A) 4 percent

B) 7 percent

C) 10 percent

D) 12 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is considered to be the best measure of the risk-free interest rate?

A) The rate of return on a corporate bond index fund

B) The rate of return on a corporate stock index fund

C) The rate of return on the Standard and Poor's 500

D) The rate of return on short-term U.S. government bonds

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Ponzi scheme can only succeed if the investors in the scheme believe that something is preventing:

A) Diversification

B) Arbitrage

C) Pooling

D) Risk premium

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You would like to have $50,000 for a new car in six years. If you deposit money today in a bank CD that pays 4% per year, how much must your deposit be?

A) $38,050

B) $39,516

C) $40,323

D) $42,108

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial investment refers to:

A) The same idea as economic investment

B) Earning profits from producing goods and services

C) Purchasing or building an asset for monetary gain

D) Making new additions to the capital stock

F) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

What do bonds represent?

A) Shares of ownership in a corporation and a guaranteed stream of profits

B) Shares of ownership in a corporation and an entitlement to its future profits

C) Debt contracts with corporations or governments, and regular interest payments on the loan

D) Debt contracts with corporations or governments, and some unspecified interest payments on the loan

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Time value of money refers to the idea that a specific amount of money:

A) Can be converted into other currencies in the foreign exchange market

B) Is needed to purchase goods and services

C) Is more valuable the sooner it is received

D) Can buy less goods and services if inflation occurs over time

F) None of the above

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

If the demand for an asset increases, its:

A) Price will increase and the rate of return for new investors of this asset will increase

B) Price will decrease and the rate of return for new investors of this asset will increase

C) Price will decrease and the rate of return for new investors of this asset will decrease

D) Price will increase and the rate of return for new investors of this asset will decrease

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Other factors constant, if the interest rate is higher, the present value of a certain future amount will be smaller.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond that pays annual interest (or coupons) and a face value at maturity will fetch a price today that is equal to the:

A) Future value of its annual coupons and face value

B) Future value of its annual coupons minus its face value

C) Present value of its annual coupons and face value

D) Present value of its annual coupons minus its face vale

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the relationship between risk and the average expected return of investments?

A) Less risky assets will have similar average expected rates of return to more risky assets

B) Less risky assets will have higher average expected rates of return than more risky assets

C) More risky assets will have higher average expected rates of return than less risky assets

D) More risky assets will have lower average expected rates of return than less risky assets

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Investors face the risk that the economy could go into another recession. This risk is:

A) Idiosyncratic

B) Diversifiable

C) Systemic

D) Time preference

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The expected rate of return from an investment is:

A) Only the rate that compensates for time preference

B) Only the rate that compensates for risk

C) The rate that compensates for time preference plus the rate that compensates for risk

D) The rate that compensates for time preference minus the rate that compensates for risk

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Joe and Linda have the opportunity to purchase a new home. The house in Glen Oaks is currently worth $250,000 but is predicted to be worth $270,000 in a year. What is the rate of appreciation for the house from one year to the next?

A) 5 percent

B) 6 percent

C) 7 percent

D) 8 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

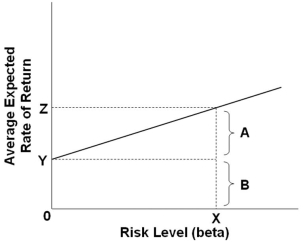

Refer to the graph above. The average expected rate of return for an asset with a beta equal to X would be:

Refer to the graph above. The average expected rate of return for an asset with a beta equal to X would be:

A) Y

B) A plus B

C) Z minus A

D) Z minus Y

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A strategy that attempts to reduce the overall risk of an entire investment portfolio by investing in a variety of assets is called:

A) Pooling

B) Arbitrage

C) Diversification

D) Weighted average

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The compensation for bearing more risk in owning an asset is a higher rate of return for the asset.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The "time value" of money is based on the fact that prices may increase over time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would best describe a mutual fund?

A) An investment that is available at many banks and is FDIC insured

B) A company that manages a portfolio that is purchased by pooling the money of its investors

C) A debt contract that is issued by a company and offers interest payment on the loan

D) Ownership of shares in a corporation with no guarantee the company will be profitable

F) C) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

An investor owns bond #1 that has a rate of return of 10 percent, but a similar bond #2 has an 11 percent return and equal risk. By selling bond #1 and buying bond #2 to earn a higher return, the investor is engaging in:

A) Pooling

B) Arbitrage

C) Diversification

D) Time preference

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 136

Related Exams