A) Revenues.

B) Expenses.

C) Dividends.

D) Beginning Retained Earnings.

E) Cash.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Financing activities provide the resources organizations use to pay for resources such as land,buildings,and equipment.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

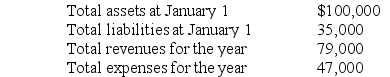

Data for Kennedy Realty are as follows:

Dividends of $30,000 were paid during the year.There were no stockholder investments.Using the above data,prepare Kennedy Realty's Statement of Retained Earnings for the year ended December 31.

Dividends of $30,000 were paid during the year.There were no stockholder investments.Using the above data,prepare Kennedy Realty's Statement of Retained Earnings for the year ended December 31.

Correct Answer

verified

Correct Answer

verified

True/False

Internal users include lenders,shareholders,brokers and nonexecutive employees.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The accounting equation can be restated as: Assets − Equity = Liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accounting is an information and measurement system that identifies,records,and communicates an organization's business activities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

External auditors examine financial statements to verify that they are prepared according to generally accepted accounting principles.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

________ are the increases in equity from a company's sales of products and services to customers.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting equation for Ying Company shows a decrease in its assets and a decrease in its equity.Which of the following transactions could have caused that effect?

A) Cash was received from providing services to a customer.

B) The company paid an amount due on credit.

C) Equipment was purchased for cash.

D) A utility bill was received for the current month,to be paid in the following month.

E) Advertising expense for the month was paid in cash.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If assets are $99,000 and liabilities are $32,000,then equity equals:

A) $32,000.

B) $67,000.

C) $99,000.

D) $131,000.

E) $198,000.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Revenues are:

A) The same as net income.

B) The excess of expenses over assets.

C) Resources owned or controlled by a company.

D) The increase in equity from a company's sales of products and services.

E) The costs of assets or services used.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Determine the net income of a company for which the following information is available for the month of July.

A) $190,000.

B) $210,000.

C) $230,000.

D) $400,000.

E) $610,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors is not a component of the fraud triangle?

A) Opportunity

B) Pressure

C) Rationalization

D) All of the above are components of the fraud triangle.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Specific accounting principles are basic assumptions,concepts,and guidelines for preparing financial statements and arise out of long-used accounting practice.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The time period assumption:

A) Means that accounting information reflects a presumption that the business will continue operating instead of being closed or sold.

B) Means that we can express transactions and events in monetary,or money,units.

C) Presumes that the life of a company can be divided into time periods,such as months and years,and that useful reports can be prepared for those periods.

D) Means that a business is accounted for separately from other business entities,including its owner.

E) Prescribes that a company record the expenses it incurred to generate the revenue reported.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Resources a company owns or controls that are expected to yield future benefits are:

A) Assets.

B) Revenues.

C) Liabilities.

D) Owner's Equity.

E) Expenses.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Operating activities:

A) Are the means organizations use to pay for resources like land,buildings and equipment.

B) Involve using resources to research,develop,purchase,produce,distribute and market products and services.

C) Involve acquiring and disposing of resources that a business uses to acquire and sell its products or services.

D) Are also called asset management.

E) Are also called strategic management.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Short Answer

Congress passed the ________ to help curb financial abuses at companies that issue their stock to the public.

Correct Answer

verified

Correct Answer

verified

Essay

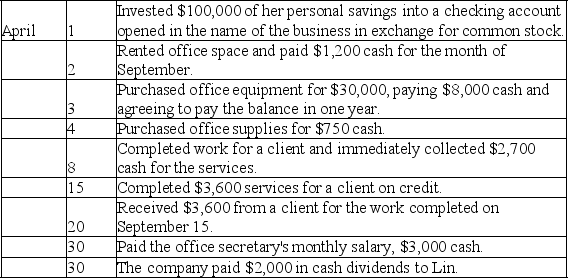

Soo Lin,the sole stockholder,began an Internet Consulting practice and completed these transactions during April of the current year:

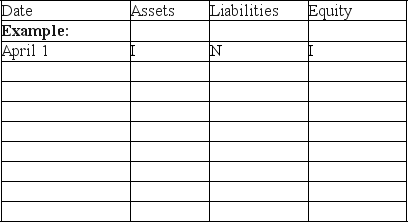

Show the effects of the above transactions on the accounting equation of Soo Lin,Consultant.Use the following format for your answers.The first item is shown as an example.

Increase = I Decrease = D No effect = N

Show the effects of the above transactions on the accounting equation of Soo Lin,Consultant.Use the following format for your answers.The first item is shown as an example.

Increase = I Decrease = D No effect = N

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are classified as liabilities except:

A) Accounts Receivable.

B) Notes Payable.

C) Wages Payable.

D) Accounts Payable.

E) Taxes Payable.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 261 - 280 of 285

Related Exams