A) selling an option with one exercise price and buying a similar one with a different exercise price

B) buying two options that have the same expiration dates but different strike prices

C) selling two options that have the same expiration dates but different strike prices

D) selling an option with one expiration date and buying a similar option with a different expiration date

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The writer of a put option ________.

A) agrees to sell shares at a set price if the option holder desires

B) agrees to buy shares at a set price if the option holder desires

C) has the right to buy shares at a set price

D) has the right to sell shares at a set price

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchase a call option on a stock. The profit at contract maturity of the option position is ________, where X equals the option's strike price, ST is the stock price at contract expiration, and C0 is the original purchase price of the option.

A) max (−C0, ST − X − C0)

B) min (−C0, ST − X − C0)

C) max (C0, ST − X + C0)

D) max (0, ST − X − C0)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A covered call strategy benefits from what environment?

A) Falling interest rates

B) Price stability

C) Price volatility

D) Unexpected events

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The common stock of the Avalon Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $40 is $3, and a call with the same expiration date and exercise price sells for $4. How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at expiration?

A) Buy the call, sell the put; lend the present value of $40.

B) Sell the call, buy the put; lend the present value of $40.

C) Buy the call, sell the put; borrow the present value of $40.

D) Sell the call, buy the put; borrow the present value of $40.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The initial maturities of most exchange-traded options are generally ________.

A) less than 1 year

B) less than 2 years

C) between 1 and 2 years

D) between 1 and 3 years

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In 1973, trading of standardized options on a national exchange started on the ________.

A) AMEX

B) CBOE

C) NYSE

D) CFTC

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

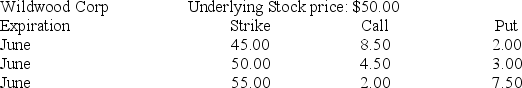

You are cautiously bullish on the common stock of the Wildwood Corporation over the next several months. The current price of the stock is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:

Suppose you establish a bullish money spread with the puts. In June the stock's price turns out to be $52. Ignoring commissions, the net profit on your position is ________.

Suppose you establish a bullish money spread with the puts. In June the stock's price turns out to be $52. Ignoring commissions, the net profit on your position is ________.

A) $500

B) $700

C) $200

D) $250

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following expressions represents the value of a call option to its holder on the expiration date?

A) ST − X if ST > X, 0 if ST ≤ X

B) − (ST − X) if ST > X, 0 if ST ≤ X

C) 0 if ST ≥ X, X − ST if ST < X

D) 0 if ST ≥ X, − (X �− ST) if ST < X

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An American put option gives its holder the right to ________.

A) buy the underlying asset at the exercise price on or before the expiration date

B) buy the underlying asset at the exercise price only at the expiration date

C) sell the underlying asset at the exercise price on or before the expiration date

D) sell the underlying asset at the exercise price only at the expiration date

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exchange-traded stock options expire on the ________ of the expiration month.

A) second Monday

B) third Wednesday

C) second Thursday

D) third Friday

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exercise prices for listed stock options usually occur in increments of ________ and bracket the current stock price.

A) $1

B) $5

C) $20

D) $25

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the statements about margin requirements on option positions is not correct?

A) The margin required will be lower if the option is in the money.

B) If the required margin exceeds the posted margin, the option writer will receive a margin call.

C) A buyer of a put or call option does not have to post margin.

D) Even if the writer of a call option owns the stock, the writer will have to meet the margin requirement in cash.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The common stock of the Avalon Corporation has been trading in a narrow range around $40 per share for months, and you believe it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $40 is $3, and a call with the same expiration date and exercise price sells for $4. Suppose you write a strap and the stock price winds up to be $42 at contract expiration. What was your net profit on the strap?

A) $200

B) $300

C) $700

D) $400

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Advantages of exchange-traded options over OTC options include all but which one of the following?

A) ease and low cost of trading

B) anonymity of participants

C) contracts that are tailored to meet the needs of market participants

D) no concerns about counterparty credit risk

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You sell one Huge-Packing August 50 call contract and sell one Huge-Packing August 50 put contract. The call premium is $1.25 and the put premium is $4.50. Your strategy will pay off only if the stock price is ________ in August.

A) either lower than $44.25 or higher than $55.75

B) between $44.25 and $55.75

C) higher than $55.75

D) lower than $44.25

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At contract maturity the value of a call option is ________, where X equals the option's strike price and ST is the stock price at contract expiration.

A) max (0, ST − X)

B) min (0, ST − X)

C) max (0, X − ST)

D) min (0, X − ST)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You write one MBI July 120 call contract (equaling 100 shares) for a premium of $4. You hold the option until the expiration date, when MBI stock sells for $121 per share. You will realize a ________ on the investment.

A) $300 profit

B) $200 loss

C) $600 loss

D) $200 profit

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You buy a call option on Summit Corp. with an exercise price of $40 and an expiration date in September, and you write a call option on Summit Corp. with an exercise price of $40 and an expiration date in October. This strategy is called a ________.

A) time spread

B) long straddle

C) short straddle

D) money spread

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An option with a payoff that depends on the average price of the underlying asset during at least some portion of the life of the option is called ________ option.

A) an American

B) a European

C) an Asian

D) an Australian

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 91

Related Exams