A) No;The payback period is 2.93 years.

B) No;The payback period is 3.26 years.

C) Yes;The payback period is 2.93 years.

D) Yes;The payback period is 3.01 years.

E) Yes;The payback period is 3.26 years.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following increases the net present value of a project?

A) an increase in the required rate of return

B) an increase in the initial capital requirement

C) a deferment of some cash inflows until a later year

D) an increase in the aftertax salvage value of the fixed assets

E) a reduction in the final cash inflow

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kristi wants to start training her most junior assistant,Amy,in the art of project analysis.Amy has just started college and has no experience or background in business finance.To get her started,Kristi is going to assign the responsibility for all projects that have initial costs less than $1,000 to Amy to analyze.Which method is Kristi most apt to ask Amy to use in making her initial decisions?

A) discounted payback

B) profitability index

C) internal rate of return

D) payback

E) average accounting return

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

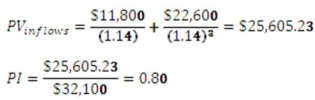

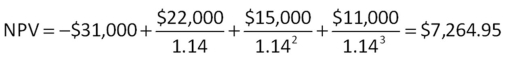

-You would like to invest in the following project.

-You would like to invest in the following project.  Sis,your boss,insists that only projects returning at least $1.06 in today's dollars for every $1 invested can be accepted.She also insists on applying a 14 percent discount rate to all cash flows.Based on these criteria,you should:

Sis,your boss,insists that only projects returning at least $1.06 in today's dollars for every $1 invested can be accepted.She also insists on applying a 14 percent discount rate to all cash flows.Based on these criteria,you should:

A) accept the project because the PI is 0.90.

B) accept the project because the PI is 1.07.

C) accept the project because the PI is 1.11.

D) reject the project because the PI is 0.90.

E) reject the project because the PI is 1.07.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investment project costs $21,500 and has annual cash flows of $6,500 for 6 years.If the discount rate is 15 percent,what is the discounted payback period?

A) 4.41 years

B) 4.91 years

C) 5.12 years

D) 5.40 years

E) never

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

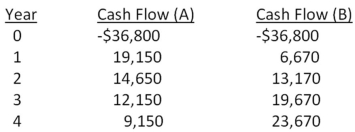

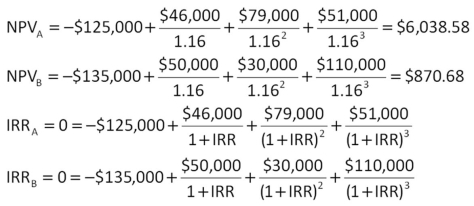

-Hungry Hoagie's has identified the following two mutually exclusive projects:

-Hungry Hoagie's has identified the following two mutually exclusive projects:  At what rate would you be indifferent between these two projects?

At what rate would you be indifferent between these two projects?

A) 17.34 percent

B) 17.72 percent

C) 19.41 percent

D) 19.69 percent

E) 20.28 percent

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

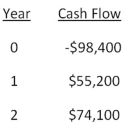

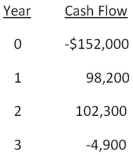

-You are considering an investment with the following cash flows.If the required rate of return for this investment is 15.5 percent,should you accept the investment based solely on the internal rate of return rule? Why or why not?

-You are considering an investment with the following cash flows.If the required rate of return for this investment is 15.5 percent,should you accept the investment based solely on the internal rate of return rule? Why or why not?

A) Yes;The IRR exceeds the required return.

B) Yes;The IRR is less than the required return.

C) No;The IRR is less than the required return.

D) No;The IRR exceeds the required return.

E) You cannot apply the IRR rule in this case.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

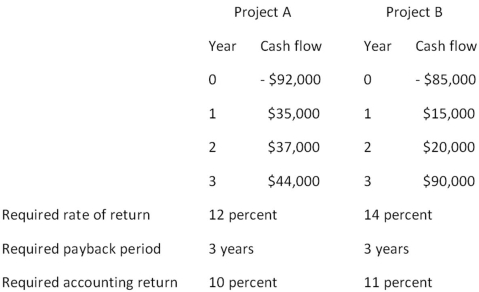

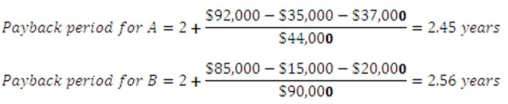

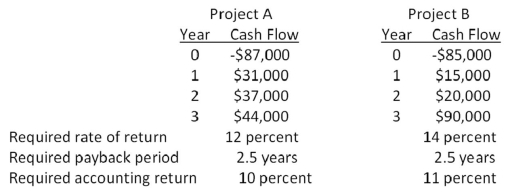

You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on payback analysis?

Should you accept or reject these projects based on payback analysis?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on payback analysis.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Applying the discounted payback decision rule to all projects may cause:

A) some positive net present value projects to be rejected.

B) the most liquid projects to be rejected in favor of the less liquid projects.

C) projects to be incorrectly accepted due to ignoring the time value of money.

D) a firm to become more long-term focused.

E) some projects to be accepted which would otherwise be rejected under the payback rule.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is a project acceptance indicator given an independent project with investing type cash flows?

A) profitability index less than 1.0

B) project's internal rate of return less than the required return

C) discounted payback period greater than requirement

D) average accounting return that is less than the internal rate of return

E) modified internal rate of return that exceeds the required return

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

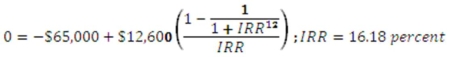

-A project that provides annual cash flows of $12,600 for 12 years costs $65,000 today.At what rate would you be indifferent between accepting the project and rejecting it?

-A project that provides annual cash flows of $12,600 for 12 years costs $65,000 today.At what rate would you be indifferent between accepting the project and rejecting it?

A) 15.28 percent

B) 15.40 percent

C) 15.51 percent

D) 16.18 percent

E) 16.74 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.

-You are considering the following two mutually exclusive projects.Both projects will be depreciated using straight-line depreciation to a zero book value over the life of the project.Neither project has any salvage value.  Should you accept or reject these projects based on the profitability index?

Should you accept or reject these projects based on the profitability index?

A) accept Project A and reject Project B

B) reject Project A and accept Project B

C) accept both Projects A and B

D) reject both Projects A and B

E) You cannot make this decision based on the profitability index.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 112 of 112

Related Exams