A) $300 and 2.5.

B) $450 and 5.

C) $400 and 4.

D) $400 and 5.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which event would most likely decrease an economy's exports?

A) a decline in the tariff on products imported from abroad

B) an increase the prosperity of trading partners for this economy

C) an appreciation of a nation's currency relative to foreign currencies

D) a depreciation of a nation's currency relative to foreign currencies

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-If the equilibrium level of GDP in a private open economy is $1000 billion and consumption is $700 billion at that level of GDP,then:

-If the equilibrium level of GDP in a private open economy is $1000 billion and consumption is $700 billion at that level of GDP,then:

A) unplanned investment must be occurring.

B) net exports must be $300 billion.

C) S + C must equal $300 billion.

D) Ig + Xn must equal $300 billion.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

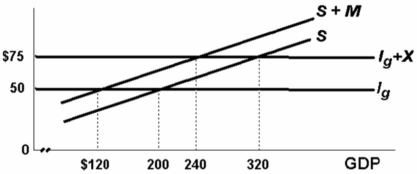

-In the above private open economy exports are __________ and imports are __________ domestic GDP:

-In the above private open economy exports are __________ and imports are __________ domestic GDP:

A) inversely related to;directly related to

B) independent of;inversely related to

C) independent of;dependent of

D) directly related to;independent of

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the recession of 2008 - 2009:

A) both after-tax consumption and government expenditures declined.

B) both after-tax consumption and investment expenditures declined.

C) both government expenditures and investment expenditures declined.

D) government expenditures declined but after- tax consumption

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

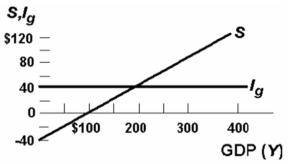

-Refer to the above diagram for a private closed economy.At the $300 level of GDP:

-Refer to the above diagram for a private closed economy.At the $300 level of GDP:

A) planned investment will exceed saving,but actual investment will be equal to saving.

B) aggregate expenditures will exceed GDP,causing GDP to rise.

C) actual investment will exceed planned investment.

D) households will consume in excess of their incomes.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If lump-sum taxes are decreased by $10 billion and the equilibrium GDP increases by $40 billion as a result,we can conclude that:

A) the expenditures multiplier is 4.

B) the MPC for this economy is .8.

C) the MPC for this economy is .6.

D) the expenditures multiplier is 3.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things equal,if $100 billion of government purchases (G) is added to private spending (C + Ig + Xn) ,GDP will:

A) increase by $100 billion.

B) increase by more than $100 billion.

C) increase by less than $100 billion.

D) fall by $100 billion

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a lump-sum tax of $40 billion is imposed and the MPC is 0.6,the saving schedule will:

A) shift downward by $24 billion.

B) shift upward by $24 billion.

C) shift downward by $16 billion.

D) shift upward by $16 billion.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the economy is in equilibrium at the $400 billion level of GDP and the full-employment level of GDP is $500 billion:

A) real and nominal GDP will both increase.

B) economy does not reach full-employment unless aggregate expenditures increases.

C) real GDP will increase,but nominal GDP will decrease.

D) the price level will increase.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Planned investment equals saving:

A) at all levels of GDP.

B) at all below-equilibrium levels of GDP.

C) at all above-equilibrium levels of GDP.

D) only at the equilibrium GDP.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Equal increases in government purchases and taxes will:

A) increase the equilibrium GDP and the size of that increase varies directly with the size of the MPC.

B) increase the equilibrium GDP and the size of that increase is independent of the size of the MPC.

C) increase the equilibrium GDP and the size of that increase varies inversely with the size of the MPC.

D) decrease the equilibrium GDP and the size of that decrease is independent of the size of the MPC.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to the above diagram for a private closed economy.Planned and actual investment will be equal at:

-Refer to the above diagram for a private closed economy.Planned and actual investment will be equal at:

A) all levels of GDP below $200.

B) all levels of GDP above $200.

C) all levels of GDP between $200 and $600.

D) $600 only.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that in a private closed economy consumption is $240 billion and investment is $50 billion at the $280 billion level of domestic output.Thus:

A) saving is $10 billion.

B) unplanned disinvestment of $10 billion will occur.

C) the MPC is .80.

D) unplanned investment of $10 billion will occur.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

For given data the aggregate expenditures-domestic output and the saving-investment approaches will yield the same equilibrium level of GDP.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

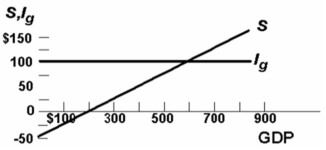

The following information is for a private closed economy,where Ig is gross investment,S is saving,and Y is gross domestic product (GDP) . Ig = 80 S = -80 + .4Y -Refer to the above information.The equilibrium GDP will be:

A) $160

B) $400

C) $360

D) $480

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-The multiplier for the economy in the above diagram:

-The multiplier for the economy in the above diagram:

A) is 3.

B) is 4.

C) is 4.8.

D) is 5.4.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In moving from a private closed to a mixed closed economy in the aggregate expenditures model,taxes:

A) must be added to gross investment.

B) must be added to saving.

C) must be added to consumption and gross investment.

D) have no impact upon the equilibrium GDP.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

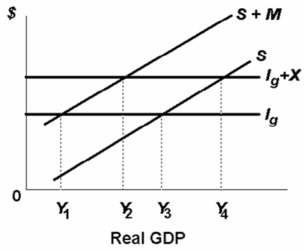

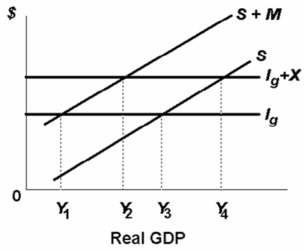

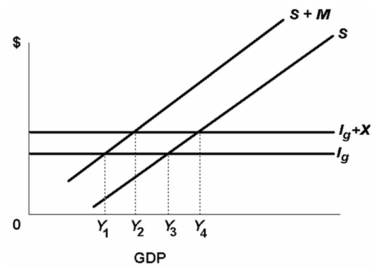

-Refer to the above diagram.The equilibrium level of GDP for this private open economy is Y3.

-Refer to the above diagram.The equilibrium level of GDP for this private open economy is Y3.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that an economy is operating at less than its full-employment level of output.Which event would most likely increase an economy's exports?

A) a rise in the tariff on products imported from abroad

B) a fall in the prosperity of trading partners for this economy

C) an appreciation of a nation's currency relative to foreign currencies

D) a depreciation of a nation's currency relative to foreign currencies

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 230

Related Exams