A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The adjusting entry to recognize uncollectible accounts expense is an asset use transaction.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

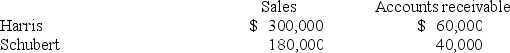

The accounting records of the Harris and Schubert Companies contained the following account balances:

Which of the following statements is true?

Which of the following statements is true?

A) Schubert Company has a lower likelihood of lost income resulting from credit costs.

B) The company with the higher accounts receivable turnover ratio will also have the longer average number of days to collect accounts receivable.

C) The accounts receivable for Schubert Company turns over 6 times each year.

D) The average number of days to collect accounts receivable for Harris is 73 days.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buttercup Florist uses the allowance method to account for uncollectible accounts.Unable to collect a $150 account from a customer,Buttercup determined it was uncollectible.How would the write-off of this account affect the elements of the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050.

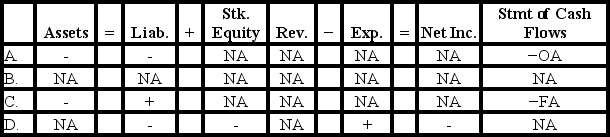

-Which of the following correctly states the effect of Loudoun Company's February Year 2 entry to write off the customer's account?

![[The following information applies to the questions displayed below.] On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. -Which of the following correctly states the effect of Loudoun Company's February Year 2 entry to write off the customer's account? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8d7a_3218_a2a1_01725a834009_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.] On January 1, Year 2, Kincaid Company's Accounts Receivable and the Allowance for Doubtful Accounts carried balances of $31,000 and $500, respectively. During Year 2, Kincaid reported $72,500 of credit sales, wrote off $550 of receivables as uncollectible, and collected cash from receivables amounting to $74,550. Kincaid estimates that it will be unable to collect one percent (1%) of credit sales. -What effect will the entry to recognize the uncollectible accounts expense for Year 2 have on the elements of the financial statements?

A) Increase total assets and retained earnings.

B) Decrease total assets and increase retained earnings.

C) Decrease total assets and net income.

D) Increase total assets and decrease net income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following reflects the effect of the year-end adjusting entry to record estimated uncollectible accounts expense using the allowance method?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

[The following information applies to the questions displayed below.]

The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction.

-Which of the following correctly describes the effect of the collection of cash from the credit card company on the financial statements of Yankee Corporation?

![[The following information applies to the questions displayed below.] The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction. -Which of the following correctly describes the effect of the collection of cash from the credit card company on the financial statements of Yankee Corporation? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8d7b_b8c2_a2a1_a176a06e3b53_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hancock Medical Supply Co. ,earned $160,000 of revenue on account during Year 1,its first year of operation.During Year 1,Hancock collected $128,000 of cash from its receivables accounts.The company did not write-off any uncollectible accounts.It estimates that it will be unable to collect 1% of revenue on account.What is the net realizable value of receivables that will be reported on the balance sheet at December 31,Year 1?

A) $30,400

B) $30,720

C) $32,000

D) $30,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How does the year-end adjusting entry to recognize uncollectible accounts expense affect the elements of the financial statements?

A) Decrease total assets and decrease stockholders' equity.

B) Increase total assets and decrease stockholders' equity.

C) Increase total liabilities and increase stockholders' equity.

D) Decrease total liabilities and increase stockholders' equity.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Glebe Company accepted a credit card account receivable in exchange for $1,100 of services provided to a customer.The credit card company charges a 5% fee for handling the transaction.What effect will the collection of cash from the credit card company have on the elements of the financial statements?

A) Increase assets by $1,045

B) Decrease assets and stockholders' equity by $55

C) Increase assets by $1,100

D) None of these answer choices are correct

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

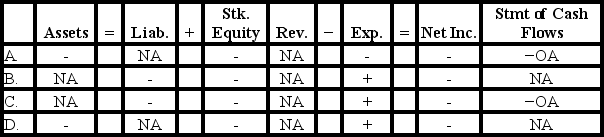

[The following information applies to the questions displayed below.]

The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction.

-Which of the following correctly shows the effects of the sale on July 7?

![[The following information applies to the questions displayed below.] The Yankee Corporation has recently begun to accept credit cards. On July 7, Year 1, Yankee made a credit card sale of $600. The credit card company charges a fee of 3% for handling a credit card transaction. -Which of the following correctly shows the effects of the sale on July 7? A) Option A B) Option B C) Option C D) Option D](https://d2lvgg3v3hfg70.cloudfront.net/TB6522/11ea8a6f_8d7b_91b1_a2a1_817b6999ca6d_TB6522_00.jpg)

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The adjusting entry to recognize uncollectible accounts expense does not affect the net realizable value of receivables.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Some accountants believe that the percent of revenue method for estimating uncollectible accounts expense is superior to the percent of receivables method because it is more conservative.

B) False

Correct Answer

verified

False

Correct Answer

verified

True/False

Using the allowance method of accounting for uncollectible receivables requires an estimate of the amount of receivables that will not be collected.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

The direct write-off method does a better job of matching revenues and expenses than does the allowance method.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The best estimate of the amount of cash a company expects to collect from its accounts receivable is the face value of the receivables.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Chadwick Company's sales for Year 1 were $8,700,000.The ending balance of accounts receivable was $801,000 at the end of the year.During Year 1,Chadwick collected $8,400,000 on its accounts receivable.The accounts receivable turnover ratio for the year was 10.5.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best describes the percent of receivables method?

A) Income statement approach

B) Direct write-off approach

C) Credit sales approach

D) Balance sheet approach

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The face value of Accounts Receivable plus the balance in the Allowance for Doubtful Accounts is equal to the net realizable value of the receivables.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 83

Related Exams