A) Assets increased by $6,500.

B) Assets increased by $1,500.

C) Equity increased by $2,500.

D) Assets increased by $5,500.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's total assets increased during the period while its liabilities and common stock were unchanged.No dividends were declared or paid during the period.Which of the following would explain this situation?

A) Revenues were greater than expenses during the period.

B) Retained earnings were less than net income during the period.

C) No dividends were paid during the period.

D) The company must have purchased assets with cash during the period.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ballard Company reported assets of $500 and liabilities of $200.What amount will Ballard's report for stockholders' equity?

A) $300

B) $500

C) $700

D) Cannot be determined

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information applies to the questions displayed below Packard Company engaged in the following transactions during Year 1, its first year of operations: (Assume all transactions are cash transactions.) 1) Acquired $950 cash from the issue of common stock. 2) Borrowed $420 from a bank. 3) Earned $650 of revenues. 4) Paid expenses of $250. 5) Paid a $50 dividend. During Year 2, Packard engaged in the following transactions: (Assume all transactions are cash transactions.) 1) Issued an additional $325 of common stock. 2) Repaid $220 of its debt to the bank. 3) Earned revenues of $750. 4) Incurred expenses of $360. 5) Paid dividends of $100. -What is the amount of assets that will be reported on Packard's balance sheet at the end of Year 2?

A) $2,115

B) $440

C) $2,215

D) $395

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

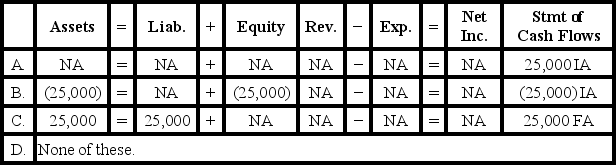

Zimmerman Company sold land for $25,000 cash.The original cost of the land was $25,000.Which of the following accurately reflects how this event affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As of December 31,Year 2,Bristol Company had $100,000 of assets,$40,000 of liabilities and $25,000 of retained earnings.What percentage of Bristol's assets were obtained through investors?

A) 60%

B) 25%

C) 40%

D) 35%

F) All of the above

Correct Answer

verified

D

Correct Answer

verified

True/False

In a market,creditors are resource providers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An asset use transaction does not affect the total amount of claims to a company's assets.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Which of the following is not an example of an asset use transaction?

A) Paying cash dividends

B) Paying cash expenses

C) Paying off the principal of a loan

D) Paying cash to purchase land

F) A) and C)

Correct Answer

verified

Correct Answer

verified

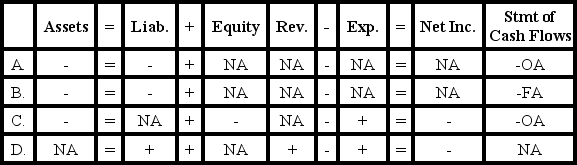

Multiple Choice

Which of the following could describe the effects of an asset exchange transaction on the elements of a company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Robertson Company paid $1,850 cash for rent expense.What happened as a result of this business event?

A) Total equity decreased.

B) Liabilities decreased.

C) The net cash flow from operating activities decreased.

D) Both total equity and net cash flow for operating activities decreased.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is false regarding managerial accounting information?

A) It is often used by investors.

B) It is more detailed than financial accounting information.

C) It can include nonfinancial information.

D) It focuses on divisional rather than overall profitability.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The historical cost concept requires that most assets be recorded at the amount paid for them,regardless of increases in market value.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Borrowing money from the bank is an example of an asset source transaction.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

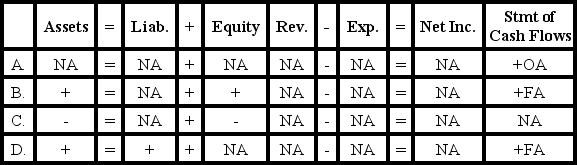

Which of the following does not describe the effects of an asset use transaction on the elements of a company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

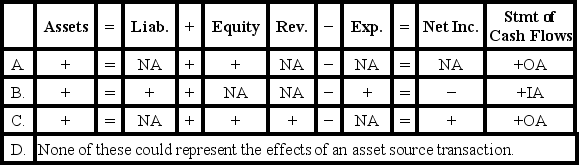

Which of the following could represent the effects of an asset source transaction on a company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The following information applies to the questions displayed below Packard Company engaged in the following transactions during Year 1, its first year of operations: (Assume all transactions are cash transactions.) 1) Acquired $950 cash from the issue of common stock. 2) Borrowed $420 from a bank. 3) Earned $650 of revenues. 4) Paid expenses of $250. 5) Paid a $50 dividend. During Year 2, Packard engaged in the following transactions: (Assume all transactions are cash transactions.) 1) Issued an additional $325 of common stock. 2) Repaid $220 of its debt to the bank. 3) Earned revenues of $750. 4) Incurred expenses of $360. 5) Paid dividends of $100. -What was the balance of Packard's Retained Earnings account before closing in Year 1?

A) $400

B) $0

C) $350

D) $450

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Retained earnings reduces a company's commitment to use its assets for the benefit of its stockholders.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

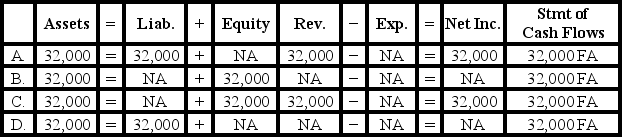

Tandem Company borrowed $32,000 of cash from a local bank.Which of the following accurately reflects how this event affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

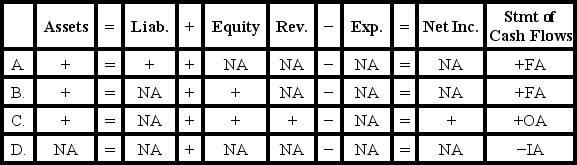

Which of the following would not describe the effects of an asset source transaction on the elements of a company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 94

Related Exams