A) Buy gold in the spot with borrowed money and sell the futures contract

B) Buy the futures contract and sell the gold spot and invest the money earned

C) Buy gold spot with borrowed money and buy the futures contract

D) Buy the futures contract and buy the gold spot using borrowed money

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

On January 1,you sold one April S&P 500 index futures contract at a futures price of 1300.If the April futures price is 1250 on February 1,your profit would be __________ if you close your position.(The contract multiplier is 250.)

A) -$12,500

B) -$15,000

C) $15,000

D) $12,500

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You believe that the spread between the September T-bond contract and the June T-bond futures contract is too large and will soon correct.This market exhibits positive cost of carry for all contracts.To take advantage of this you should ______________.

A) buy the September contract and sell the June contract

B) sell the September contract and buy the June contract

C) sell the September contract and sell the June contract

D) buy the September contract and buy the June contract

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchase an interest rate futures contract that has an initial margin requirement of 15% and a futures price of $115,098.The contract has a $100,000 underlying par value bond.If the futures price falls to $108,000 you will experience a ______ percent loss on your money invested.

A) 31

B) 41

C) 52

D) 64

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor would want to __________ to hedge a long position in treasury bonds.

A) buy interest rate futures

B) buy treasury bonds in the spot market

C) sell interest rate futures

D) sell S&P 500 futures

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Single stock futures,as opposed to stock index futures,are _______________.

A) not yet being offered by any exchanges

B) offered overseas but not in the U.S.

C) currently trading on OneChicago, a joint venture of several exchanges

D) scheduled to begin trading in 2010 at various exchanges

F) A) and B)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

A market timer now believes that the economy will soften over the rest of the year as the housing market slump continues and he also believes that foreign investors will stop buying U.S.fixed income securities in such large quantities as they have in the past.One way the timer could take advantage of this forecast is to ________________.

A) buy T-bond futures and sell stock index futures

B) sell T-bond futures and but stock index futures

C) buy stock index futures and buy T-bond futures

D) sell stock index futures and sell T-bond futures

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A one year gold futures contract is selling for $641. Spot gold prices are $600 and the one year risk free rate is 6%. -A hypothetical futures contract on a non-dividend-paying stock with current spot price of $100 has a maturity of one year.If the T-bill rate is 5% what should the futures price be?

A) $95.24

B) $100

C) $105

D) $107

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At contract maturity the basis should equal ___________.

A) 1

B) 0

C) risk-free interest rate

D) -1

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

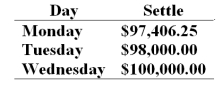

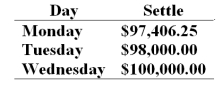

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700 and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer questions 67 through 70.  -At the close of day Tuesday your cumulative rate of return on your investment is

-At the close of day Tuesday your cumulative rate of return on your investment is

A) 16.2%

B) -5.8%

C) -0.16%

D) -2.2%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors who take short positions in futures contract agree to ___________ delivery of the commodity on the delivery date,and those who take long positions agree to __________ delivery of the commodity.

A) make; make

B) make; take

C) take; make

D) take; take

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Recently most of the growth in the number of contracts traded on the Chicago Board of Trade has come in the _______ contracts.

A) metals

B) agriculture

C) financial

D) commodity

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Margin requirements for futures contracts can be met by ______________.

A) cash only

B) cash or highly marketable securities such as Treasury bills

C) cash or any marketable securities

D) cash or warehouse receipts for an equivalent quantity of the underlying commodity

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The CME weather futures contract is an example of ______________.

A) a cash settled contract

B) an agricultural contract

C) a financial future

D) a commodity future

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97,843.75. The contract's face value is $100,000. The initial margin requirement is $2,700 and the maintenance margin requirement is $2,000 per contract. Use the following price data to answer questions 67 through 70.  -If rf is greater than d then we know that _______________.

-If rf is greater than d then we know that _______________.

A) the futures price will be higher as contract maturity increases

B) F0 < S0

C) FT > ST

D) arbitrage profits are possible

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor who goes long in a futures contract will _____ any increase in value of the underlying asset and will _____ any decrease in value in the underlying asset.

A) pay; pay

B) pay; receive

C) receive; pay

D) receive; receive

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A short hedge is a simultaneous __________ position in the spot market and a __________ position in the futures market.

A) long; long

B) long; short

C) short; long

D) short; short

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fact that the exchange is the counter-party to every futures contract issued is important because it eliminates _________ risk.

A) market

B) credit

C) interest rate

D) basis

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A speculator will often prefer to buy a futures contract rather than the underlying asset because ____________. I.gains in futures contracts can be larger due to leverage II.transaction costs in futures are typically lower than in spot markets III.futures markets are often more liquid than the markets of the underlying commodities

A) I and II only

B) II and III only

C) I and III only

D) I, II and III

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor who is hedging a corporate bond portfolio using a T-bond futures contract is said to have a(n) _______.

A) arbitrage

B) cross-hedge

C) over-hedge

D) spread-hedge

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 87

Related Exams