A) 117.2% for 2017 and 100.0% for 2016.

B) 119.4% for 2017 and 100.0% for 2016.

C) 55.0% for 2017 and 56.0% for 2016.

D) 36.4% for 2017 and 41.1% for 2016.

E) 65.1% for 2017 and 64.6% for 2016.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Evaluation of company performance does not include analysis of (1) past and current performance, (2) current financial position, and (3) future performance and risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Intra-company analysis is based on comparisons with competitors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zhang Company reported Cost of goods sold of $835,000 and average Inventory of $41,750. The Inventory turnover ratio is:

A) 0.5 times.

B) 20 times.

C) 418 times.

D) 56 times.

E) 19 times.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal analysis is the comparison of a company's financial condition and performance across time.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A good financial statement analysis report often includes the following sections: executive summary, analysis overview, evidential matter, assumptions, key factors, and inferences.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

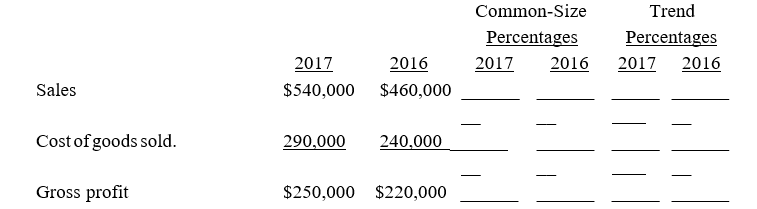

Express the following income statement information in common-size percentages and in trend percentages using 2016 as the base year.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jones Corp. reported current assets of $193,000 and current liabilities of $137,000 on its most recent balance sheet. - The current assets consisted of $62,000 Cash; $43,000 Accounts Receivable; and $88,000 of Inventory. The acid-test (quick) ratio is:

A) 1.4:1.

B) 0.77:1.

C) 0.64:1.

D) 0.54:1.

E) 1:1.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a company is comparing its financial condition or performance to a base amount, it is using vertical analysis.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The base amount for a common-size balance sheet is usually total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The comparison of a company's financial condition and performance to a base amount is known as:

A) Vertical analysis.

B) Investment analysis.

C) Risk analysis.

D) Financial reporting.

E) Horizontal ratios.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Carducci Corporation reported Net sales of $3.6 million and average Total assets of $1.1 million. The Total asset turnover is:

A) 0.31 times.

B) 0.77 times.

C) 3.27 times.

D) 2.27 times.

E) 4.30 times.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Common-size statements:

A) Compare financial statements over time.

B) Show the dollar amount of change for financial statement items.

C) Do not emphasize the relative importance of each item.

D) Reveal patterns in data across successive periods.

E) Reveal changes in the relative importance of each financial statement item to a base amount.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Vertical analysis is used to reveal patterns in data covering two or more successive periods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following selected financial information from McCormik, LLC. Compute the company's days' sales uncollected for Year 2. (Use 365 days a year.)

A) 43.9.

B) 42.3.

C) 80.0.

D) 113.3.

E) 46.2.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Working capital is computed as current liabilities minus current assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Financial reporting includes not only general purpose financial statements, but also information from SEC filings, press releases, shareholders' meetings, forecasts, management letters, auditor's reports, and Webcasts.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Profitability is the ability to generate future revenues and meet long-term obligations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company reports basic earnings per share of $3.50, cash dividends per share of $1.25, and a market price per share of $64.75. The company's dividend yield equals:

A) 18.50%.

B) 5.41%.

C) 2.14%.

D) 1.93%.

E) 4.67%.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following selected financial information from Dodge Company. Compute the company's acid-test ratio.

A) 1.12.

B) 0.92.

C) 2.75.

D) 1.63.

E) 2.66.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 235

Related Exams