A) Sheet steel in a file cabinet made by the company.

B) Manufacturing equipment depreciation.

C) Idle time for direct labor.

D) Taxes on a factory building.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In a traditional format income statement for a merchandising company,the cost of goods sold reports the product costs attached to the merchandise sold during the period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

All costs incurred in a merchandising firm are considered to be period costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fiene Sales, Inc., a merchandising company, reported sales of 2,200 units in June at a selling price of $600 per unit. Cost of goods sold, which is a variable cost, was $364 per unit. Variable selling expenses were $23 per unit and variable administrative expenses were $33 per unit. The total fixed selling expenses were $30,500 and the total administrative expenses were $55,300. -The gross margin for June was:

A) $310,200

B) $1,234,200

C) $396,000

D) $519,200

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

In October,Patnode Inc. ,a merchandising company,had sales of $294,000,selling expenses of $27,000,and administrative expenses of $35,000.The cost of merchandise purchased during the month was $211,000.The beginning balance in the merchandise inventory account was $38,000 and the ending balance was $34,000. Required: Prepare a traditional format income statement for October.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gambarini Corporation is a wholesaler that sells a single product.Management has provided the following cost data for two levels of monthly sales volume.The company sells the product for $197.80 per unit. The best estimate of the total monthly fixed cost is:

A) $541,800

B) $1,192,100

C) $1,099,200

D) $1,145,650

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following costs should NOT be considered a direct cost of serving a particular customer who orders a customized personal computer by phone directly from the manufacturer?

A) The cost of the hard disk drive installed in the computer.

B) The cost of shipping the computer to the customer.

C) The cost of leasing a machine on a monthly basis that automatically tests hard disk drives before they are installed in computers.

D) The cost of packaging the computer for shipment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Aberge Company's manufacturing overhead is 60% of its total conversion costs.If direct labor is $38,000 and if direct materials are $21,000,the manufacturing overhead is:

A) $57,000

B) $88,500

C) $25,333

D) $31,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Selling and administrative expenses are product costs under generally accepted accounting principles.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Each of the following would be a period cost except:

A) the salary of the company president's secretary.

B) the cost of a general accounting office.

C) depreciation of a machine used in manufacturing.

D) sales commissions.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

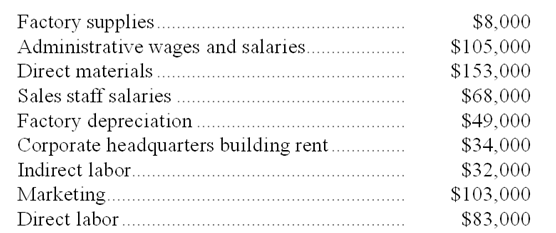

A partial listing of costs incurred during December at Gagnier Corporation appears below:  -The total of the product costs listed above for December is:

-The total of the product costs listed above for December is:

A) $310,000

B) $89,000

C) $635,000

D) $325,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead consists of:

A) all manufacturing costs.

B) indirect materials but not indirect labor.

C) all manufacturing costs,except direct materials and direct labor.

D) indirect labor but not indirect materials.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In any decision making situation,sunk costs are irrelevant and should be ignored.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

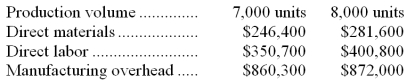

Dabney Corporation has provided the following production and total cost data for two levels of monthly production volume.The company produces a single product.  The best estimate of the total monthly fixed manufacturing cost is:

The best estimate of the total monthly fixed manufacturing cost is:

A) $778,400

B) $1,457,400

C) $1,505,900

D) $1,554,400

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Traditional format income statements are prepared primarily for external reporting purposes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Advertising costs are considered product costs for external financial reports because they are incurred in order to promote specific products.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In describing the cost formula equation Y = a + bX,which of the following statements is correct?

A) "X" is the dependent variable.

B) "a" is the fixed component.

C) In the high-low method,"b" equals change in activity divided by change in costs.

D) As "X" increases "Y" decreases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following costs were incurred in September: Prime costs during the month totaled:

A) $79,000

B) $120,000

C) $62,000

D) $40,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In external financial reports,factory utilities costs may be included in an asset account on the balance sheet at the end of the period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

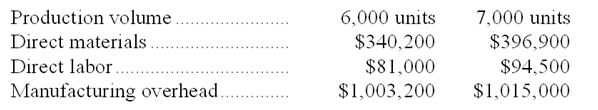

Babuca Corporation has provided the following production and total cost data for two levels of monthly production volume. The company produces a single product.  -The best estimate of the total variable manufacturing cost per unit is:

-The best estimate of the total variable manufacturing cost per unit is:

A) $82.00

B) $70.20

C) $56.70

D) $11.80

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 166

Related Exams