B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the steps below is not aided by the preparation of the end-of-period spreadsheet?

A) preparing the adjusted trial balance

B) posting to the general ledger

C) preparing the financial statements

D) preparing the closing entries

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Common stock and dividends are reported in the stockholders' equity section of the balance sheet.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

There is really no benefit in preparing financial statements in any particular order.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounting cycle requires three trial balances be done. In what order should they be prepared?

A) post-closing, unadjusted, adjusted

B) unadjusted, post-closing, adjusted

C) unadjusted, adjusted, post-closing

D) post-closing, adjusted, unadjusted

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Cash and other assets that may reasonably be expected to be realized in cash, sold, or consumed through the normal operations of a business, usually longer than one year, are called current assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stockholders' equity is

A) added to assets and the two are equal to liabilities

B) added to liabilities and the two are equal to assets

C) subtracted from liabilities and the net amount is equal to assets

D) equal to the total of assets and liabilities

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

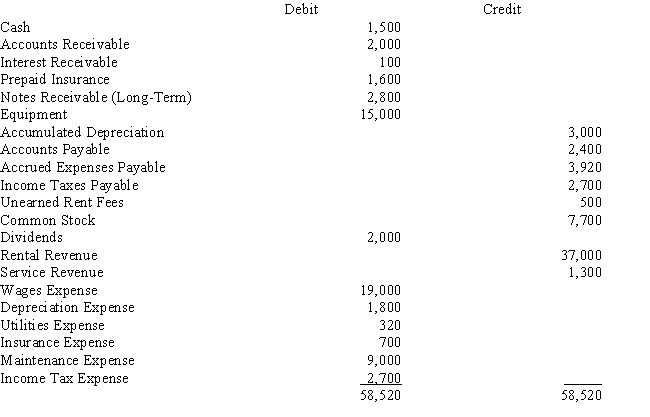

Shores Sports rents canoes and kayaks. Below is the adjusted trial balance at December 31.  The entry required to close the revenue accounts at the end of the period includes a

The entry required to close the revenue accounts at the end of the period includes a

A) debit to Income Summary for $37,000

B) credit to Income Summary for $38,300

C) debit to Income Summary for $38,300

D) credit to Income Summary for $37,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The balance sheet accounts are referred to as real or permanent accounts.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income statement should be prepared

A) before the retained earnings statement and balance sheet

B) after the retained earnings statement and before the balance sheet

C) after the retained earnings statement and balance sheet

D) after the balance sheet and before the retained earnings statement

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On which financial statement will Income Summary be shown?

A) retained earnings statement

B) balance sheet

C) income statement

D) no financial statement

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

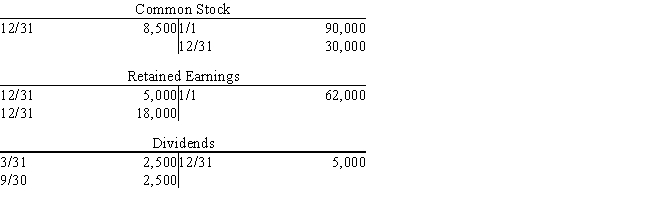

A summary of selected ledger accounts appears below for Solomon's Electrical Services for the current calendar year-end. (1)  The $18,000 debit to Retained Earnings on December 31 must represent

The $18,000 debit to Retained Earnings on December 31 must represent

A) dividends paid

B) net income

C) net loss

D) sales of common stock

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between the totals of the debit and credit columns of the Adjusted Trial Balance columns on the end-of-period spreadsheet

A) is the amount of net income or loss

B) indicates there is an error on the end-of-period spreadsheet

C) is the amount of retained earnings

D) is the difference between revenue and expenses

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The usual presentation of the retained earnings statement is (1) Beginning balance, (2) Net income or loss, (3) Dividends, (4) Stockholders' contributions, (5) Ending balance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Accumulated Depreciation is a permanent account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The income summary account is also known as the clearing account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What does working capital measure?

A) the excess of a business's assets over its liabilities

B) the excess of a business's current assets over its liabilities

C) the excess of a business's current assets over its current liabilities

D) the excess of a business's net income over its current liabilities

F) B) and C)

Correct Answer

verified

Correct Answer

verified

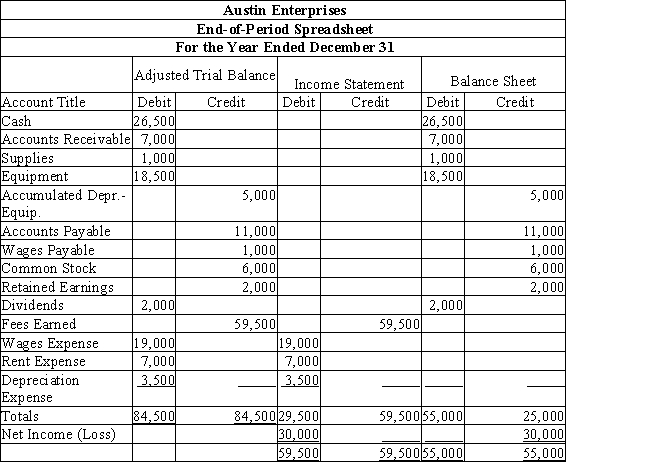

Essay

Prepare closing entries from the following end-of-period spreadsheet.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After all of the account balances have been extended to the Income Statement columns of the end-of-period spreadsheet, the totals of the Debit and Credit columns are $77,500 and $83,900, respectively. What is the amount of the net income or net loss for the period?

A) $6,400 net income

B) $6,400 net loss

C) $83,900 net income

D) $77,500 net loss

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

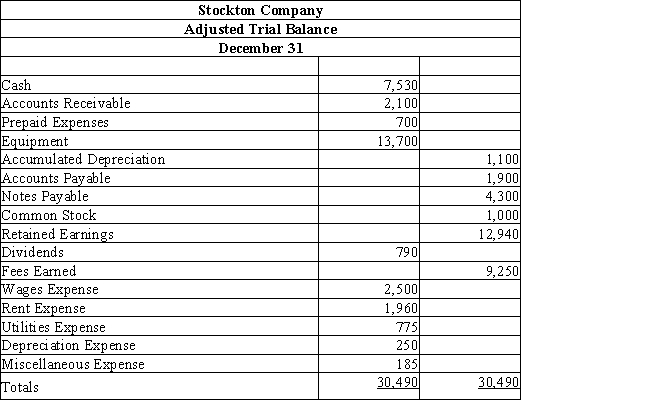

Use the adjusted trial balance for Stockton Company below to answer the questions that follow.

-Determine the total assets.

-Determine the total assets.

A) $25,130

B) $16,830

C) $22,930

D) $24,030

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 213

Related Exams