A) Federal Open Market Committee

B) Office of Management and Budget

C) Thrift Advisory Council

D) Federal Advisory Council

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The currency held in the vaults of commercial banks is included in the money supply M1.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Securitization, the process of forming new securities by bundling or slicing up groups of securities like mortgages and bonds, is:

A) A way of reducing risk though diversification

B) Well-understood by financial analysts and managers who engaged in it

C) Considered shady by legitimate financial institutions

D) Still only a minor portion of the modern financial system

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true about the Federal Reserve banks?

A) They serve as bankers' banks

B) They are privately owned but government-controlled

C) Unlike other banks, they are not motivated by profits

D) They compete with commercial banks in their basic functions

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The functions of money are to serve as a:

A) Resource allocator, method for accounting, and means of income distribution

B) Unit of account, store of value, and medium of exchange

C) Determinant of consumption, investment, and government spending

D) Factor of production, exchange, and aggregate supply

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given the fact that "too big to fail" could translate into "too big to jail", many economists are calling for a return to the separation of high-risk from the low-risk activities in the financial sector. This separation is embodied in the Wall Street Reform and Consumer Protection Act of 2010 in the so-called:

A) Greenspan Policy

B) Volker Rule

C) Bernanke Policy

D) Obama Rule

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The general public can open deposit accounts at their district's Federal Reserve Bank.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The so-called near-monies have the following characteristics, except:

A) Highly liquid assets

B) Not a means of payment

C) Part of money supply M1

D) Readily converted into cash

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

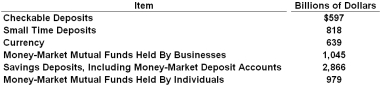

Refer to the table above. The size of the M1 money supply is:

Refer to the table above. The size of the M1 money supply is:

A) $979 billion

B) $1,236 billion

C) $1,415 billion

D) $1,618 billion

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Reserve System performs many functions but its most important one is:

A) Issuing currency

B) Controlling the money supply

C) Providing for check clearing and collection

D) Acting as fiscal agent for the U.S. government

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money in the U.S. is essentially debt of:

A) Businesses and the banks

B) The Federal Reserve System and the banks

C) The national and local governments

D) Businesses and the Federal Reserve System

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

People can generally get the following items at their commercial banks, except:

A) Money market deposit accounts

B) Time deposits

C) Certificates of deposit

D) Money market mutual funds

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following list to answer the question about the money supply. Items 1) Money market mutual funds held by individuals 2) Savings deposits, including money market deposit accounts 3) Money market mutual funds held by businesses 4) Currency held by the public 5) Small time deposits 6) Checkable deposits Refer to the list above. The M2 money supply is composed of items:

A) 1, 2, 3, 4, 5, and 6

B) 1, 2, 4, 5, and 6

C) 1, 2, 4, and 6

D) 2, 4, 5, and 6

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A few years prior to the Financial Crisis of 2007-2008, many people were getting approved for mortgage loans even without proper documentation or credit checks.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

"Thrifts" refer to the following institutions, except:

A) Commercial banks

B) Credit unions

C) Mutual savings banks

D) Savings and loan associations

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

How many members can serve on the Board of Governors of the Federal Reserve System?

A) 7

B) 9

C) 12

D) 14

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Money eliminates the need for a coincidence of wants in trading primarily through its role as a:

A) Unit of account

B) Medium of exchange

C) Store of value

D) Medium of deferred payment

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When there is inflation in the economy, it implies that the:

A) Price index is rising and the purchasing power of money is also rising

B) Price index is falling and the purchasing power of money is also falling

C) Price index is falling and the purchasing power of money is rising

D) Price index is rising and the purchasing power of money is falling

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price index rises from 100 to 130, then the purchasing power of the dollar will fall by about:

A) 15 percent

B) 19 percent

C) 23 percent

D) 30 percent

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Subprime mortgages, which played a central role in the Financial Crisis of 2007-2008, had been strongly encouraged and supported by the government before the crisis.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 130

Related Exams