A) Only (1) is false.

B) Only (2) is false.

C) Both (1) and (2) are false.

D) Neither (1) nor (2) are false.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Work-in-Process Inventory of the Rapid Fabricating Corp.was $3,000 higher on December 31,2012 than it was on January 1,2012.This implies that in 2012

A) cost of goods manufactured was higher than cost of goods sold.

B) cost of goods manufactured was less than total manufacturing costs.

C) manufacturing costs were higher than cost of goods sold.

D) manufacturing costs were less than cost of goods manufactureD.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be considered part of a manufacturing company's direct labor cost?

A) Factory supervisor's salary

B) Forklift operator's hourly wages

C) Employer-paid health insurance on factory assemblers' wages

D) Cost of idle time

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

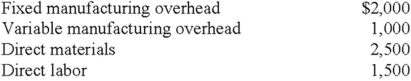

Calculate the conversion costs from the following information:

A) $3,000

B) $4,000

C) $4,500

D) $5,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

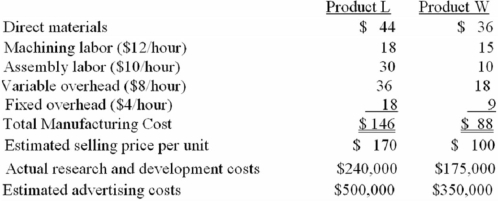

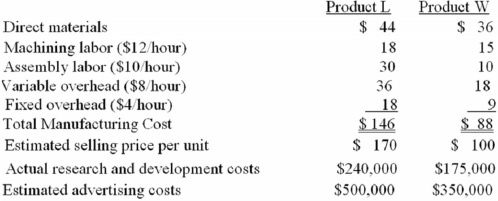

Makwa Industries has developed two new products but has only enough plant capacity to introduce one product during the current year.The following data will assist management in deciding which product should be selected.Makwa's fixed overhead includes rent and utilities,equipment depreciation,and supervisory salaries.Selling and administrative expenses are not allocated to individual products.  The total overhead cost of $27 for Makwa's Product W is a

The total overhead cost of $27 for Makwa's Product W is a

A) Sunk cost.

B) Opportunity cost.

C) Variable cost.

D) Mixed cost.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is (are) true? (1) .An asset is a cost that will be matched with revenues in a future accounting period.(2) .Opportunity costs are recorded as intangible assets in the current accounting period.

A) Only (1) is true.

B) Only (2) is true.

C) Both (1) and (2) are true.

D) Neither (1) nor (2) are true.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An opportunity cost is

A) a cost that is charged against revenue in an accounting period.

B) the foregone benefit from the best alternative course of action.

C) the excess of operating revenues over operating costs.

D) the cost assigned to the products sold during the perioD.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

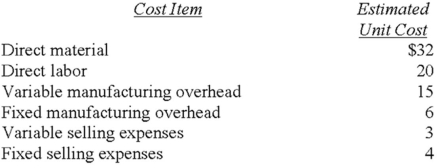

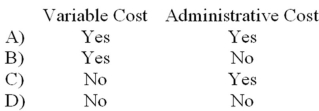

The estimated unit costs for a company to produce and sell a product at a level of 12,000 units per month are as follows:  What are the estimated conversion costs per unit?

What are the estimated conversion costs per unit?

A) $35

B) $41

C) $44

D) $48

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

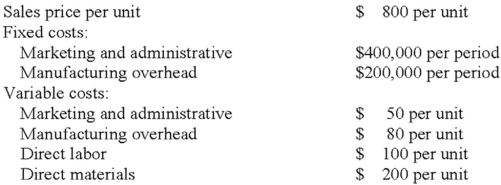

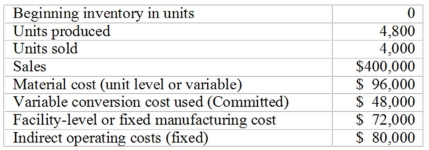

Laner Company has the following data for the production and sale of 2,000 units.  What is the contribution margin per unit?

What is the contribution margin per unit?

A) $70

B) $320

C) $370

D) $430

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Accounting systems typically record opportunity costs as assets and treat them as intangible items on the financial statements.Opportunity costs are not reflected in the accounting system-they are what did not happen.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Variable marketing and administrative costs are included in determining full absorption costs.The two costs are included in full cost and not in determining full absorption costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Makwa Industries has developed two new products but has only enough plant capacity to introduce one product during the current year.The following data will assist management in deciding which product should be selected.Makwa's fixed overhead includes rent and utilities,equipment depreciation,and supervisory salaries.Selling and administrative expenses are not allocated to individual products.  Research and development costs for Makwa's two new products are

Research and development costs for Makwa's two new products are

A) Prime costs.

B) Conversion costs.

C) Opportunity costs.

D) Sunk costs.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of direct materials issued to production is found by

A) subtracting ending work in process from total work in process during the period.

B) adding beginning direct materials inventory and the delivered cost of direct materials.

C) subtracting ending direct materials from direct materials available for production.

D) adding delivered cost of materials,labor,and manufacturing overheaD.

F) A) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

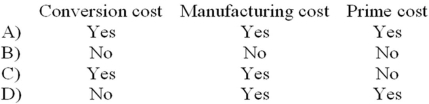

The costs of direct materials are classified as:

A) Choice A

B) Choice B

C) Choice C

D) Choice D

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

The beginning Finished Goods Inventory plus the cost of goods manufactured equals

A) ending finished goods inventory.

B) cost of goods sold for the period.

C) total work-in-process during the period.

D) total cost of goods manufactured for the perioD.

E) cost of goods available for sale for the period.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between variable costs and fixed costs is (CMA adapted)

A) Unit variable costs fluctuate and unit fixed costs remain constant.

B) Unit variable costs are fixed over the relevant range and unit fixed costs are variable.

C) Total variable costs are constant over the relevant range,while fixed costs change in the long-term.

D) Total variable costs are variable over the relevant range but fixed in the long-term,while fixed costs never change.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Total cost of goods purchased minus beginning merchandise inventory plus ending merchandise inventory equals cost of goods sold.Purchases plus beginning inventory minus ending inventory equals cost of goods sold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which terms below correctly describe the cost of the black paint used to paint the dots on a pair of dice?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The difference between the variable ending inventory cost and the absorption ending inventory cost is:

The difference between the variable ending inventory cost and the absorption ending inventory cost is:

A) 800 units times $15 per unit indirect manufacturing cost.

B) 800 units times $10 per unit material cost.

C) 800 units times $20 per unit variable conversion cost plus $15 per unit indirect manufacturing cost.

D) 800 units times $20 per unit variable conversion cost plus $15 per unit indirect manufacturing cost plus $16.67 per unit indirect operating costs.

F) None of the above

Correct Answer

verified

A

Correct Answer

verified

True/False

An expense is an expired cost matched with revenues in a specific accounting period.This statement is the definition of expense.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 105

Related Exams