A) $45 billion

B) $30 billion

C) $15 billion

D) $60 billion

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Planned investment is $20 billion and saving is $15 billion when GDP in the economy is $180 billion. The economy is:

A) At the equilibrium level of GDP

B) In disequilibrium and its GDP will increase

C) In disequilibrium and its GDP will decrease

D) Having a GDP level that is greater than its aggregate expenditures

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a private closed economy is at equilibrium, then (GDP - C) is equal to planned investment.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A downward-sloping investment demand curve and a horizontal investment schedule indicate that investments are inversely related to interest rates but are not affected by the level of income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the most important views expressed by classical macroeconomists was that:

A) Wages and prices are inflexible

B) Wages and prices are always rising

C) Demand creates its own supply

D) Supply creates its own demand

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

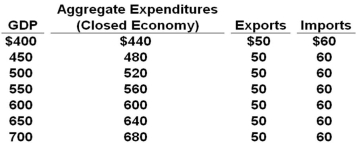

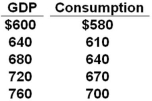

All figures in the table below are in billions of dollars.  Refer to the above data. If exports should decrease by $20 billion at each level of GDP, other factors constant, then the equilibrium GDP for the economy will be:

Refer to the above data. If exports should decrease by $20 billion at each level of GDP, other factors constant, then the equilibrium GDP for the economy will be:

A) $650 billion

B) $550 billion

C) $500 billion

D) $450 billion

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the aggregate expenditure model, which of the following variables is assumed to be independent of real GDP?

A) Profit

B) Saving

C) Investment

D) Consumption

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The effect of a decline in taxes on the level of income will differ somewhat from an increase in government expenditures of the same amount because:

A) Tax declines tend to be more expansionary

B) Households may not spend all of an increase in disposable income

C) The MPC which applies to the incomes of households always exceeds the MPC which applies to business incomes

D) The multiplier is high when the MPS is low

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The investment schedule shows the:

A) Inverse relationship between the expected rate of return and the quantity of investment demanded

B) Positive relationship between the expected rate of return and the quantity of investment demanded

C) Amounts business firms collectively intend to invest at each possible level of GDP

D) Rate of interest that business firms must pay when they make investments in capital goods

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

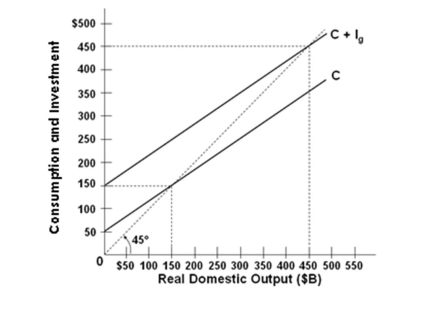

Refer to the graph above for a private closed economy. In this economy, investment is:

Refer to the graph above for a private closed economy. In this economy, investment is:

A) $50 billion

B) $100 billion

C) $150 billion

D) $200 billion

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between the investment demand curve and the investment schedule is that the former shows:

A) A direct relationship between investment and interest rate, while the latter shows no correlation between investment and income

B) An inverse relationship between investment and interest rate, while the latter shows no correlation between investment and income

C) A direct relationship between investment and income, while the latter shows no correlation between investment and interest rate

D) An inverse relationship between investment and income, while the latter shows no correlation between investment and interest rate

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

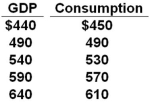

The data below is the consumption schedule in an economy. All figures are in billions of dollars.  Refer to the above table. Given the level of investment at $34 billion, zero net exports, and a lump-sum tax of $30 billion, the addition of government expenditures of $20 billion at each level of GDP will result in an equilibrium GDP of:

Refer to the above table. Given the level of investment at $34 billion, zero net exports, and a lump-sum tax of $30 billion, the addition of government expenditures of $20 billion at each level of GDP will result in an equilibrium GDP of:

A) $490 billion

B) $540 billion

C) $590 billion

D) $640 billion

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax-cut will have a greater effect on equilibrium GDP if the:

A) Marginal propensity to consume is smaller

B) Marginal propensity to save is smaller

C) Marginal propensity to save is larger

D) Average propensity to consume is larger

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

John Maynard Keynes expressed his ideas about the macroeconomy and attacked classical economics in his book, The:

A) Affluent Society

B) Wealth of Nations

C) Theory and Practice of Economics in Capitalism

D) General Theory of Employment, Interest, and Money

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

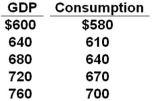

The table shows a consumption schedule. All figures are in billions of dollars.  Refer to the above information. If planned investment was $20 billion, government purchases of goods and services were $20 billion, and taxes and net exports were zero, then the equilibrium level of GDP would be:

Refer to the above information. If planned investment was $20 billion, government purchases of goods and services were $20 billion, and taxes and net exports were zero, then the equilibrium level of GDP would be:

A) $600 billion

B) $640 billion

C) $680 billion

D) $720 billion

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Actual investment is $28 billion and saving is $15 billion at the $166 billion level of output in a private closed economy. At this level:

A) Consumption will be $151 billion

B) Planned investment will be $13 billion

C) Unplanned investment will be $15 billion

D) Planned investment minus saving will be $38 billion

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the flow of income and spending, saving and investment are, respectively:

A) An injection and a leakage

B) A leakage and an injection

C) Wealth and income

D) Income and wealth

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The table shows a consumption schedule. All figures are in billions of dollars.  Refer to the above information. If lump-sum taxes were $20 billion, planned investment $45 billion, net exports zero, and government purchases $20 billion, then equilibrium GDP would be:

Refer to the above information. If lump-sum taxes were $20 billion, planned investment $45 billion, net exports zero, and government purchases $20 billion, then equilibrium GDP would be:

A) $640 billion

B) $680 billion

C) $720 billion

D) $760 billion

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In the aggregate expenditures model of a private closed economy, aggregate expenditures (C + Ig) is always equal to output GDP.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An economy characterized by high unemployment is likely to be:

A) Experiencing a high rate of economic growth

B) Experiencing hyperinflation

C) Having a recessionary expenditure gap

D) Having an inflationary expenditure gap

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 143

Related Exams