A) Segregation of duties

B) Physical controls

C) Fidelity bonding

D) Use of prenumbered documents

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following entries would be required to establish a $500 petty cash fund?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

All journal entries made related to bank reconciliations include an expense or revenue account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

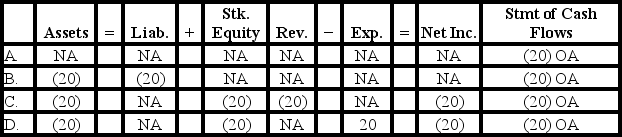

While performing the monthly bank reconciliation,the bookkeeper for Avon Company made the journal entry for a bank service charge of $20.Which of the following correctly shows the effect of the entry on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A well-designed system of internal controls will eliminate all fraud.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a common internal control procedure over cash payments?

A) A receipt should be provided to each cash customer

B) Checks should be properly authorized with approval signatures

C) All checks should be prenumbered

D) Voided checks should be defaced and retained

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements about the materiality concept is not true?

A) Materiality is different for each company.

B) A material error would change the opinion of the average prudent investor.

C) Any error greater than $5,000 is considered material in a financial statement audit.

D) Material misstatements should not exist in order for a company to receive an unqualified audit opinion.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The April 30 bank statement for Trimble Corporation shows an ending balance of $34,351.The unadjusted cash account balance was $28,250.The accountant for Trimble gathered the following information: There was a deposit in transit for $4,240. The bank statement reports a service charge of $39. A credit memo included in the bank statement shows interest earned of $95. Outstanding checks totaled $10,935. The bank statement included a $650 NSF check deposited in April. What is the true cash balance as of April 30?

A) $27,656

B) $27,006

C) $31,801

D) $31,896

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Typical adjustments to the unadjusted bank balance on a bank reconciliation include deposits in transit and outstanding checks.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What account is used to record the amount of cash shortages or overages relative to a petty cash system?

A) Petty Cash Payable

B) Gain or Loss on Petty Cash

C) Petty Cash Expense

D) Cash Short and Over

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following adjustments reflected on a bank reconciliation would not require an adjusting journal entry?

A) An error in which the company's accountant recorded a check as $235 that was written correctly for $253.

B) A check for $37 deposited during the month,but returned for non-sufficient funds.

C) An error in which the bank charged the company $83 for a check that had been written by another account holder.

D) All of these answer choices would require adjusting journal entries.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In preparing the April bank reconciliation for Oscar Company,it was discovered that on April 10 a check was written to pay delivery expense of $45 but the check was erroneously recorded as $54 in the company's books.Which of the following journal entries would correct this error?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) All of the above

Correct Answer

verified

Correct Answer

verified

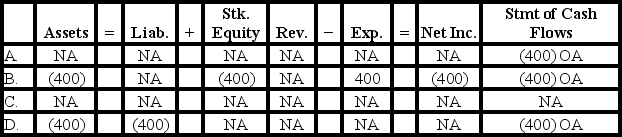

Multiple Choice

The owner of Barnes Company established a petty cash fund amounting to $400.What is the effect on the financial statements of the entry to record this transaction?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How is a customer's NSF check reflected on a bank reconciliation?

A) Subtracted from the unadjusted book balance to get the true cash balance

B) Added to the unadjusted bank balance to get the true cash balance

C) Subtracted from the unadjusted bank balance to get the true cash balance

D) Added to the unadjusted book balance to get the true cash balance

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The primary focus of financial statement audits is the discovery of fraud.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Owen Company's unadjusted book balance at June 30 is $9,700.The company's bank statement reveals bank service charges of $45.Two credit memos are included in the bank statement: one for $900,which represents a collection that the bank made for Owen,and one for $50,which represents the amount of interest that Owen had earned on its interest-bearing account in June.What is the true cash balance?

A) $9,700

B) $10,695

C) $10,550

D) $10,605

F) A) and B)

Correct Answer

verified

Correct Answer

verified

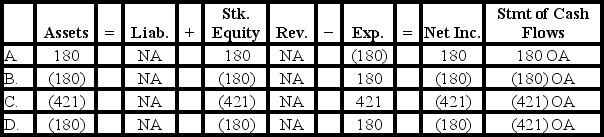

Multiple Choice

While performing its monthly bank reconciliation,the bookkeeper for Mosaic Company discovered that a check written for $421 for advertising expense was recorded in the firm's books as $241.Which of the following shows the effect of the correcting entry on the financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following describes an activity that reduces a company's bank account balance?

A) A debit entry

B) A debit memo

C) A credit memo

D) A reconciling entry

F) B) and C)

Correct Answer

verified

Correct Answer

verified

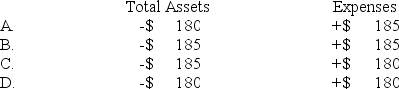

Multiple Choice

Blake Company established a petty cash fund in the amount of $400.At the end of the accounting period,the petty cash box contained receipts for expenditures amounting to $180 and $215 in cash.If the entries to record the disbursements and to replenish the fund are combined,what effect will the entries to replenish the fund have on total assets and expenses?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

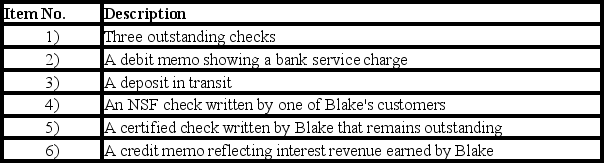

A review of the bank statement and accounting records of Blake Company revealed the following items:

-Which of the item(s) would be added to the unadjusted bank balance to determine the true cash balance?

-Which of the item(s) would be added to the unadjusted bank balance to determine the true cash balance?

A) Item numbers 3 and 3

B) Item number 2

C) Item numbers 3,4,and 6

D) Item number 3

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 82

Related Exams