B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

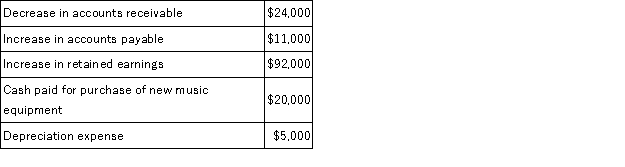

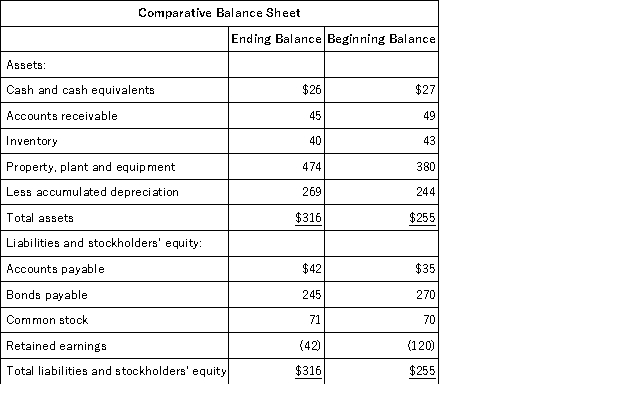

Klutz Dance Studio had net income of $167,000 for the year just ended. Klutz collected the following additional information to prepare its statement of cash flows for the year:  Klutz uses the indirect method to prepare its statement of cash flows. What is Klutz's net cash provided (used) by operating activities?

Klutz uses the indirect method to prepare its statement of cash flows. What is Klutz's net cash provided (used) by operating activities?

A) $95,000

B) $137,000

C) $185,000

D) $207,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

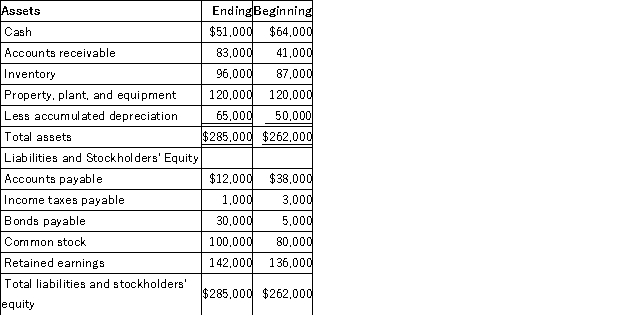

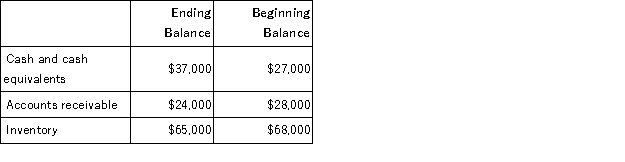

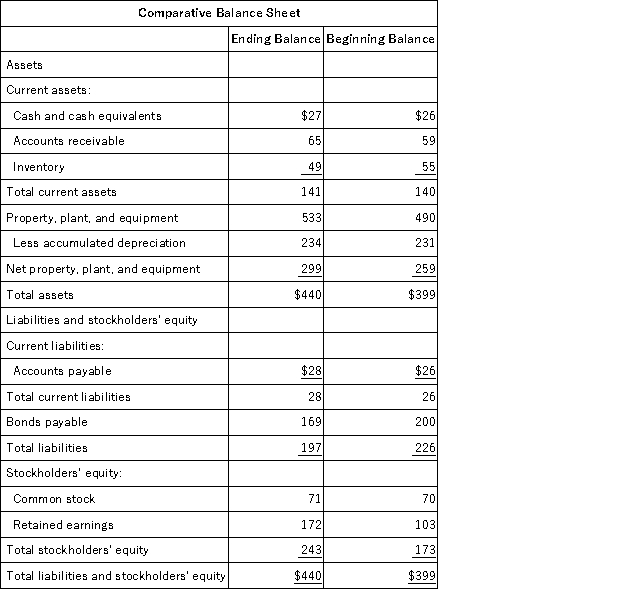

Stone Retail Corporation's most recent comparative Balance Sheet is as follows:  Stone's net income was $46,000. No equipment was sold or purchased. Cash dividends of $40,000 were declared and paid. Stone uses the indirect method to prepare its statement of cash flows. What is Stone's net cash provided by (used in) investing activities?

Stone's net income was $46,000. No equipment was sold or purchased. Cash dividends of $40,000 were declared and paid. Stone uses the indirect method to prepare its statement of cash flows. What is Stone's net cash provided by (used in) investing activities?

A) $0

B) ($15,000)

C) $25,000

D) $45,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be added to net income in the operating activities section of a statement of cash flows prepared using the indirect method?

A) a decrease in accounts receivable.

B) an increase in prepaid expenses.

C) an increase in accrued liabilities.

D) an increase in property, plant and equipment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Cash payments to repay the principal amount of debt are reported as a cash outflow in the investing activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

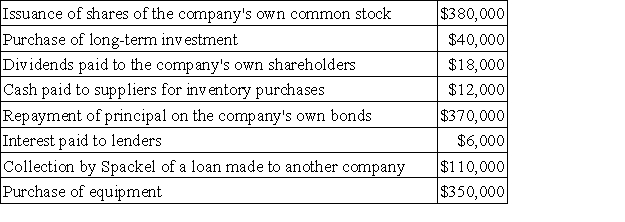

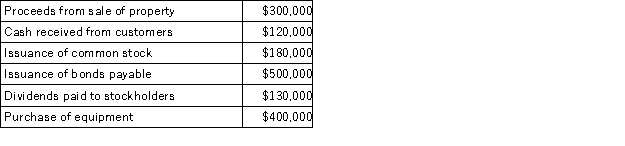

Spackel Corporation recorded the following events last year:  On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities. Based solely on the information above, the net cash provided by (used in) investing activities on the statement of cash flows would be:

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities. Based solely on the information above, the net cash provided by (used in) investing activities on the statement of cash flows would be:

A) ($280,000)

B) ($390,000)

C) ($760,000)

D) ($1,286,000)

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

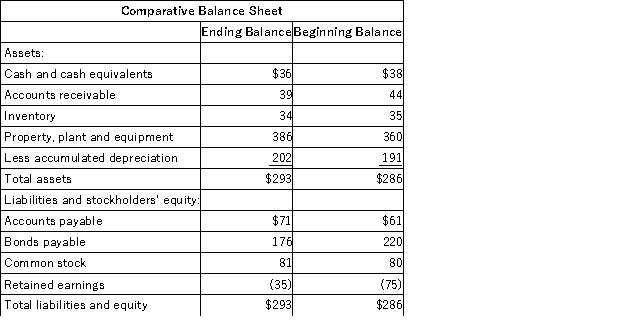

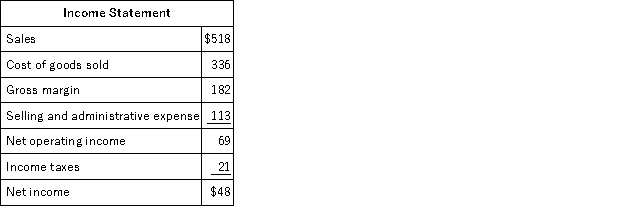

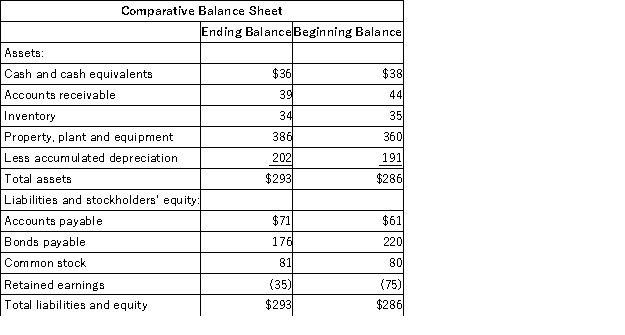

Financial statements of Rukavina Corporation follow:

Cash dividends were $8. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) financing activities for the year was:

Cash dividends were $8. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) financing activities for the year was:

A) ($8)

B) ($44)

C) ($51)

D) $1

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in accounts receivable of $1,000 over the course of a year would be shown on the company's statement of cash flows prepared under the indirect method as:

A) an addition to net income of $1,000 in order to arrive at net cash provided by operating activities.

B) a deduction from net income of $1,000 in order to arrive at net cash provided by operating activities.

C) an addition of $1,000 under financing activities.

D) a deduction of $1,000 under financing activities.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

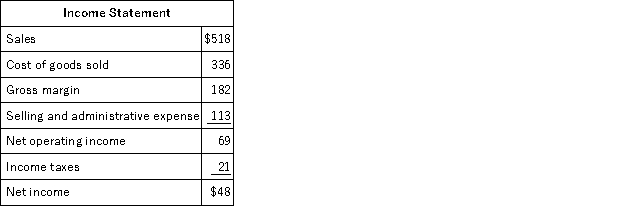

Sonier Corporation's most recent balance sheet appears below:  The net income for the year was $97. Cash dividends were $19. The company did not issue any bonds or repurchase any of its common stock during the year. The net cash provided by (used in) financing activities for the year was:

The net income for the year was $97. Cash dividends were $19. The company did not issue any bonds or repurchase any of its common stock during the year. The net cash provided by (used in) financing activities for the year was:

A) ($43)

B) ($19)

C) ($25)

D) $1

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The collection of a loan made to a supplier would be treated as an investing activity on a statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Excerpts from Neuwirth Corporation's comparative balance sheet appear below:  Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method?

A) The change in Accounts Receivable is added to net income; The change in Inventory is added to net income

B) The change in Accounts Receivable is added to net income; The change in Inventory is subtracted from net income

C) The change in Accounts Receivable is subtracted from net income; The change in Inventory is subtracted from net income

D) The change in Accounts Receivable is subtracted from net income; The change in Inventory is added to net income

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

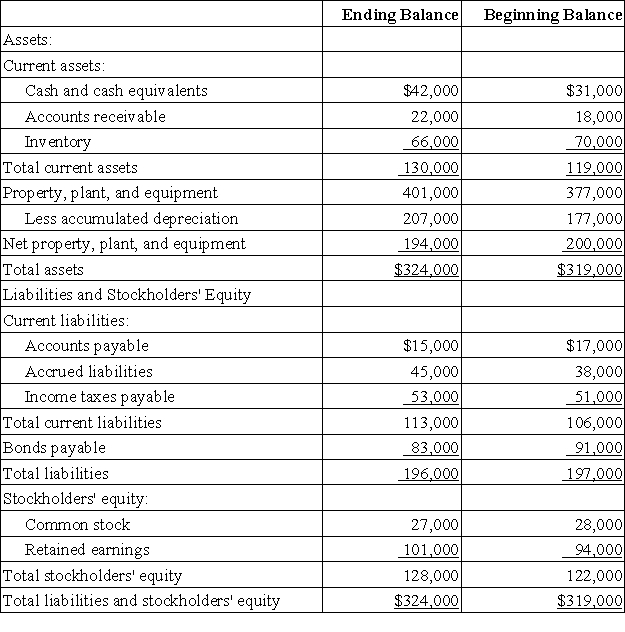

Hirshberg Corporation's comparative balance sheet appears below:  The company's net income (loss) for the year was $11,000 and its cash dividends were $4,000. It did not sell or retire any property, plant, and equipment during the year. The company's net cash used in investing activities is:

The company's net income (loss) for the year was $11,000 and its cash dividends were $4,000. It did not sell or retire any property, plant, and equipment during the year. The company's net cash used in investing activities is:

A) $6,000

B) $54,000

C) $24,000

D) $44,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a statement of cash flows, a change in an income taxes payable account would be recorded in the:

A) operating activities section.

B) financing activities section.

C) investing activities section.

D) stockholders' equity section.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

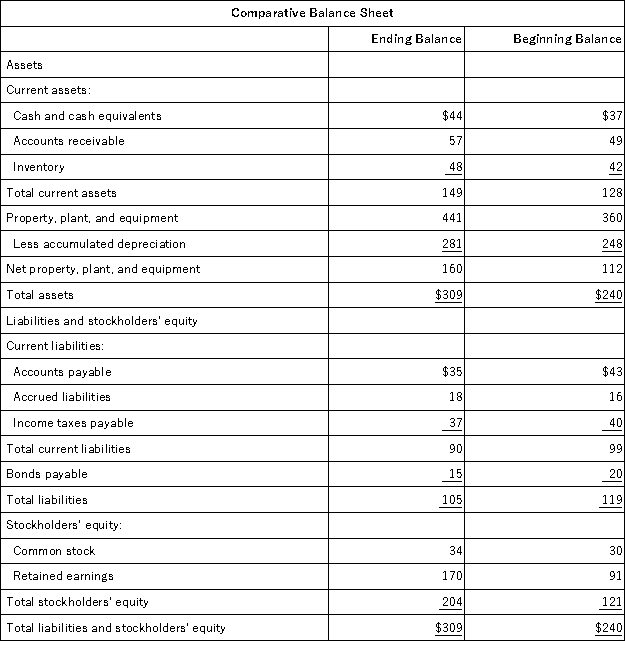

Birchett Corporation's most recent balance sheet appears below:  The company's net income for the year was $91 and it did not sell or retire any property, plant, and equipment during the year. Cash dividends were $22. The net cash provided by (used in) operating activities for the year was:

The company's net income for the year was $91 and it did not sell or retire any property, plant, and equipment during the year. Cash dividends were $22. The net cash provided by (used in) operating activities for the year was:

A) $86

B) $5

C) $96

D) $130

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

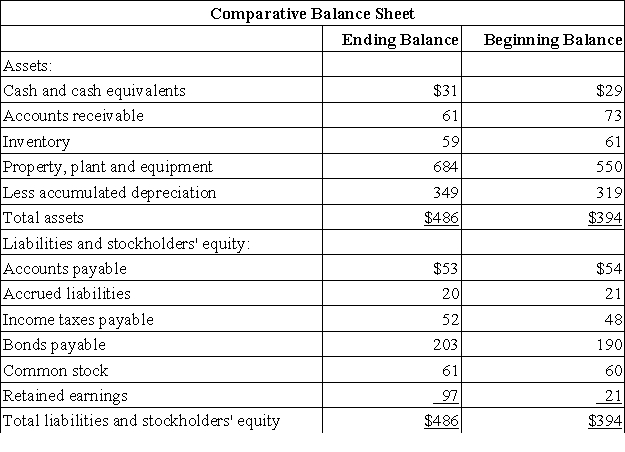

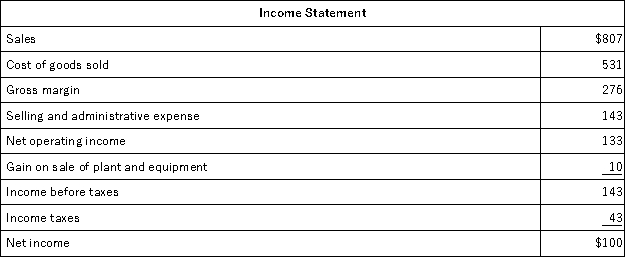

Vandy Corporation's balance sheet and income statement appear below:

The company sold equipment for $18 that was originally purchased for $14 and that had accumulated depreciation of $12. It paid a cash dividend of $28 during the year and did not retire any bonds payable or repurchase any of its own common stock.

Required:

Prepare a statement of cash flows for the year using the indirect method.

The company sold equipment for $18 that was originally purchased for $14 and that had accumulated depreciation of $12. It paid a cash dividend of $28 during the year and did not retire any bonds payable or repurchase any of its own common stock.

Required:

Prepare a statement of cash flows for the year using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

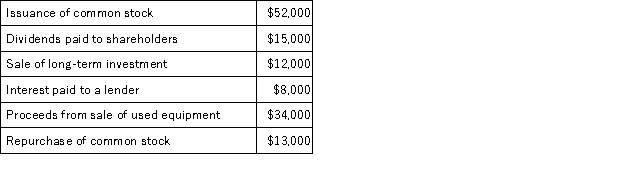

The following events occurred last year for the Cart Corporation:  Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows was:

Based solely on the above information, the net cash provided by financing activities for the year on the statement of cash flows was:

A) $12,000

B) $24,000

C) $20,000

D) $49,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under the indirect method of determining the net cash provided by operating activities on the statement of cash flows, a decrease in inventory would be added to net income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial statements of Rukavina Corporation follow:

Cash dividends were $8. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) operating activities for the year was:

Cash dividends were $8. The company did not dispose of any property, plant, and equipment. It did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows. The net cash provided by (used in) operating activities for the year was:

A) $21

B) $75

C) $27

D) $69

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

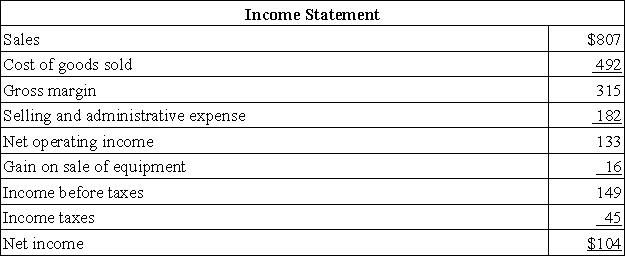

Marbry Corporation's balance sheet and income statement appear below:

Cash dividends were $21. The company did not issue any bonds or repurchase any of its own common stock during the year. The net cash provided by (used in) financing activities for the year was:

Cash dividends were $21. The company did not issue any bonds or repurchase any of its own common stock during the year. The net cash provided by (used in) financing activities for the year was:

A) $4

B) ($22)

C) ($5)

D) ($21)

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Randal Corporation recorded the following activity for the year just ended:  The net cash provided by financing activities for the year was:

The net cash provided by financing activities for the year was:

A) $100,000

B) $550,000

C) $180,000

D) $680,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 132

Related Exams