A) $13,000 and Zero

B) Zero and $13,000

C) $13,000 and $13,000

D) Zero and Zero

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

On January 1,Year 1,Daniels Company issued bonds with a face value of $500,000,receiving $496,000 cash.These bonds were issued at a discount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currie Company borrowed $20,000 from Sierra Bank by issuing a 10% three-year note.Currie agreed to repay the principal and interest by making annual payments in the amount of $8,042.Based on this information,what is the amount of the interest expense associated with the second payment? (Round your answer to the nearest dollar. )

A) $730

B) $1,396

C) $2,000

D) $8,042

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

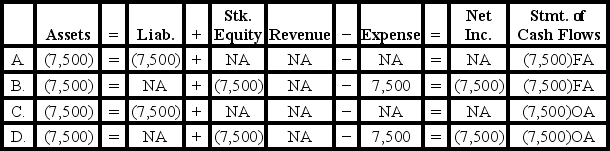

On January 1, Year 1, Niagara Corporation arranges a $6,000 line of credit with Centennial Bank. It accepted the bank's offer of 1% above the prime rate with interest payments on December 31 of each year. All borrowings and repayments are to take place on January 1 of each year.

-Niagara begins its loan transactions with Centennial Bank by borrowing $2,000 on January 1,Year 1.Which of the following shows the effect of this event on the elements of the financial statements?

![[The following information applies to the questions displayed below.] On January 1, Year 1, Niagara Corporation arranges a $6,000 line of credit with Centennial Bank. It accepted the bank's offer of 1% above the prime rate with interest payments on December 31 of each year. All borrowings and repayments are to take place on January 1 of each year. -Niagara begins its loan transactions with Centennial Bank by borrowing $2,000 on January 1,Year 1.Which of the following shows the effect of this event on the elements of the financial statements? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8d4f_a05a_a2a1_c1a115783624_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Echols Company borrowed $100,000 cash from Sun Bank by issuing a 5-year, 8% term note. The principal and interest are repaid by making annual payments beginning on December 31, Year 1. The annual payment on the loan equals $25,045.65. -What is the amount of principal repayment included in the payment made on December 31,Year 1?

A) $20,000.00

B) $8,000.00

C) $25,045.65

D) $17,045.65

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

On January 1,Year 1,Daniels Company issued bonds with a face value of $500,000,receiving $496,000 cash.When the bonds mature,Daniels will have to pay the face value of the bonds to the bondholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true when bonds are issued at a premium?

A) The carrying value decreases by equal amounts each year if straight-line amortization is used.

B) The carrying value decreases by equal amounts each year if effective interest amortization is used.

C) The carrying value decreases by larger and larger amounts each year if effective interest amortization is used.

D) The carrying value decreases by equal amounts each year if straight-line amortization is used and decreases by increasing amounts each year if effective interest amortization is used.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Victor Company issued bonds with a $250,000 face value, a stated rate of interest of 6%, and a 5-year term to maturity. The bonds sold at 95. Interest is payable in cash on December 31 of each year. Victor uses the straight-line method to amortize bond discounts and premiums. -What is the carrying value of the bond liability at December 31,Year 3?

A) $241,000

B) $242,500

C) $237,500

D) $245,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Serial bonds are issued based on the overall strength of the borrower's credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, Jones Company issued bonds with a $200,000 face value, a stated rate of interest of 7.5%, and a 5-year term to maturity. The bonds were issued at 97. Interest is payable in cash on December 31st of each year. The company amortizes bond discounts and premiums using the straight-line method. -What is the total amount of liabilities shown on Jones' balance sheet at December 31,Year 2?

A) $191,600

B) $194,000

C) $196,400

D) $195,200

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company uses the effective interest method to amortize a bond discount.Which of the following statements is true regarding the interest expense that is recognized each year?

A) It will be greater than the interest payment.

B) It will increase from year to year.

C) It will remain the same from year to year.

D) It will be greater than the interest payment and it will also increase from year to year.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marvin Company issues $125,000 of bonds at face value on January 1.The bonds carry a 6% annual stated rate of interest.Interest is payable in cash on December 31 of each year.Which of the following shows the effect of the first interest payment on the elements of the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

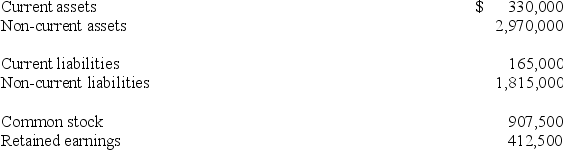

[The following information applies to the questions displayed below.]

On January 1 Year 1, Gordon Corporation issued bonds with a face value of $70,000, a stated rate of interest of 6%, and a 5-year term to maturity. The bonds were issued at 98. Interest is payable in cash on December 31 each year. Gordon uses the straight-line method to amortize bond discounts and premiums.

-Which of the following shows the effect of the first interest payment and amortization of the premium or discount on the elements of the financial statements?

![[The following information applies to the questions displayed below.] On January 1 Year 1, Gordon Corporation issued bonds with a face value of $70,000, a stated rate of interest of 6%, and a 5-year term to maturity. The bonds were issued at 98. Interest is payable in cash on December 31 each year. Gordon uses the straight-line method to amortize bond discounts and premiums. -Which of the following shows the effect of the first interest payment and amortization of the premium or discount on the elements of the financial statements? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8d56_cb62_a2a1_7122823657bc_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gates,Inc.and Markham,Inc.each had the same financial position on January 1,Year 2.The following is a summary of each of their balance sheets on that date:

Gates is about to raise $200,000 in cash by issuing bonds.Markham is going to raise $200,000 on the same day by issuing common stock.Immediately after these transactions,which of the following statements will be correct?

Gates is about to raise $200,000 in cash by issuing bonds.Markham is going to raise $200,000 on the same day by issuing common stock.Immediately after these transactions,which of the following statements will be correct?

A) Gates' current ratio will be higher than Markham's.

B) Gates' current ratio will be lower than Markham's.

C) Gates' debt to asset ratio will be higher than Markham's.

D) Gates' debt to asset ratio will be lower than Markham's.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the term used to describe bonds that mature at specified intervals throughout the life of the issuance?

A) Term bonds

B) Registered bonds

C) Coupon bonds

D) Serial bonds

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 1, The Palms borrowed $200,000 to purchase a warehouse by agreeing to a 8%, 5-year note with the bank. Payments of $50,091.29 are due at the end of each year. The first payment will be made on December 31, Year 1. -What is the interest expense for Year 1 and Year 2,respectively? (Round your final answers to the nearest dollar. )

A) $3,200 and $14,000

B) $16,000 and $16,350

C) $16,000 and $13,273

D) $20,625 and $16,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the amortization of the principal balance on an installment note payable affect the amount of interest expense recorded each succeeding year?

A) Reduces the amount of interest expense each year

B) Increase the amount of interest expense each year

C) Has no effect on interest expense each year

D) Cannot be determined from the information provided

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Park Enterprises issued bonds with a face value of $500,000,a stated rate of interest of 7%,and a 5-year term to maturity.The proceeds from the issuance were $508,000.Interest is payable in cash on December 31 of each year.Assuming straight-line amortization,the amount of interest expense for the first year would be $31,600.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chico Company borrowed $40,000 on a four-year,8% installment note.How will Chico record the issuance of this note?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Davis Corporation borrowed $50,000 on January 1,Year 1.The loan is for a 10-year period and has an annual interest rate of 9%.At the end of each year,Davis will make a payment of $7,791,which includes both principal and interest.With this loan,the amount of interest expense that Davis reports on its income statement will be the same for each year of the loan.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 105

Related Exams