B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The credit terms 2/10, n/30 are interpreted as:

A) 2% cash discount if the amount is paid within 10 days, or the balance due in 30 days.

B) 10% cash discount if the amount is paid within 2 days, or the balance due in 30 days.

C) 30% discount if paid within 2 days.

D) 30% discount if paid within 10 days.

E) 2% discount if paid within 30 days.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debit to Sales Returns and Allowances and a credit to Accounts Receivable:

A) Reflects an increase in amount due from a customer.

B) Recognizes that a customer returned merchandise and/or received an allowance.

C) Requires a debit memorandum to recognize the customer's return.

D) Is recorded when a customer takes a discount.

E) Reflects a decrease in amount due a supplier.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has net sales and cost of goods sold of $752,000 and $543,000, respectively. Its net income is $17,530. The company's gross margin and operating expenses are ________ and ___________, respectively.

A) $209,000; $191,470

B) $191,470; $209,000

C) $525,470; $227,000

D) $227,000; $525,470

E) $734,000; $191,470

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Credit terms of 2/10, n/30 imply that the seller offers the purchaser a 2% cash discount if the amount is paid within 10 days of the invoice date. Otherwise, the full amount is due in 30 days.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Purchase allowances refer to merchandise a buyer acquires but then returns to the seller.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sales returns:

A) Refer to merchandise that customers return to the seller after the sale.

B) Refer to reductions in the selling price of merchandise sold to customers.

C) Represent cash discounts.

D) Represent trade discounts.

E) Are not recorded under the perpetual inventory system until the end of each accounting period.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Under a periodic inventory system, purchases, purchases returns and allowances, purchase discounts, and transportation in transactions are recorded in separate temporary accounts

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beginning inventory plus net purchases is:

A) Cost of goods sold.

B) Merchandise available for sale.

C) Ending inventory.

D) Sales.

E) Shown on the balance sheet.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Short Answer

A _______________________ is a document the buyer issues to inform the seller of a debit made to the seller's account in the buyer's records.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following statements regarding merchandise inventory are true except:

A) Merchandise inventory is reported on the balance sheet as a current asset.

B) Merchandise inventory refers to products a company owns and intends to sell.

C) Merchandise inventory can include the cost of shipping the goods to the store and making them ready for sale.

D) Merchandise inventory does not appear on the balance sheet of a service company.

E) Merchandise inventory purchases are not considered part of the operating cycle for a business.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company had net sales and cost of goods sold of $752,000 and $543,000, respectively. Its net income was $17,530. The company's gross margin ratio equals:

A) 18.9%

B) 24.5%

C) 27.8%

D) 34.7%

E) 35.2%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Cost of Goods Sold is debited to close the account during the closing process.

B) False

Correct Answer

verified

Correct Answer

verified

Not Answered

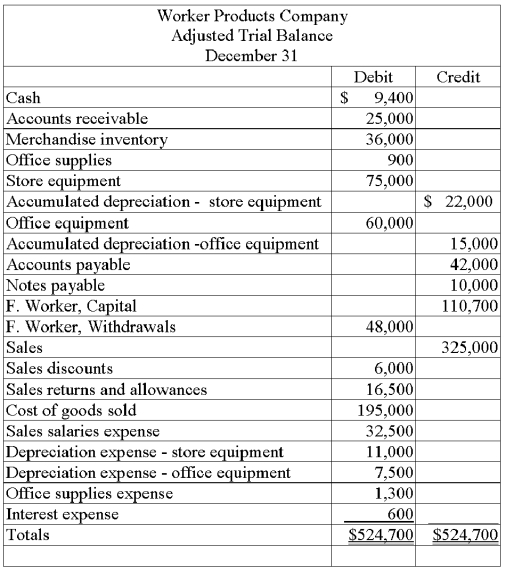

From the adjusted trial balance for Worker Products Company given below, prepare the necessary closing entries.

Correct Answer

verified

Correct Answer

verified

True/False

The gross margin ratio is defined as gross margin divided by net sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company purchased $10,000 of merchandise on June 15 with terms of 3/10, n/45. On June 20, it returned $800 of that merchandise. On June 24, it paid the balance owed for the merchandise taking any discount it is entitled to. The cash paid on June 24 equals:

A) $8,924.

B) $9,700.

C) $10,000.

D) $9,800.

E) $8,724.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Multiple-step income statements:

A) Are required by the FASB.

B) Contain more detail than a simple listing of revenues and expenses.

C) Are required for the perpetual inventory system.

D) List cost of goods sold as an operating expense.

E) Can only be used in perpetual inventory systems.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The acid-test ratio is defined as current assets divided by current liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Not Answered

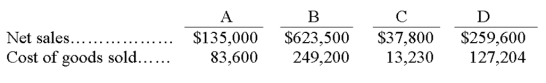

Calculate the gross margin ratio for each of the following separate cases A through D:

Correct Answer

verified

Correct Answer

verified

Not Answered

Describe the recording process (including costs) for purchasing merchandise inventory using a perpetual inventory system.

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 198

Related Exams