A) Specific goals are established

B) Periodic comparison of actual results to goals

C) Execution of plans to achieve goals

D) Increase in sales by increasing marketing efforts.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following budget information: materials to be used totals $64,750; direct labor totals $198,400; factory overhead totals $394,800; work in process inventory January 1, 2012, was expected to be $189,100; and work in progress inventory on December 31, 2012, is expected to be $197,600. What is the budgeted cost of goods manufactured?

A) $649,450

B) $657,950

C) $197,600

D) $1,044,650

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Next year's sales forecast shows that 20,000 units of Product A and 22,000 units of Product B are going to be sold for prices of $10 and $12 per unit, respectively. The desired ending inventory of Product A is 20% higher than its beginning inventory of 2,000 units. The beginning inventory of Product B is 2,500 units. The desired ending inventory of B is 3,000 units. Budgeted purchases of Product B for the year would be:

A) 24,500 units

B) 22,500 units

C) 26,500 units

D) 23,200 units

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

The production budget is the starting point for preparation of the direct labor cost budget.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Southern Company is preparing a cash budget for April. The company has $12,000 cash at the beginning of April and anticipates $30,000 in cash receipts and $34,500 in cash disbursements during April. Southern Company has an agreement with its bank to maintain a cash balance of at least $10,000. To maintain the $10,000 required balance, during April the company must:

A) borrow $4,500.

B) borrow $2,500.

C) borrow $7,500.

D) borrow $5,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Management accountants usually provide for a minimum cash balance in their cash budgets for which of the following reasons:

A) stockholders demand a minimum cash balance

B) to comply with U.S. GAAP

C) it provides a safety buffer for variations in estimates

D) to have funds available for major capital expenditures

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The budget procedure that requires all levels of management to start from zero in estimating sales, production, and other operating data is called zero-based budgeting.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following budgets provides the starting point for the preparation of the direct labor cost budget?

A) Direct materials purchases budget

B) Cash budget

C) Production budget

D) Sales budget

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scott Manufacturing Co.'s static budget at 10,000 units of production includes $40,000 for direct labor and $4,000 for electric power. Total fixed costs are $25,000. At 12,000 units of production, a flexible budget would show:

A) variable costs of $52,800 and $30,000 of fixed costs

B) variable costs of $44,000 and $25,000 of fixed costs

C) variable costs of $52,800 and $25,000 of fixed costs

D) variable and fixed costs totaling $69,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

Maxim Technologies projected sales of 35,000 computers for 2012. The estimated January 1, 2012, inventory is 3,000 units, and the desired December 31, 2012, inventory is 9,000 units. What is the budgeted production (in units) for 2012?

Correct Answer

verified

Correct Answer

verified

True/False

The capital expenditures budget is part of the planned investing activities of a company.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following budgets allow for adjustments in activity levels?

A) Static Budget

B) Continuous Budget

C) Zero-Based Budget

D) Flexible Budget

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manicotti Corporation sells a single product. Budgeted sales for the year are anticipated to be 640,000 units, estimated beginning inventory is 108,000 units, and desired ending inventory is 90,000 units. The quantities of direct materials expected to be used for each unit of finished product are given below. Material A .50 lb. per unit @ $ .60 per pound Material B 1.00 lb. per unit @ $1.70 per pound Material C 1.20 lb. per unit @ $1.00 per pound The dollar amount of direct material A used in production during the year is:

A) $186,600

B) $181,200

C) $240,000

D) $210,600

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dove Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business are $250,000, $320,000, and $410,000, respectively, for September, October, and November. The company expects to sell 25% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month of the sale, 30% in the month following the sale. The cash collections in October are:

A) $320,000

B) $248,000

C) $304,250

D) $382,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budgeted finished goods inventory and cost of goods sold for a manufacturing company for the year 2012 are as follows: January 1 finished goods, $765,000; December 31 finished goods, $640,000; cost of goods sold for the year, $2,560,000. The budgeted costs of goods manufactured for the year is?

A) $1,405,000

B) $2,560,000

C) $2,435,000

D) $3,965,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's history indicates that 20% of its sales are for cash and the rest are on credit. Collections on credit sales are 20% in the month of the sale, 50% in the next month, 25% the following month, and 5% is uncollectible. Projected sales for December, January, and February are $60,000, $85,000, and $95,000, respectively. The February expected cash receipts from all current and prior credit sales is:

A) $61,200

B) $57,000

C) $66,400

D) $90,250

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The budgeted finished goods inventory and cost of goods sold for a manufacturing company for the year 2012 are as follows: January 1 finished goods, $765,000; December 31 finished goods, $540,000; cost of goods sold for the year, $2,560,000. The budgeted costs of goods manufactured for the year is?

A) $1,255,000

B) $2,335,000

C) $2,785,000

D) $3100,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

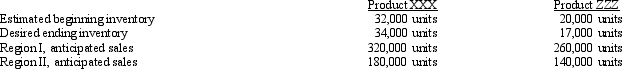

Below is budgeted production and sales information for Flushing Company for the month of December:  The unit selling price for product XXX is $5 and for product ZZZ is $15.

Budgeted production for product ZZZ during the month is:

The unit selling price for product XXX is $5 and for product ZZZ is $15.

Budgeted production for product ZZZ during the month is:

A) 403,000 units

B) 380,000 units

C) 397,000 units

D) 417,000 units

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The objectives of budgeting are (1) establishing specific goals for future operations, (2) executing plans to achieve the goals, and (3) periodically comparing actual results with these goals.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

At the beginning of the period, the Molding Department budgeted direct labor of $33,000 and supervisor salaries of $24,000 for 3,000 hours of production. The department actually completed 2,500 hours of production. Determine the budget for the department assuming that it uses flexible budgeting?

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 188

Related Exams