B) False

Correct Answer

verified

Correct Answer

verified

True/False

Short-term financing is riskier than long-term financing since, during periods of tight credit, the firm may not be able to rollover (renew)its debt.This is especially true if the funds are used to finance long-term assets rather than short-term assets.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Not taking cash discounts is costly, and as a result, firms that do not take them are usually those that are performing poorly and have inadequate cash balances.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Dimon Products' sales are expected to be $5 million this year, with 90% on credit and 10% for cash.Sales are expected to grow at a stable, steady rate of 10% annually in the future.Dimon's accounts receivable balance will remain constant at the current level, because the 10% cash sales can be used to support the 10% growth rate, other things held constant.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A lockbox plan is most beneficial to firms that

A) have widely dispersed manufacturing facilities.

B) have a large marketable securities portfolio and cash to protect.

C) receive payments in the form of currency, such as fast food restaurants, rather than in the form of checks.

D) have customers who operate in many different parts of the country.

E) have suppliers who operate in many different parts of the country.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Thornton Universal Sales' cost of goods sold (COGS) average $2, 000, 000 per month, and it keeps inventory equal to 50% of its monthly COGS on hand at all times.Using a 365-day year, what is its inventory conversion period?

A) 11.7 days

B) 13.0 days

C) 14.4 days

D) 15.2 days

E) 16.7 days

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Trade credit can be separated into two components: free trade credit, which is credit received after the discount period ends, and costly trade credit, which is the cost of discounts not taken.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An informal line of credit and a revolving credit agreement are similar except that the line of credit creates a legal obligation for the bank and thus is a more reliable source of funds for the borrower.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Suppose a firm changes its credit policy from 2/10 net 30 to 3/10 net 30.The change is meant to meet competition, so no increase in sales is expected.The average accounts receivable balance will probably decline as a result of this change.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor Textbooks Inc.buys on terms of 2/15, net 50 days.It does not take discounts, and it typically pays on time, 50 days after the invoice date.Net purchases amount to $450, 000 per year.On average, what is the dollar amount of costly trade credit (total credit - free credit) the firm receives during the year? (Assume a 365-day year, and note that purchases are net of discounts.)

A) $43, 151

B) $45, 308

C) $47, 574

D) $49, 952

E) $52, 450

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Krackle Korn Inc.had credit sales of $3, 500, 000 last year and its days sales outstanding was DSO = 35 days.What was its average receivables balance, based on a 365-day year?

A) $335, 616

B) $352, 397

C) $370, 017

D) $388, 518

E) $407, 944

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The overriding goal of inventory management is to ensure that the firm never suffers a stock-out, i.e., never runs out of an inventory item.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Albrecht Inc.is a no-growth firm whose sales fluctuate seasonally, causing total assets to vary from $320, 000 to $410, 000, but fixed assets remain constant at $260, 000.If the firm follows a maturity matching (or moderate) working capital financing policy, what is the most likely total of long-term debt plus equity capital?

A) $260, 642

B) $274, 360

C) $288, 800

D) $304, 000

E) $320, 000

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Andrews Corporation buys on terms of 2/8, net 45 days, it does not take discounts, and it actually pays after 58 days.What is the effective annual percentage cost of its non-free trade credit? (Use a 365-day year.)

A) 14.34%

B) 15.10%

C) 15.89%

D) 16.69%

E) 17.52%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's collection policy, i.e., the procedures it follows to collect accounts receivable, plays an important role in keeping its average collection period short, although too strict a collection policy can reduce profits due to lost sales.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The cash conversion cycle (CCC)combines three factors: The inventory conversion period, the average collection period, and the payables deferral period, and its purpose is to show how long a firm must finance its working capital.Other things held constant, the shorter the CCC, the more effective the firm's working capital management.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The four primary elements in a firm's credit policy are (1)credit standards, (2)discounts offered, (3)credit period, and (4)collection policy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Buchholz Corporation follows a moderate current asset investment policy, but it is now considering a change, perhaps to a restricted or maybe to a relaxed policy.The firm's annual sales are $400, 000; its fixed assets are $100, 000; its target capital structure calls for 50% debt and 50% equity; its EBIT is $35, 000; the interest rate on its debt is 10%; and its tax rate is 40%.With a restricted policy, current assets will be 15% of sales, while under a relaxed policy they will be 25% of sales.What is the difference in the projected ROEs between the restricted and relaxed policies?

A) 4.25%

B) 4.73%

C) 5.25%

D) 5.78%

E) 6.35%

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

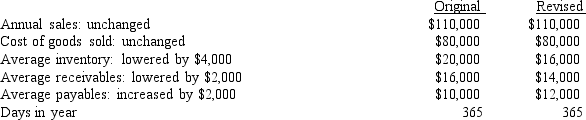

Kiley Corporation had the following data for the most recent year (in millions) .The new CFO believes (1) that an improved inventory management system could lower the average inventory by $4, 000, (2) that improvements in the credit department could reduce receivables by $2, 000, and (3) that the purchasing department could negotiate better credit terms and thereby increase accounts payable by $2, 000.Furthermore, she thinks that these changes would not affect either sales or the costs of goods sold.If these changes were made, by how many days would the cash conversion cycle be lowered?

A) 34.0

B) 37.4

C) 41.2

D) 45.3

E) 49.8

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

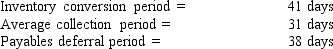

Whaley & Whaley has the following data.What is the firm's cash conversion cycle?

A) 31 days

B) 34 days

C) 37 days

D) 41 days

E) 45 days

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 138

Related Exams