Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zenith Corporation sells some of its used store fixtures.The acquisition cost of the fixtures is $12,500,and the accumulated depreciation on these fixtures is $9,750 at the time of sale.The fixtures are sold for $5,300.The value of this transaction in the investing section of the statement of cash flows is

A) $12,500

B) $5,300

C) $2,750

D) $2,550

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

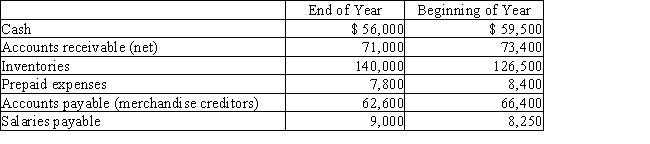

The net income reported on the income statement for the current year was $210,000.Depreciation recorded on equipment and a building amount to $62,500 for the year.Balances of the current asset and current liabilities accounts at the beginning and end of the year are as follows:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of goods sold during the year was $50,000.Merchandise inventories were $12,500 and $10,500 at the beginning and end of the year,respectively.Accounts payable (all owed to merchandise suppliers) were $6,000 and $5,000 at the beginning and end of the year,respectively.Using the direct method of reporting cash flows from operating activities,cash payments for merchandise total

A) $49,000

B) $47,000

C) $51,000

D) $53,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

There is no difference in the investing and financing sections of the statement of cash flows using the indirect and direct method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following can be found on the statement of cash flows?

A) cash flows from operating activities

B) total assets

C) total changes in stockholders' equity

D) changes in retained earnings

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If cash dividends of $135,000 were paid during the year and the company sold 1,000 shares of common stock at $30 per share,the statement of cash flows would report net cash flow from financing activities as $165,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cash flows from operating activities,as part of the statement of cash flows,include cash flow from transactions that enter into the determination of net income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

To determine cash payments for income taxes for the statement of cash flows using the direct method,an increase in income taxes payable is added to the income tax expense.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

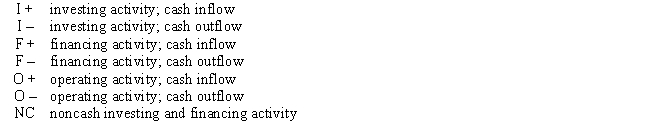

Each of the events below may have an effect on the statement of cash flows.Designate how the event should be reported within the statement of cash flows using the codes provided below.Codes may be used more than once,or not at all.

Codes:

Events:

1.

Paid the weekly payroll

2.

Paid an account payable

3.

Issued bonds payable for cash

4.

Declared and paid a cash dividend

5.

Paid cash for a new piece of equipment

6.

Purchased treasury stock for cash

7.

Paid cash for stock in another company

8.

Received interest on a long-term bond investment

9.

Received cash for sales

10.

Sold a long-term stock investment for cash at book value

Events:

1.

Paid the weekly payroll

2.

Paid an account payable

3.

Issued bonds payable for cash

4.

Declared and paid a cash dividend

5.

Paid cash for a new piece of equipment

6.

Purchased treasury stock for cash

7.

Paid cash for stock in another company

8.

Received interest on a long-term bond investment

9.

Received cash for sales

10.

Sold a long-term stock investment for cash at book value

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash collections from customers were

A) $56,000

B) $52,000

C) $60,000

D) $45,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

To determine cash payments for operating expenses for the statement of cash flows using the direct method,a decrease in prepaid expenses is added to operating expenses other than depreciation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Depreciation on factory equipment would be reported in the statement of cash flows prepared by the indirect method in

A) the cash flows from financing activities section

B) the cash flows from investing activities section

C) a separate schedule

D) the cash flows from operating activities section

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Under the direct method of preparing a statement of cash flows,the gain on the sale of land is not adjusted or reported as part of cash flows from operating activities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The declaration and issuance of a stock dividend would be reported on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 175 of 175

Related Exams