A) A store of value

B) A unit of account

C) A medium of deferred payment

D) A medium of exchange

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Currency and checkable deposits are:

A) Assets of the Federal Reserve Banks or of financial institutions

B) Redeemable for gold and silver from the Federal Reserve System

C) Of intrinsic value which determines the relative worth of money

D) The major components of money supply M1

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Credit card balances are part of money supply M2.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Money performs its function as a store of value very well, because it protects one against the erosion of purchasing power from inflation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is NOT true about subprime mortgage loans:

A) They played a central role in the financial crisis of 2007-2008

B) They were encouraged by the Federal government for many years before the financial crisis

C) They had always been discouraged by the government, and even banned in some cases

D) They were considered high-risk loans because the borrowers had poor credit ratings

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Bureau of Consumer Financial Protection was created in 2010 to become part of the:

A) U.S. Treasury Department

B) Federal Reserve System

C) Department of Commerce

D) Office of the President

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true about the use of a credit card?

A) It is a means of deferring payment for a short period of time

B) It allows people to "economize" on the use of money

C) Credit-card balances are part of M2, but not part of M1

D) A credit card transaction is not the same as a debit card transaction

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What function is money serving when you deposit money in a savings account?

A) A store of value

B) A unit of account

C) A checkable deposit

D) A medium of exchange

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One reason that "near-monies" are important is because:

A) They simplify the definition of money and therefore the formulation of monetary policy

B) They can be easily converted into money or vice versa, and thereby can influence the stability of the economy

C) They do not reflect the level of consumer spending but they have a critical impact on saving and investment in the economy

D) Credit cards synchronize one's expenditures and income, thereby reducing the cash and checkable deposits one must hold

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a consumer wants to compare the price of one product with another, money is primarily functioning as a:

A) Store of value

B) Unit of account

C) Checkable deposit

D) Medium of exchange

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Debit card balances are part of money supply M1, but credit card balances are not.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When you use money to purchase groceries, money is functioning as a store of value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reason for the Fed being set up as an independent agency of government is to:

A) Protect it from political pressure

B) Allow it to earn profits like private firms

C) Make it be managed and controlled by member banks

D) Let it be able to compete with other financial institutions

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

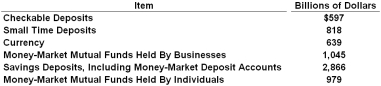

Refer to the table above. The size of the M2 money supply is:

Refer to the table above. The size of the M2 money supply is:

A) $2,054 billion

B) $2,696 billion

C) $5,899 billion

D) $6,792 billion

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following "backs" the value of money in the United States?

A) The gold stored in the Federal Reserve Bank of New York

B) The acceptability of it as a medium of exchange

C) The willingness of foreign government to hold U.S. dollars

D) The size of the budget surplus in the U.S. government

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The M1 money supply is composed of:

A) All coins and paper money held by the general public and the banks

B) Bank deposits of households and business firms

C) Bank deposits and mutual funds

D) Checkable deposits and currency in circulation

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following list to answer the question about the money supply. Items 1) Money market mutual funds held by individuals 2) Savings deposits, including money market deposit accounts 3) Money market mutual funds held by businesses 4) Currency held by the public 5) Small time deposits 6) Checkable deposits Refer to the list above. Which items are included in the M2 money supply, but not the M1 money supply?

A) 1 and 7

B) 3 and 5

C) 1 and 2

D) 1, 2, and 5

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following financial institutions traditionally accept deposits from savers, except:

A) Thrifts

B) Mutual fund companies

C) Investment banks

D) Pension funds

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal backing for money in the United States comes from:

A) Providing sufficient quantities of precious metals such as gold and silver to cover the amount of paper money in circulation

B) Pledging physical assets, such as land, natural resources, and public buildings as collateral for outstanding currency

C) Controlling the money supply in order to keep the value of money relatively stable over time

D) Protecting checkable deposits at financial institutions with deposit guarantees

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be considered to be the most liquid?

A) Checkable deposits

B) Small time deposits

C) Money market mutual funds

D) Savings deposits

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 130

Related Exams