A) A decrease in the money supply M1

B) An increase in the money supply M1

C) An increase in the bank's net worth

D) An increase in the bank's liabilities

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sharon sells a government security worth $4,600,000 to the Federal Reserve Bank of Kansas City. She then deposits the funds in her checking account at First Commerce Bank. Her checking account had a $150,000 balance before this deposit. The reserves of First Commerce Bank would:

A) Increase by $4,750,000

B) Increase by $4,600,000

C) Decrease by $4,600,000

D) Decrease by $4,450,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Requiring banks to use less leveraging is equivalent to:

A) Expanding the loan portfolio of banks

B) Reducing the banks' reserve ratio

C) Requiring a higher level of bank net worth

D) Requiring banks to accept more deposits

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) When borrowers repay bank loans, the money supply is increased

B) When borrowers take out bank loans, the money supply is decreased

C) A single bank can legally lend an amount equal to its total reserves

D) A bank can only grant loans to customers if it has excess reserves

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

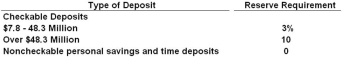

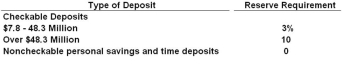

Refer to the table above. If a bank has checkable deposits of $45 million and reserves of $2 million, then its excess reserves are:

Refer to the table above. If a bank has checkable deposits of $45 million and reserves of $2 million, then its excess reserves are:

A) $0.35 million

B) $0.65 million

C) $1.35 million

D) $1.65 million

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

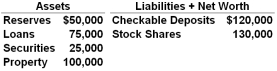

Answer the question based on the following balance sheet for the First National Bank. Assume the reserve ratio is 15 percent:  Refer to the data above. If a check for $20,000 is drawn and cleared against this bank, it will then have excess reserves of:

Refer to the data above. If a check for $20,000 is drawn and cleared against this bank, it will then have excess reserves of:

A) $15,000

B) $20,000

C) $25,000

D) $30,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that the reserve ratio is 6%, and applies only to checkable deposits. A bank has non-checkable time deposits of $300 million, checkable deposits of $100 million, and reserves of $8 million. What are the excess reserves of this bank?

A) $5.6 million

B) $6 million

C) $2 million

D) $2.4 million

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bank has excess reserves of $5,000 and demand deposits of $50,000; the required reserve ratio is 20 percent. If the reserve ratio is raised to 25 percent, then this bank can lend a maximum of:

A) $1,000

B) $1,500

C) $2,000

D) $2,500

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a commercial banking system has $200,000 in checkable deposits and actual reserves of $70,000, then with a reserve ratio of 20 percent the banking system can expand the supply of money by a maximum of $180,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash held by a bank in its vault is a part of the bank's:

A) Reserves

B) Liabilities

C) Money supply

D) Net worth

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When required reserves exceed actual reserves, commercial banks will be forced to have borrowers:

A) Use credit cards

B) Withdraw some of their deposits

C) Repay loans

D) Take out more loans

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The commercial banking system can lend by a multiple of its excess reserves primarily because:

A) Its reserves are on deposit with the Federal Reserve Banks

B) Its reserves are highly liquid assets

C) It loses reserves when it extends credit

D) Its required reserves are fractional

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money is "created" when:

A) A depositor deposits money at the bank

B) A bank grants a loan to a customer

C) Someone lends money to a friend or a family member

D) People use money to pay for stuff they buy from one another

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fractional reserve banking refers to a system where banks:

A) Grant loans to their borrowing customers

B) Deposit a fraction of their reserves at the central bank

C) Hold only a fraction of their deposits in their reserves

D) Accept a portion of their deposits in checkable accounts

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When you deposit money at a bank, the bank will normally turn around and lend most of it to a borrower.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One major component of money supply M1 is part of a bank's:

A) Assets

B) Reserves

C) Liabilities

D) Net worth

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the table above. If a bank has $60 million in savings deposits and $40 million in checkable deposits, then its required reserves are:

Refer to the table above. If a bank has $60 million in savings deposits and $40 million in checkable deposits, then its required reserves are:

A) $30 million

B) $3 million

C) $1.8 million

D) $1.2 million

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a bank sells capital stock (equity shares) in return for cash:

A) The capital stock increases the assets side and the cash increases the liabilities side

B) The capital stock decreases the liabilities and the cash increases the assets side

C) The capital stock increases the net worth and the cash increases the liabilities

D) The capital stock increases the net worth and the cash increases the assets side

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a bank accepts a checkable deposit from a customer, its deposits will increase and its excess reserves will:

A) Increase by the same amount as deposits

B) Increase by less than the deposits

C) Increase by more than the deposits

D) Decrease

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the required reserve ratio is 5 percent. If a commercial bank has $2 million cash in its vault, $1 million in government securities, $3 million on deposit at the Fed, and $60 million in checkable deposits, then its excess reserves equal:

A) $0 million

B) $2 million

C) $5 million

D) $6 million

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 127

Related Exams