A) An appreciation of the pound and a depreciation of the dollar

B) A depreciation of the pound and a depreciation of the dollar

C) An appreciation of the pound and an appreciation of the dollar

D) A depreciation of the pound and an appreciation of the dollar

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the income of country A relative to the income of country B will usually lead to an increase in country:

A) A's exports to country B

B) B's imports from country A

C) A's demand for the currency of country B

D) B's demand for the currency of country A

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All else being equal, increased U.S. exports to nations in the European Union create a:

A) Demand for euros

B) Supply of euros

C) Shortage of euros

D) Surplus of euros

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following would add to the demand for U.S. dollars except:

A) Long-term capital inflows

B) Foreign travel by United States citizens

C) Exports of commodities from the United States

D) Travel by foreigners on United States airlines

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S. imports:

A) Increase the foreign demand for foreign currencies

B) Increase the domestic demand for foreign currencies

C) Decrease the foreign supply of foreign currencies

D) Increase the domestic supply of foreign currencies

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

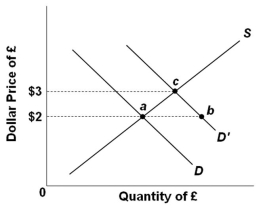

Refer to the graph above, which shows a change in the demand for pounds from D to D'. Under a system of fixed exchange rates, the:

Refer to the graph above, which shows a change in the demand for pounds from D to D'. Under a system of fixed exchange rates, the:

A) Price of a pound will increase to $3

B) Price of a dollar will increase to 3 pounds

C) Shortage equal to ab would be met using international monetary reserves

D) Payment deficit will cause changes in price and income levels, which reestablishes the original exchange rate

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To Americans buyers, there is a decrease in the relative prices of Japanese goods when the:

A) Yen appreciates

B) Dollar appreciates

C) Inflation rate in the United States is higher than the inflation rate in Japan, and there are flexible exchange rates

D) Inflation rate in Japan is higher than the inflation rate in the United States and there are fixed exchange rates

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a Japanese company buys a U.S. software company, this transaction will be a:

A) Credit on the current account of the U.S. balance of payments

B) Debit on the current account of the U.S. balance of payments

C) Credit on the financial account of the U.S. balance of payments

D) Debit on the financial account of the U.S. balance of payments

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Answer the question on the basis of the following balance of payments data for the hypothetical nation of Econland. All figures are in billions of dollars. (1) Goods exports +$220 (2) Goods imports -328 (3) Exports of services +54 (4) Imports of services -55 (5) Net investment income +18 (6) Net transfers -11 (7) Capital account -1 (8) Foreign purchases of Econland assets +124 (9) Econland purchases of foreign assets -21 Refer to the table above. Econland's balance of trade in goods and services shows a:

A) Net inflow of payments of $109 billion

B) Net outflow of payments of $109 billion

C) Net inflow of payments of $108 billion

D) Net outflow of payments of $108 billion

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which system would be accompanied by occasional currency interventions by central banks to stabilize or alter rates to avoid persistent balance of payments deficits or surpluses?

A) The gold standard

B) Fixed exchange rates

C) Flexible exchange rates

D) Managed floating exchange rates

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The United States, Germany, Japan, Britain, France, Italy, Canada, and Russia are:

A) G-8 nations

B) Adjustable peg nations

C) Gold standard nations

D) Nations using the Bretton Woods System

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a European importer can buy $10,000 for 11,100 euros, the exchange rate for the euro is:

A) 1 euro = $0.80

B) 1 euro = $0.90

C) 1 euro = $0.95

D) 1 euro = $1.11

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nation's current account balance is equal to its exports less its imports of:

A) Goods and services

B) Goods and services, minus U.S. purchases of assets abroad

C) Goods and services, plus net investment income and net transfers

D) Goods and services, plus foreign purchases of assets in the United States

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the U.S. dollar decreases in value relative to foreign currencies the:

A) Demand for U.S. exports will decrease

B) Supply of U.S. exports will decrease

C) Demand for U.S. exports will increase

D) Supply of U.S. exports will remain constant

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If real interest rates rise in the United Kingdom relative to the United States, then this event is most likely to cause the British pound to:

A) Depreciate and the U.S. dollar to depreciate

B) Depreciate and the U.S. dollar to appreciate

C) Appreciate and the U.S. dollar to appreciate

D) Appreciate and the U.S. dollar to depreciate

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an item in the current account balance of the United States? The purchase of:

A) A U.S. company by a foreign company

B) Stock in a foreign corporation by a U.S. company

C) Insurance in the United States by a foreign company

D) A United States Treasury bond by a wealthy foreigner

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

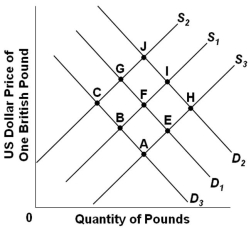

Refer to the graph above, which shows the supply and demand for British pounds. D1 and S1 represent the initial demand and supply curves. What will be the new equilibrium point as indicated in the graph if there is an increase in consumer spending by the British for American products and a decrease in consumer spending by Americans for British products?

Refer to the graph above, which shows the supply and demand for British pounds. D1 and S1 represent the initial demand and supply curves. What will be the new equilibrium point as indicated in the graph if there is an increase in consumer spending by the British for American products and a decrease in consumer spending by Americans for British products?

A) A

B) C

C) H

D) J

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following table contains hypothetical data for the U.S. balance of payments in a year. Answer the following question on the basis of these data. All figures are in billions of dollars. U.S.  Refer to the table above. What does the figure for net investment income indicate?

Refer to the table above. What does the figure for net investment income indicate?

A) Americans invested more abroad than the amount foreigners invested in the U.S.

B) The size of the net inflow of foreign investment to the United States in that year

C) The net amount Americans received as interest and dividends on existing American investments abroad

D) The net amount Americans paid as interest and dividends on existing foreign investments in the United States

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

U.S. exports represent two flows:

A) An outflow of goods or services, and an outflow of payments

B) An inflow of goods or services, and an outflow of payments

C) An outflow of goods or services, and an inflow of payments

D) An inflow of goods or services, and an inflow of payments

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Comparing what the United States owes to other nations against what other nations owe to the United States, the United States is currently a(n) :

A) Net creditor

B) Net debtor

C) International banking asset

D) International banking liability

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 152

Related Exams