B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

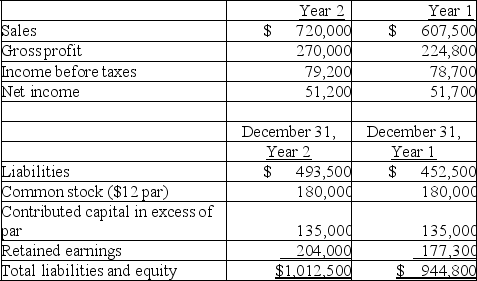

Refer to the following selected financial information from Winterfell Company.Compute the company's debt to equity for Year 2.

A) 0.9.

B) 1.1.

C) 0.5.

D) 1.9.

E) 2.1.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current assets minus current liabilities is:

A) Profit margin.

B) Financial leverage.

C) Current ratio.

D) Working capital.

E) Quick assets.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The base amount for a common-size balance sheet is usually total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following selected financial information from Troy Manufacturing.

-Compute the company's current ratio.

-Compute the company's current ratio.

A) 6.44.

B) 2.84.

C) 6.27.

D) 3.60.

E) 1.44.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

The standards for comparisons when interpreting measures from financial statement analysis include (1)________,(2)________,(3)________,and (4)________.

Correct Answer

verified

intracompany; compet...View Answer

Show Answer

Correct Answer

verified

View Answer

Multiple Choice

The measurement of key relations among financial statement items is known as:

A) Financial reporting.

B) Horizontal analysis.

C) Investment analysis.

D) Ratio analysis.

E) Risk analysis.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Comparative calendar year financial data for a company are shown below.Calculate the following ratios for Year 2:

(a)return on total assets

(b)return on common stockholders' equity.

Correct Answer

verified

Correct Answer

verified

True/False

External users of accounting information manage and operate the company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following selected financial information from Texas Electronics.

-Compute the company's current ratio for Year 2.

-Compute the company's current ratio for Year 2.

A) 2.26.

B) 1.98.

C) 2.95.

D) 3.05.

E) 1.88.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Capital structure measures a company's ability to earn net income from sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The greater the times interest earned ratio,the greater the risk a company will not be able to pay interest expense.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Market prospects is the ability to meet short-term obligations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Powers Company reported net sales of $1,200,000,average Accounts Receivable,net of $78,500,and net income of $51,025.The Day's sales uncollected (rounded to whole days) is:

A) 24 days.

B) 15 days.

C) 4 days.

D) 562 days.

E) 48 days

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The evaluation of company performance and financial condition includes evaluation of (1)past and current performance,(2)current financial position,and (3)future performance and risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal analysis is used to understand the relative importance of each financial statement item.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carducci Corporation reported net sales of $3.6 million,average total assets of $1.1 million,and net income of $847,000.The total asset turnover is:

A) 0.31 times.

B) 3.27 times.

C) 4.30 times.

D) 2.27 times.

E) 0.77 times.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

________ financial statements are reports where financial amounts are placed side-by-side in columns on a single statement for analytical purposes.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following selected financial information from Phantom Corp.

-Compute the company's days' sales in inventory for Year 2.(Use 365 days a year.)

-Compute the company's days' sales in inventory for Year 2.(Use 365 days a year.)

A) 203.4.

B) 228.4.

C) 179.5.

D) 215.1.

E) 113.3.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's sales in Year 1 were $250,000 and in Year 2 were $287,500.Using Year 1 as the base year,the percent change for Year 2 compared to the base year is:

A) 87%.

B) 100%.

C) 115%.

D) 15%.

E) 13%.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 245

Related Exams