B) False

Correct Answer

verified

Correct Answer

verified

True/False

The flow of payments for purchases and sale of financial assets is included in the current account balance of a nation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true of a world with a system of fixed exchange rates as opposed to one with floating rates?

A) It requires less world liquidity or reserves

B) It creates less confidence about future values of currencies

C) It facilitates the transmission of shifts in economic conditions between countries

D) It increases the role of the central banks in foreign exchange markets

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

People will have to exchange their currency for another only when they do exporting or importing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The current account portion of a nation's balance of payments statement includes net investment income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In one year the dollar would buy 162 Japanese yen, but ten years later, it would buy only 123 yen. Relative to the yen, the value of the dollar:

A) Increased by about 32 percent

B) Decreased by about 24 percent

C) Decreased by about 32 percent

D) Increased by about 24 percent

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Relatively high rates of U.S. inflation compared to other countries will increase the supply of, and decrease the demand for, dollars in foreign exchange markets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following table contains data for the U.S. balance of payments in a prior year. Answer the question on the basis of this information. All figures are in billions of dollars. U.S. goods exports +$793 U.S. goods imports -1573 U.S. exports of service +280 U.S. imports of services -222 Net investment income +5 Net transfers -81 Capital account -5 Foreign purchases of assets in the U.S. +1198 U.S. purchases of foreign assets -395 By how much did Americans forgive debt owed to them by foreigners than foreigners forgave debt owed to them by Americans?

A) +$5 billion

B) -$5 billion

C) +$72 billion

D) -$72 billion

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following appears as a positive item on the balance of payments accounts for the United States?

A) U.S. government sending aid to natural-disaster victims in Asia

B) American tourists spending money in the other countries

C) The buying of U.S. Treasury bonds by a foreign bank

D) The payment of stock dividends by U.S. firms to foreign shareholders

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

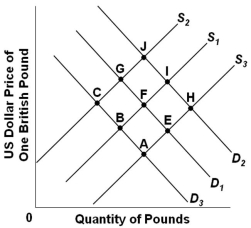

In a graph showing the market supply and demand for British pounds in terms of U.S. dollars, the supply-of-pounds curve is upsloping because:

A) Fewer British pounds can be purchased per dollar if U.S. dollars become more expensive

B) Fewer U.S. dollars can be purchased per pound if the British pounds become less expensive

C) The British will purchase more U.S. goods or services when the dollar price of pounds rises

D) The British will purchase more U.S. goods or services when the dollar price of pounds falls

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

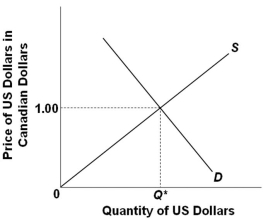

Refer to the graph above. If Canadian investors buy more U.S. financial and real assets, then:

Refer to the graph above. If Canadian investors buy more U.S. financial and real assets, then:

A) The demand curve will shift left

B) The demand curve will shift right

C) The supply curve will shift left

D) The supply curve will shift right

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following table contains hypothetical data for the U.S. balance of payments in a year. Answer the following question on the basis of these data. All figures are in billions of dollars. U.S.  Refer to the table above. If there was a net inflow of $7 billion in official reserves in the capital and financial account that year, the United States experienced a balance-of-payments:

Refer to the table above. If there was a net inflow of $7 billion in official reserves in the capital and financial account that year, the United States experienced a balance-of-payments:

A) Surplus of $7 billion

B) Deficit of $7 billion

C) Surplus of $99 billion

D) Deficit of $99 billion

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A market basket of goods costs $350 in the United States and 200 pounds in the United Kingdom. According to the purchasing power parity theory, the exchange rate should move towards:

A) $0.67 per British pound

B) $1.50 per British pound

C) $0.57 per British pound

D) $1.75 per British pound

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the graph above, which shows the supply and demand for British pounds. D1 and S1 represent the initial demand and supply curves. If the supply of British pounds in the foreign exchange market shifts to S3, and the British government wanted to fix the exchange rate at its initial level, then it should:

Refer to the graph above, which shows the supply and demand for British pounds. D1 and S1 represent the initial demand and supply curves. If the supply of British pounds in the foreign exchange market shifts to S3, and the British government wanted to fix the exchange rate at its initial level, then it should:

A) Sell U.S. dollars out of its reserves

B) Buy U.S. dollars to add to its reserves

C) Sell British pounds in the foreign exchange market

D) Buy British bonds in the open market

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the dollar price of the British pounds will:

A) Increase the pound price of dollars

B) Decrease the pound price of dollars

C) Leave the pound price of dollars unchanged

D) Cause Britain's terms of trade with the United States to deteriorate

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a financial portfolio manager in the U.S. buys British company stocks in the London Stock Exchange, this would involve:

A) A demand for British pounds in the foreign exchange market

B) A supply of British pounds in the foreign exchange market

C) No effect on the demand for British pounds in the foreign exchange market

D) A demand for U.S. dollars in the foreign exchange market

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purchase of a British Rolls-Royce by a U.S. citizen would result in all of the following except a(n) :

A) Supply of payments to England

B) Sale of dollars and the purchase of British pounds

C) Increase in imports to the United States

D) Gain of foreign exchange for the United States

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following table contains data for the U.S. balance of payments in a prior year. Answer the question on the basis of this information. All figures are in billions of dollars. U.S. goods exports +$793 U.S. goods imports -1573 U.S. exports of service +280 U.S. imports of services -222 Net investment income +5 Net transfers -81 Capital account -5 Foreign purchases of assets in the U.S. +1198 U.S. purchases of foreign assets -395 Refer to the table above. The data indicate that Americans:

A) Bought foreign assets abroad more than foreigners bought assets in the U.S.

B) Invested abroad more than foreigners invested in America

C) Earned more from their investments abroad than foreigners earned from their investments in America

D) Sold more products to buyers abroad than what foreign producers sold to buyers in America

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An inflow of investment funds into the United States from overseas is likely to result from a(n) :

A) Decline in expectations for economic growth in the United States

B) Growing belief among investors that the U.S. dollar ($) is overvalued

C) Rise in U.S. interest rates relative to world interest rates

D) Increase in the U.S. inflation rate

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S. businesses are demanders of foreign currencies because they need them to:

A) Sell goods and services exported to foreign countries

B) Pay for goods and services imported from foreign countries

C) Receive interest payments from foreign governments

D) Receive interest payments from foreign businesses

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 152

Related Exams