Correct Answer

verified

Correct Answer

verified

Multiple Choice

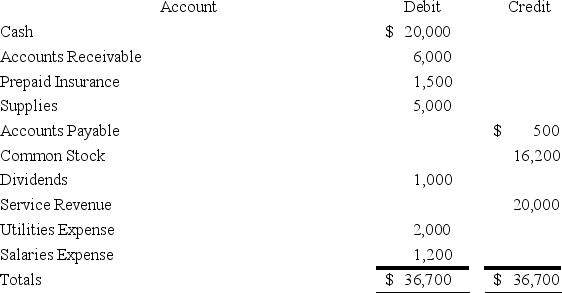

Jackson Services had the following accounts and balances at December 31:  Using the information in the table,calculate the company's reported net income for the period.

Using the information in the table,calculate the company's reported net income for the period.

A) $16,800.

B) $15,800.

C) $15,300.

D) $10,300.

E) $23,200.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Edison Consulting received a $300 utilities bill and immediately paid it.Edison's general journal entry to record this transaction will include a:

A) Debit to Utilities Expense for $300.

B) Credit to Accounts Payable for $300.

C) Debit to Cash for $300.

D) Credit to Utilities Expense for $300.

E) Debit to Accounts Payable for $300.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

At a given point in time,a trial balance is a list of all ledger accounts and their balances.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A law firm collected $1,800 in advance for work to be performed in three months.Which of the following general journal entries will the firm make to record this transaction?

A) Debit Accounts Receivable,$1,800; credit Unearned Legal Fees Revenue,$1,800.

B) Debit Cash,$1,800; credit Unearned Legal Fees Revenue,$1,800.

C) Debit Legal Fees Revenue,$1,800; credit Accounts Receivable,$1,800.

D) Debit Accounts Receivable,$1,800; credit Legal Fees Revenue,$1,800.

E) Debit Cash,$1,800; credit Accounts Receivable,$1,800.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Essay

Rowdy Bolton began Bolton Office Services in October and during that month completed these transactions: a.Invested $10,000 cash and $15,000 of computer equipment in the business in exchange for common stock. b.Paid $500 cash for an insurance premium covering the next 12 months. c.Completed office services for a customer and collected $1,000 cash. d.Paid $200 cash for office supplies. e.Paid $2,000 for October's rent. Prepare journal entries to record the above transactions.Explanations are unnecessary.

Correct Answer

verified

Correct Answer

verified

True/False

If a company purchases equipment paying cash,the journal entry to record this transaction will include a debit to Cash.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jennings Co.has total assets of $425 million.Its total liabilities are $110.5 million.Its equity is $314.5 million.Calculate the debt ratio.

A) 38%.

B) 13%.

C) 34%.

D) 26%.

E) 14%.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of the current year,James Co.reported total liabilities of $300,000 and total equity of $100,000.The company's debt ratio was:

A) 300%.

B) 33%.

C) 75%.

D) 67%.

E) $400,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The heading on every financial statement lists the three W's-Who (the name of the business); What (the name of the statement); and Where (the organization's address).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT an asset account:

A) Cash

B) Land

C) Services Revenue

D) Buildings

E) Equipment

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company provides services to a customer on credit,the company providing the service should credit Accounts Receivable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $15 credit to Sales was posted as a $150 credit.By what amount is the Sales account in error?

A) $150 understated.

B) $135 overstated.

C) $150 overstated.

D) $15 understated.

E) $135 understated.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A company's chart of accounts is a list of all the accounts used and includes an identification number assigned to each account.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

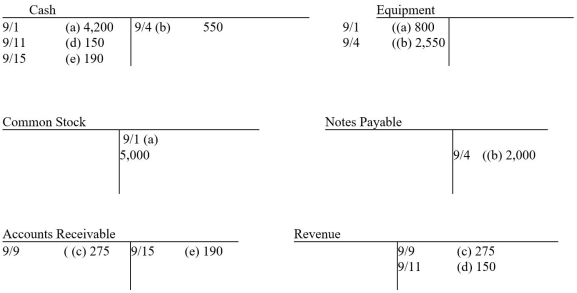

Jarrod Automotive,owned and operated by Jarrod Johnson,began business in September of the current year.Jarrod,a mechanic,had no experience with recording business transactions.As a result,Jarrod entered all of September's transactions directly into the ledger accounts.When he tried to locate a particular entry he found it confusing and time consuming.He has hired you to improve his accounting procedures.The accounts in his General Ledger follow:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Silvia's Studio provided $150 of dance instruction and rented out its dance studio to the same client for another $100.The client paid cash immediately.Identify the general journal entry below that Silvia's Studio will make to record the transaction.

A) ![]()

B) ![]()

C) ![]()

D) ![]()

E) ![]()

G) A) and E)

Correct Answer

verified

Correct Answer

verified

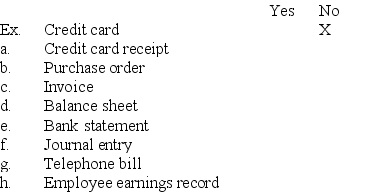

Essay

Identify by marking an X in the appropriate column,whether each of the following items would likely serve as a source document.The first one is done as an example

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bookkeeper has debited an asset account for $3,500 and credited a liability account for $2,000.Which of the following would be an incorrect way to complete the recording of this transaction:

A) Credit another asset account for $1,500.

B) Credit another liability account for $1,500.

C) Credit a revenue account for $1,500.

D) Credit the common stock account for $1,500.

E) Debit another asset account for $1,500.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

While in the process of posting from the journal to the ledger,a company failed to post a $500 debit to the Equipment account.The effect of this error will be that:

A) The Equipment account balance will be overstated.

B) The trial balance will not balance.

C) The error will overstate the debits listed in the journal.

D) The total debits in the trial balance will be larger than the total credits.

E) The error will overstate the credits listed in the journal.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debit is used to record which of the following:

A) A decrease in an asset account.

B) A decrease in an expense account.

C) An increase in a revenue account.

D) An increase in the common stock account.

E) An increase in the dividends account.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 221 - 240 of 251

Related Exams