A) the real exchange rate is 120/140.

B) the real exchange rate is 140/120.

C) the nominal exchange rate is 120/140

D) the nominal exchange rate is 140/120

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

It is possible for a country to have domestic investment that exceeds national saving.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

A country had a net capital outflow of $1.5 trillion and imports of $0.5 trillion. What was the value of its exports?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If U.S. exports are $150 billion and U.S. imports are $100 billion, which of the following is correct?

A) The U.S. has a trade surplus of $100 billion.

B) The U.S. has a trade surplus of $50 billion.

C) The U.S. has a trade deficit of $100 billion.

D) The U.S. has a trade deficit of $50 billion.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Other things the same, a country could move from having a trade surplus to having a trade deficit if either

A) saving rose or domestic investment rose.

B) saving rose or domestic investment fell.

C) saving fell or domestic investment rose.

D) saving fell or domestic investment fell.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

A country recently had a trade deficit of $2.5 trillion and purchased $3 trillion of foreign assets. How many of its assets did foreigners purchase?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Portuguese company exchanges euros for $60,000 from a U.S. bank. The Portuguese firm then uses the dollars to purchase $60,000 of canning equipment from a U.S. company. As a result of these two transactions alone

A) both U.S. net capital outflow and U.S. net exports rise.

B) U.S. net capital outflow rose and U.S. net exports fall.

C) U.S. net capital outflow fell and U.S. net exports rise.

D) both U.S. net capital and U.S. net exports fall.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a Starbucks tall latte cost $4.00 in the United States, 5.00 euros in the euro area and $2.50 Australian dollars in Australia. Nominal exchange rates are .80 euros per dollar and 1.4 Australian dollars per U.S. dollar. Where does purchasing-power parity hold?

A) both the euro area and Australia

B) the euro area but not Australia

C) Australia but not the euro area

D) neither the euro area or Australia

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Spain has a trade deficit, then

A) Foreign countries purchase more Spanish assets than Spain purchases from them. This makes Spanish saving greater than Spanish domestic investment.

B) foreign countries purchase more Spanish assets than Spain purchases from them. This makes Spanish saving smaller then Spanish domestic investment..

C) foreign countries purchase fewer Spanish assets than Spain purchases from them. This makes Spanish saving greater than Spanish domestic investment.

D) Foreign countries purchase fewer Spanish assets than Spain purchases from them. This makes Spanish saving greater than Spanish domestic investment.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gabrielle, an Italian citizen, uses some previously obtained dollars to purchase a bond issued by a U.S. company. This transaction

A) decreases U.S. net capital outflow.

B) does not change U.S. net capital outflow.

C) increases U.S. net capital outflow by more than the value of the bond.

D) increases U.S. net capital outflow by the value of the bond.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the tough economic times from 2008-2012,

A) investment fell but saving rose, so net capital outflow rose.

B) investment fell by more than saving fell, so net capital outflow rose

C) investment fell by less than saving fell, so net capital outflow fell.

D) investment and saving both fell by about the same percent.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to purchasing-power parity, if the Federal Reserve increased the money supply

A) U.S. prices would rise and the nominal exchange rate would rise.

B) U.S. prices would rise and the nominal exchange rate would fall.

C) U.S. prices would fall and the nominal exchange rate would rise.

D) U.S. prices and the nominal exchange rate would fall.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a country sells more goods and services abroad than it purchases abroad, it has positive net exports and a trade surplus.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year a country had exports of $50 billion, imports of $60 billion, and domestic investment of $40 billion. What was its saving last year?

A) $30 billion

B) $20 billion

C) $10 billion

D) -$10 billion

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the Sykes Corporation an American company) buys shares of Audi stock a German company) for its pension fund, U.S. net capital outflow

A) increases because an American company makes a portfolio investment in Germany.

B) declines because an American company makes a portfolio investment in Germany.

C) increases because an American company makes a direct investment in Germany.

D) declines because an American company makes a direct investment in Germany.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

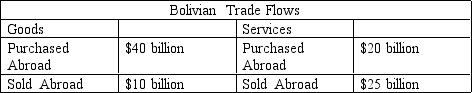

Table 31-1

-Refer to Table 31-1. What are Bolivia's net exports?

-Refer to Table 31-1. What are Bolivia's net exports?

A) $30 billion

B) $5 billion

C) -$5 billion

D) -$25 billion

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From 1970 to 1998 the U.S. dollar

A) gained value compared to the Italian lira because inflation was higher in the U.S.

B) gained value compared to the Italian lira because inflation was lower in the U.S.

C) lost value compared to the Italian lira because inflation was higher in the U.S.

D) lost value compared to the Italian lira because inflation was lower in the U.S.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a U.S. textbook publishing company sells texts overseas, U.S. net exports

A) increase, and U.S. net capital outflow increases.

B) increase, and U.S. net capital outflow decreases.

C) decrease, and U.S. net capital outflow increases.

D) decrease, and U.S. net capital outflow decreases.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the exchange rate changes from 148 Kazakhstan tenge per dollar to 155 Kazakhstan tenge per dollar, the dollar has

A) appreciated. Other things the same, it now takes fewer dollars to buy Kazakhstani goods.

B) appreciated. Other things the same, it now takes more dollars to buy Kazakhstani goods.

C) depreciated. Other things the same, it now takes fewer dollars to buy Kazakhstani goods.

D) depreciated. Other things the same, it now takes more dollars to buy Kazakhstani goods.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the U.S. a digital camera costs $200. The same camera in London sells for 90 pounds. If the exchange rate were .50 pounds per dollar, then which of the following would be correct?

A) The real exchange rate is greater than 1. A person in London with $200 could exchange them for pounds and have more than enough to buy the camera there.

B) The real exchange rate is greater than 1. A person in London with $200 could exchange them for pounds but then wouldn't have enough to buy the camera there.

C) The real exchange rate is less than 1. A person in London with $200 could exchange them for pounds and have more than enough to buy the camera there.

D) The real exchange rate is less than 1. A person in London with $200 could exchange them for pounds but then wouldn't have enough to buy the camera.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 522

Related Exams