B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

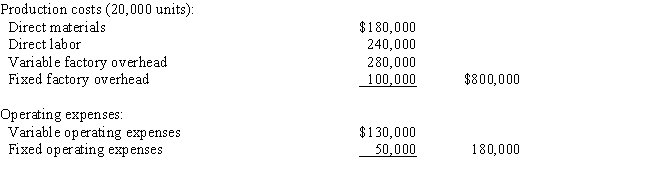

A business operated at 100% of capacity during its first month and incurred the following costs:

If 1,500 units remain unsold at the end of the month,what is the amount of inventory that would be reported on the variable costing balance sheet?

If 1,500 units remain unsold at the end of the month,what is the amount of inventory that would be reported on the variable costing balance sheet?

A) $62,500

B) $73,500

C) $60,000

D) $52,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If the ability to sell and the amount of production facilities devoted to each of two products is equal,it is profitable to increase the sales of that product with the highest contribution margin.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

At XLT Inc,variable costs are $80 per unit,and fixed costs are $40,000.Sales are estimated to be 4,000 units.(a)How much would absorption costing income from operations differ between a plan to produce 8,000 units and a plan to produce 10,000 units? (b)How much would variable costing income from operations differ between the two production plans?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under variable costing,which of the following costs would not be included in finished goods inventory?

A) direct labor cost

B) direct materials cost

C) variable factory overhead cost

D) fixed factory overhead cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In contribution margin analysis,the effect of a difference in unit sales price or unit cost on the number of units sold is termed the quantity factor.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sales mix is generally defined as the relative distribution of sales among the various products sold.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a service firm,it may be necessary to have several activity bases to properly match the change in costs with the changes in various activities.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

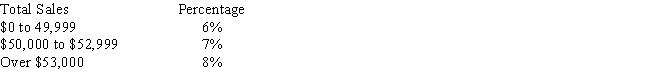

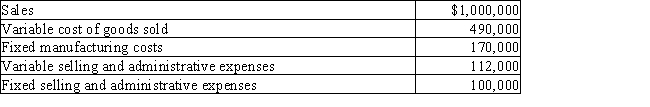

The Excelsior Company has three salespersons.Average sales price per unit sold,average variable manufacturing costs per unit,and number of units sold for each salesperson are shown below.

Commissions are earned according to the following schedule:

Prepare a contribution by salesperson report.

Prepare a contribution by salesperson report.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The contribution margin ratio is computed as:

A) sales divided by contribution margin

B) contribution margin divided by sales

C) contribution margin divided by cost of sales

D) contribution margin divided by variable cost of sales

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The relative distribution of sales among various products sold is referred to as the:

A) by-product mix

B) joint product mix

C) profit mix

D) sales mix

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

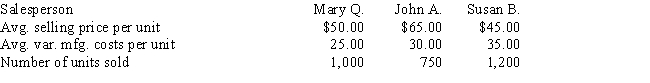

Tony's Company has the following information for March:

Determine the March (a)manufacturing margin,(b)contribution margin,and (c)income from operations for Tony's Company.

Determine the March (a)manufacturing margin,(b)contribution margin,and (c)income from operations for Tony's Company.

Correct Answer

verified

Correct Answer

verified

Essay

The actual price for a product was $50 per unit,while the planned price was $44 per unit.The volume increased by 4,000 to 60,000 total units.Determine (a)the quantity factor and (b)the price factor for sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the amount of the income from operations that would be reported on the variable costing income statement?

A) $18,900

B) $18,200

C) $18,000

D) $21,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

On the variable costing income statement,variable selling and administrative expenses are deducted from manufacturing margin to yield contribution margin.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In contribution margin analysis,the quantity factor is computed as:

A) the increase or decrease in the number of units sold multiplied by the planned unit sales price or unit cost

B) the increase or decrease in unit sales price or unit cost multiplied by the planned number of units to be sold

C) the increase or decrease in the number of units sold multiplied by the actual unit sales price or unit cost

D) the increase or decrease in the unit sales price or unit cost multiplied by the actual number of units sold

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under absorption costing,increases or decreases in income from operations due to changes in inventory levels could be misinterpreted to be the result of operating efficiencies or inefficiencies.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In contribution margin analysis,the increase or decrease in unit sales price or unit cost on the number of units sold is referred to as the:

A) sales factor

B) cost of goods sold factor

C) quantity factor

D) unit price or unit cost factor

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a supervisor of a manufacturing department,which of the following costs is controllable?

A) direct materials

B) insurance on factory building

C) depreciation of factory building

D) sales salaries

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is(are) reason(s) for easy identification and control of variable manufacturing costs under the variable costing method?

A) variable and fixed costs are reported separately.

B) variable costs can be controlled by the operating management.

C) fixed costs,such as property insurance,are normally the responsibility of higher management not the operating management.

D) All of the above are true.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 151

Related Exams