A) Revenue expenditure.

B) Asset expenditure.

C) Long-term expenditure.

D) Contributed capital expenditure.

E) Balance sheet expenditure.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A change in an accounting estimate is:

A) Reflected in past financial statements.

B) Reflected in future financial statements and also requires modification of past statements.

C) Reflected in current and future years' financial statements,not in prior statements.

D) Not allowed under current accounting rules.

E) Considered an error in the financial statements.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Depreciation expense is calculated using its cost,estimates of an asset's salvage value,and an estimated useful life.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A total asset turnover ratio of 3.5 indicates that:

A) For every $1 in sales,the firm acquired $3.50 in assets during the period.

B) For every $1 in assets,the firm produced $3.50 in net sales during the period.

C) For every $1 in assets,the firm earned gross profit of $3.50 during the period.

D) For every $1 in assets,the firm earned $3.50 in net income.

E) For every $1 in assets,the firm paid $3.50 in expenses during the period.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mohr Company purchases a machine at the beginning of the year at a cost of $24,000.The machine is depreciated using the straight-line method. -The machine's useful life is estimated to be 5 years with a $4,000 salvage value.The book value of the machine at the end of year 2 is:

A) $4,000.

B) $8,000.

C) $12,000.

D) $16,000.

E) $20,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Essay

On July 1 of the current year,Timberlake Company signed a contract to lease space in a building for 7 years.After taking possession of the leased space,Timberlake pays $140,000 for improving the office portion of the lease space.The improvements are paid on July 2 of the current year,and are estimated to have a useful life equal to 13 years.Prepare entries for Timberlake to record (a)its payment for the office improvements,(b)the December 31 year-end entry to amortize the office improvements.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Betterments are:

A) Expenditures making a plant asset more efficient or productive.

B) Also called ordinary repairs.

C) Always increase an asset's life.

D) Revenue expenditures.

E) Credited against the asset account when incurred.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Total asset turnover is calculated by dividing net sales by average total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The depreciation method that produces larger depreciation expense during the early years of an asset's life and smaller expense in the later years is a(an) :

A) Accelerated depreciation method.

B) Book value depreciation method.

C) Straight-line depreciation method.

D) Units-of-production depreciation method.

E) Unrealized depreciation method.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An asset's cost includes all normal and reasonable expenditures necessary to get the asset in place and ready for its intended use.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total cost of an asset less its accumulated depreciation is called:

A) Historical cost.

B) Book value.

C) Present value.

D) Current (market) value.

E) Replacement cost.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

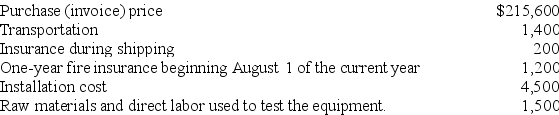

A company purchased equipment on June 28 of the current year and placed it in service on August 1.The following costs were incurred in acquiring the equipment:

Determine the amount to be recorded as cost for the equipment.

Determine the amount to be recorded as cost for the equipment.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wickland Company installs a manufacturing machine in its production facility at the beginning of the year at a cost of $87,000.The machine's useful life is estimated to be 5 years,or 400,000 units of product,with a $7,000 salvage value.During its second year,the machine produces 84,500 units of product. -Determine the machines' second year depreciation under the double-declining-balance method.

A) $16,900.

B) $16,000.

C) $17,400.

D) $18,379.

E) $20,880.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

A company exchanged its used machine for a new machine in a transaction that had commercial substance.The old machine cost $68,000,and the new one had a cash price of $95,000.The company had taken $59,000 depreciation on the old machine and was allowed a $2,500 trade-in allowance and the balance of $92,500 was paid in cash.What gain or loss should be recorded on the exchange?

Correct Answer

verified

Correct Answer

verified

True/False

Obsolescence refers to plant assets that typically have longer useful lives and higher salvage values.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minor Company installs a machine in its factory at the beginning of the year at a cost of $135,000.The machine's useful life is estimated to be 5 years,or 300,000 units of product,with a $15,000 salvage value.During its first year,the machine produces 64,500 units of product. -Determine the machines' first year depreciation under the straight-line method.

A) $27,000.

B) $29,025.

C) $25,800.

D) $23,779.

E) $24,000.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A leasehold is:

A) A short-term rental agreement.

B) The same as a patent.

C) The rights granted to the lessee by the lessor of a lease.

D) Recorded as revenue expenditure when paid.

E) An asset held as an investment.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Revenue expenditures are also called balance sheet expenditures.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 241 - 258 of 258

Related Exams