B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Annual cash dividends per share divided by market price per share is the:

A) Price-earnings ratio.

B) Price-dividends ratio.

C) Profit margin.

D) Dividend yield ratio.

E) Earnings per share.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to the following selected financial information from Marston Company.Compute the company's days' sales uncollected for Year 2.(Use 365 days a year.)

A) 43.9.

B) 43.7.

C) 46.2.

D) 85.4.

E) 42.7.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Vertical analysis is the comparison of a company's financial condition and performance across time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following terms with the appropriate formulas. - * 365

A) Debt ratio

B) Days' sales in inventory

C) Return on common stockholders' equity

D) Inventory turnover

E) Dividend yield

F) Days' sales uncollected

G) Profit margin ratio

H) Gross margin ratio

I) Times interest earned

J) Total asset turnover

L) B) and E)

Correct Answer

verified

Correct Answer

verified

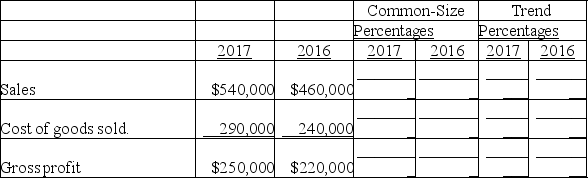

Essay

Express the following income statement information in common-size percentages and in trend percentages using 2016 as the base year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the financial analysis building block most appropriately associated with each ratio. Each building block may be used more than once. -Dividend Yield

A) Market Prospects

B) Liquidity and Efficiency

C) Solvency

D) Profitability

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to the following selected financial information from Shakley's Incorporated.Compute the company's debt-to-equity ratio for Year 2.

A) 1.75.

B) 2.34.

C) 0.75.

D) 1.34.

E) 2.63.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal analysis is used to reveal patterns in data covering successive periods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-Refer to the following selected financial information from Shakley's Incorporated.Compute the company's profit margin for Year 2.

A) 14.1%.

B) 11.7%.

C) 9.6%.

D) 16.7%.

E) 33.9%.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The building blocks of financial statement analysis include (1)liquidity, (2)salability, (3)solvency,and (4)profitability.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

The debt ratio,the equity ratio,pledged assets to secured liabilities,and times interest earned are all ________ ratios.

Correct Answer

verified

Correct Answer

verified

True/False

The percent change of a comparative financial statement item is computed by subtracting the analysis period amount from the base period amount,dividing the result by the base period amount and multiplying that result by 100.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Intra-company analysis is based on comparisons with competitors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In horizontal analysis the percent change is computed by:

A) Subtracting the analysis period amount from the base period amount.

B) Subtracting the base period amount from the analysis period amount.

C) Subtracting the analysis period amount from the base period amount, dividing the result by the base period amount, then multiplying that amount by 100.

D) Subtracting the base period amount from the analysis period amount, dividing the result by the base period amount, then multiplying that amount by 100.

E) Subtracting the base period amount from the analysis amount, then dividing the result by the analysis period amount.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jones Corp.reported current assets of $193,000 and current liabilities of $137,000 on its most recent balance sheet.The current ratio is:

A) 1.4:1.

B) 0.7:1.

C) 0.3:1.

D) 1:1.

E) 0.4:1.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Efficiency refers to how productive a company is in using its assets,and is usually measured relative to how much revenue is generated from a certain level of assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal analysis is used to reveal changes in the relative importance of each financial statement item.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

________ is a method of analysis used to evaluate individual financial statement items or groups of items in terms of a specific base amount.

Correct Answer

verified

Correct Answer

verified

Essay

Calculate the percent increases for each of the following selected balance sheet items.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 263

Related Exams