A) $300

B) $200

C) $475

D) $0

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A European put option gives its holder the right to _________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You buy a call option and a put option on General Electric.Both the call option and the put option have the same exercise price and expiration date.This strategy is called a _________.

A) time spread

B) long straddle

C) short straddle

D) money spread

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The common stock of the Avalon Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $40 is $3, and a call with the same expiration date and exercise price sells for $4. -What would be a simple options strategy using a put and a call to exploit your conviction about the stock price's future movement?

A) Sell a call

B) Purchase a put

C) Sell a straddle

D) Buy a straddle

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the statements about margin requirements on option positions is not correct?

A) The margin required will be higher if the option is in the money.

B) If the required margin exceeds the posted margin the option writer will receive a margin call.

C) A buyer of a put or call option does not have to post margin.

D) Even if the writer of a call option owns the stock the writer will have to meet the margin requirement in cash.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own a stock portfolio worth $50,000.You are worried that stock prices may take a dip before you are ready to sell so you are considering purchasing either at the money or out of the money puts.If you decide to purchase the out of the money puts your maximum loss is __________ than if you buy at the money puts and your maximum gain is __________.

A) greater; lower

B) greater; greater

C) lower; greater

D) lower; lower

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You sell one IBM July 90 call contract for a premium of $4 and two puts for a premium of $3 each.You hold the position until the expiration date when IBM stock sells for $95 per share.You will realize a ______ on this strip.

A) $300 profit

B) $100 loss

C) $500 profit

D) $200 profit

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An Asian call option gives its holder the right to ____________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at a price determined by the average stock price during some specified portion of the option's life

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at a price determined by the average stock price during some specified portion of the option's life

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A put option on Snapple Beverage has an exercise price of $30.The current stock price of Snapple Beverage is $24.25.The put option is _________.

A) at the money

B) in the money

C) out of the money

D) knocked out

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Warrants differ from listed options in that ________. I.exercise of warrants results in dilution of a firm's earnings per share II.when warrants are exercised new shares of stock must be created III.warrant exercise result in cash flows to the firm whereas exercise of listed options does not

A) I only

B) I and II only

C) II and III only

D) I, II and III

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What strategy could be considered insurance for an investment in a portfolio of stocks?

A) Covered call

B) Protective put

C) Short put

D) Straddle

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The September 14,2009 price quotation for a Boeing call option with a strike price of $50 due to expire in November is $3.50 while the stock price of Boeing is $51.The premium on one Boeing November 50 call contract is _________.

A) $1

B) $2.50

C) $250.00

D) $350.00

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

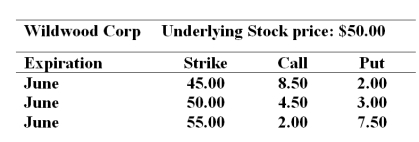

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:  -Suppose you establish a bullish money spread with the puts.In June the stock's price turns out to be $52.Ignoring commissions the net profit on your position is __.

-Suppose you establish a bullish money spread with the puts.In June the stock's price turns out to be $52.Ignoring commissions the net profit on your position is __.

A) $500

B) $700

C) $200

D) $250

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You invest in the stock of Valleyview Corp.and purchase a put option on Valleyview Corp.This strategy is called a _________.

A) long straddle

B) naked put

C) protective put

D) short stroll

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A down-and-out option is one type of ________ option.

A) barrier

B) lookback

C) digital

D) Asian

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you purchase one Texas Instruments August 75 call contract quoted at $8.50 and write one Texas Instruments August 80 call contract quoted at $6.If,at expiration,the price of a share of Texas Instruments stock is $79,your profit would be _________.

A) $150

B) $400

C) $600

D) $1,850

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchase one IBM July 120 put contract for a premium of $3.You hold the option until the expiration date when IBM stock sells for $123 per share.You will realize a ______ on the investment.

A) $300 profit

B) $300 loss

C) $500 loss

D) $200 profit

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You buy a call option on Merritt Corp.with an exercise price of $50 and an expiration date in July and write a call option on Merritt Corp.with an exercise price of $55 with an expiration date in July.This is called a ________.

A) time spread

B) long straddle

C) short straddle

D) money spread

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You find digital option quotes on jobless claims.You can buy a call option with a strike price of 300,000 jobless claims.This option pays $100 if actual claims exceed the strike price and pays zero otherwise.The option costs $68.A second digital call with a strike price of 305,000 jobless claims is available at a cost of $53.Suppose you buy the option with the 300,000 strike and sell the option with the 305,000 strike and jobless claims actually wind up at 303,000 your net profit on the position is ______.

A) -$15

B) $200

C) $85

D) $185

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchase one IBM March 120 put contract for a put premium of $10.The maximum profit that you could gain from this strategy is _________.

A) $120

B) $1,000

C) $11,000

D) $12,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 88

Related Exams