an initial maturity less than one year.

D) Call options may be convertible into the stock while warrants are not convertible into the stock.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A European call option gives the buyer the right to _________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Advantages of exchange traded options over OTC options include all but which one of the following?

A) Ease and low cost of trading

B) Anonymity of participants

C) Contracts that are tailored to meet the needs of market participants

D) No concerns about counterparty credit risk

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:  -To establish a bull money spread with puts you would _______________.

-To establish a bull money spread with puts you would _______________.

A) sell the 55 put and buy the 45 put

B) buy the 45 put and buy the 55 put

C) buy the 55 put and sell the 45 put

D) sell the 45 put and sell the 55 put

F) A) and C)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

A convertible bond is deep in the money.This means the bond price will closely track the __________.

A) straight debt value of the bond

B) conversion value of the bond

C) straight debt value of the bond minus the conversion value

D) straight debt value of the bond plus the conversion value

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The common stock of the Avalon Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $40 is $3, and a call with the same expiration date and exercise price sells for $4. -Selling a straddle would generate total premium income of _____.

A) $300

B) $400

C) $500

D) $700

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lookback option provides its holder with _______________.

A) a payoff determined by either the maximum or minimum price of the underlying stock during the life of the option

B) a payoff determined by the difference between the maximum and minimum price of the underlying stock during the life of the option

C) a payoff if the firm's stock price falls below some specified dollar amount during the term of the option

D) a payoff based on the average price of the underlying stock over the life of the option

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following strategies makes a profit if the stock price stays stable?

A) Long call and short put

B) Long call and long put

C) Short call and short put

D) Short call and long put

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you find two bonds identical in all respects except that Bond A is convertible to common stock and Bond B is not.Bond A is priced at $1,245 and Bond B is priced at $1,120.Bond A has a promised yield to maturity of 5.6% and Bond B has a promised yield to maturity of 6.7%.The stock of Bond A is trading at $49.80 per share.Which of the following statements is/are correct? I.The value of the conversion option for Bond A is $125. II.The lower promised yield to maturity of Bond A indicates that the bond is priced according to its straight debt value rather than its conversion value. III.Bond A can be converted into 25 shares of stock.

A) II only

B) I and III only

C) III only

D) I, II and III

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 88

Related Exams