A) An increase in operating expenses shown on the income statement

B) An increase in the amount of cost of goods sold shown on the income statement

C) An increase in inventory shown on the balance sheet

D) A decrease in gross margin shown on the income statement

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

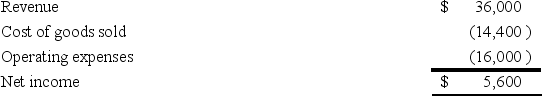

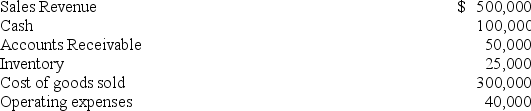

The following data is from the income statement of Ralston Company:

What is the company's gross margin percentage?

What is the company's gross margin percentage?

A) 66.67%

B) 25.93%

C) 60.00%

D) 15.60%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The beginning inventory plus cost of goods sold equals the cost of goods available for sale during the period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Costs charged to the Merchandise Inventory account are product costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

SX Company sold merchandise on account for $16,000.The merchandise had cost the company $6,000.What is the effect of the sale on the income statement?

A) Revenue increases by $10,000.

B) Expenses increase by $6,000.

C) Net income increases by $16,000.

D) All of these answer choices are correct.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

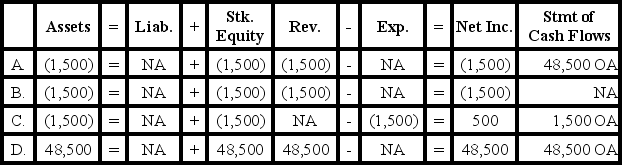

On April 1,Snell Company made a $50,000 sale giving the customer terms of 3/10,n/30.The receivable was collected from the customer on April 8.How does the collection of cash from the customer affect the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Common size financial statements are prepared by converting dollar amounts to percentages.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Gross margin is equal to the amount of change (increase or decrease)in Merchandise Inventory during a period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a company uses the periodic inventory system,it records inventory purchases in the Purchases account at the time of purchase.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would not be considered as primarily a merchandising business?

A) Abercrombie and Fitch

B) Sam's Clubs

C) Amazon

D) Regal Cinemas

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Butte Company recognized $24,000 of revenue on the cash sale of merchandise that cost $11,000.How will the sale be reported on the statement of cash flows?

A) Cash inflow from investing activities

B) Cash inflow from operating activities

C) Cash inflow from financing activities

D) Cash inflow from principal activities

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A company's amount of cost of goods sold reported on the income statement will be the same with a periodic inventory system as it would be with a perpetual system.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vargas Company sold a piece of land for $39,000 that had originally cost $32,500.How does this business event affect the company's financial statements?

A) An increase in cash flows from investing activities by $39,000.

B) No effect on operating income.

C) An increase in net income by $6,500.

D) All of these answer choices are correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Abbott Company purchased $6,500 of merchandise inventory on account.Abbott uses the perpetual inventory system.Which of the following entries would be required to record this transaction?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When are product costs matched directly with sales revenue?

A) In the period immediately following the purchase

B) In the period immediately following the sale

C) When the merchandise is purchased

D) When the merchandise is sold

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

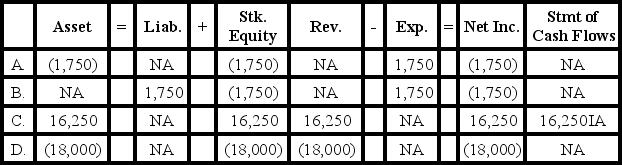

The Garrett Company uses the perpetual inventory system.The company's records showed a book balance of $18,000 in the Merchandise Inventory account,and a physical count finds only $16,250 of inventory.Which of the following indicates the effect of the necessary write-down entry?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year,Gomez Co.had beginning inventory of $2,400 and ending inventory of $1,200.The cost of goods sold was $9,600.What is the amount of inventory purchased during the year?

A) $8,400

B) $9,600

C) $10,800

D) $13,200

F) None of the above

Correct Answer

verified

Correct Answer

verified

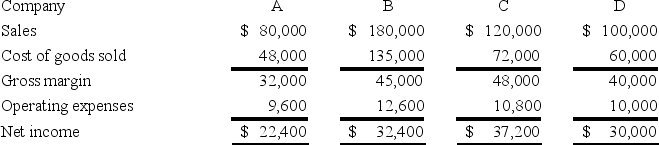

Multiple Choice

-Three of the companies are upscale stores and one is a discount store.Which company is most likely to be the discount store?

-Three of the companies are upscale stores and one is a discount store.Which company is most likely to be the discount store?

A) Company A

B) Company B

C) Company C

D) Company D

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olly Company is a merchandising business that sells dog food.Based on the following information,what is the gross margin for Olly Company?

A) $135,000

B) $160,000

C) $200,000

D) $285,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ballard Company uses the perpetual inventory system.The company purchased $16,000 of merchandise from Andes Company under the terms 2/10,net/30.Ballard paid for the merchandise within 10 days and also paid $500 freight to obtain the goods under terms FOB shipping point.All of the merchandise purchased was sold for $30,000 cash.What is the amount of gross margin that resulted from these business events?

A) $14,000

B) $13,820

C) $16,000

D) $13,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 114

Related Exams