A) debts of chartered banks and other financial institutions.

B) debts of the Bank of Canada.

C) credits of the Bank of Canada.

D) credits of chartered banks and other financial institutions.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

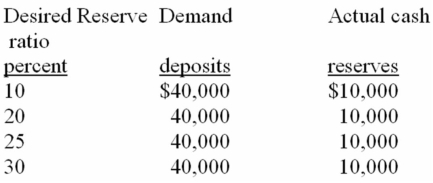

Refer to the information below.When the desired reserve ratio is 25 percent,the excess reserves of this single bank are:

A) zero dollars.

B) $1,000

C) $5,000

D) $30,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

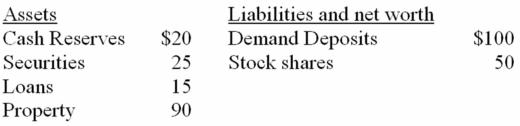

The following balance sheet is for the First Edmonton Bank.Assume that the desired reserve ratio is 10%.All figures are in millions.

-Refer to the above information.Suppose that customers of this bank collectively write cheques for cash at the bank in the amount of $1 million.As a result,the bank's excess reserves diminish to:

-Refer to the above information.Suppose that customers of this bank collectively write cheques for cash at the bank in the amount of $1 million.As a result,the bank's excess reserves diminish to:

A) $0

B) $6 million.

C) $9 million.

D) $9.1 million.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A chartered bank has demand-deposit liabilities of $500,000,cash reserves of $150,000,and a desired reserve ratio of 20 percent.The amount by which this single chartered bank and the amount by which the banking system can increase loans are respectively:

A) $30,000 and $150,000.

B) $50,000 and $250,000.

C) $50,000 and $500,000.

D) $100,000 and $500,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If D equals the maximum amount of new demand-deposit money that can be created by the banking system on the basis of any given amount of excess reserves;E equals the amount of excess reserves;and m is the money multiplier,then we can say that:

A) m = E/D.

B) D = E × m.

C) D = E - 1/m.

D) D = m/E.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between M1 and M2 is that:

A) the former includes notice deposits.

B) the latter includes personal saving deposits and non-personal notice deposits.

C) the latter includes government bonds.

D) the latter includes cash held by chartered banks.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

One of the three basic functions of money is to serve as legal tender.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The prime rate is:

A) the interest rate charged by the chartered banks in Canada for lending to their best corporate customers.

B) the interest rate charged by the chartered banks in Canada for lending to other financial intermediaries.

C) the interest rate charged by the chartered banks in Canada for lending to the Federal government.

D) the interest rate charged by the chartered banks in Canada for lending to the trust companies.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The money supply is "backed":

A) by the government's ability to control the supply of money and therefore to keep its value relatively stable.

B) by government bonds.

C) dollar-for-dollar with gold and silver.

D) dollar-for-dollar with gold bullion.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the fractional reserve banking system:

A) half of the total money supply is held in reserves as currency

B) a fraction of the total money supply is held in reserves as currency.

C) an amount equal to the total money supply is held in reserves as currency.

D) no fraction of the total money supply is held in reserves as currency.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a chartered bank has demand deposits of $500,000 and the desired reserve ratio is 10 percent.If the institution has excess reserves of $4,000,then its actual cash reserves are:

A) $46,000

B) $50,000

C) $4,000

D) $54,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The major component of the money supply (M1) is:

A) gold certificates.

B) demand deposits.

C) paper money in circulation.

D) coins.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the desired reserve ratio were 15 percent,the value of the monetary multiplier would be:

A) 5.50.

B) 6.67.

C) 7.32.

D) 8.54.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the ABC bank has excess reserves of $4,000 and outstanding demand deposits of $80,000.If the desired reserve ratio is 25 percent,what is the size of the bank's actual cash reserves?

A) $16,000

B) $84,000

C) $24,000

D) $20,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a coin is token money,its face value is greater than its intrinsic value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes the fundamental identity embodied in a balance sheet?

A) Net Worth plus Assets equal Liabilities

B) Assets plus Liabilities equal Net Worth

C) Assets equal Liabilities plus Net Worth

D) Assets plus Reserves equal Net Worth

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The banking system can lend by a multiple of its excess reserves because lending does not result in a loss of reserves to the banking system as a whole.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

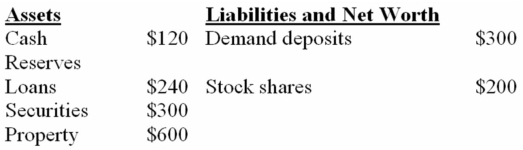

The following is a consolidated balance sheet for the chartered banking system.All figures are in billions.Assume that the desired reserve ratio is 20 percent.

-Refer to the above information.If there is a deposit of $10 billion of new currency into chequing accounts in the banking system,excess reserves will increase by:

-Refer to the above information.If there is a deposit of $10 billion of new currency into chequing accounts in the banking system,excess reserves will increase by:

A) $1 billion.

B) $2 billion.

C) $8 billion.

D) $10 billion.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price index rises from 100 to 130,the value of the dollar will fall by about:

A) 15 percent.

B) 19 percent.

C) 30 percent.

D) 23 percent.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 15 percent increase in the price

A) increases the value of a dollar by 15 percent.

B) decreases the value of a dollar by about 13 percent.

C) decreases the value of a dollar by 15 percent.

D) decreases the value of a dollar by about 8 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 203

Related Exams