A) 3.39

B) 3.6

C) 13.33

D) 10.67

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

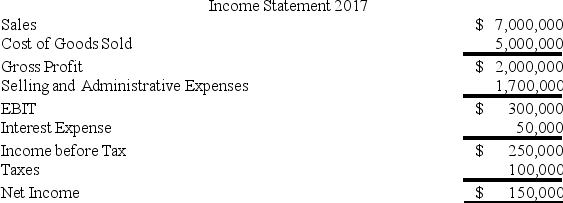

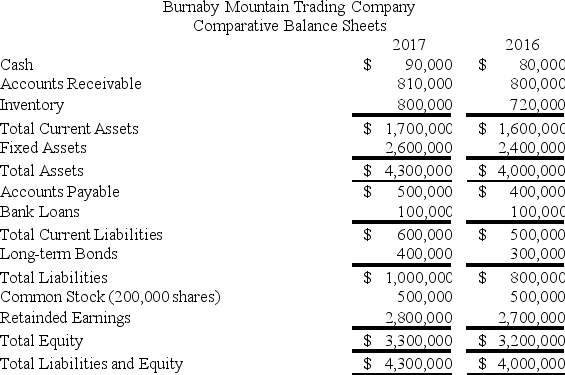

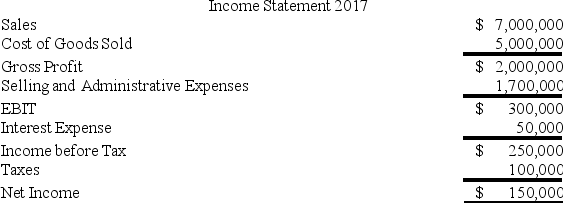

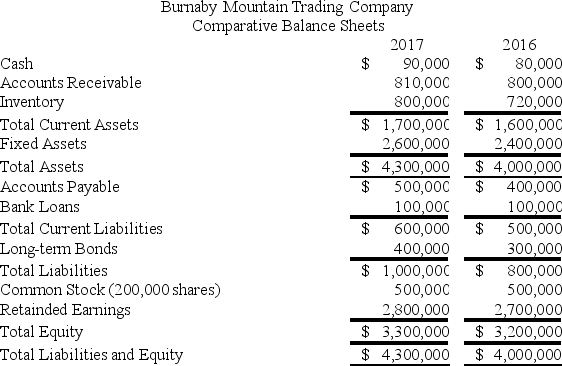

The financial statements of Burnaby Mountain Trading Company are shown below.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's return-on-equity ratio for 2017 is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's return-on-equity ratio for 2017 is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

A) 0.0409

B) 0.0429

C) 0.0462

D) 0.0923

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

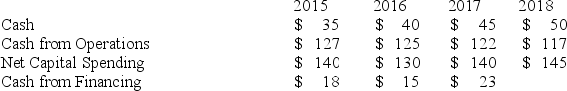

Cash Flow Data for Interceptors, Inc.

Based on the cash flow data in the table for Interceptors Inc., which of the following statements is (are) correct?

I. This firm appears to be a good investment because of its steady growth in cash.

II. This firm has been able to generate growing cash flows only by borrowing or selling equity to offset declining operating cash flows.

III. Financing activities have been increasingly important for this firm's operations, at least in the short run.

Based on the cash flow data in the table for Interceptors Inc., which of the following statements is (are) correct?

I. This firm appears to be a good investment because of its steady growth in cash.

II. This firm has been able to generate growing cash flows only by borrowing or selling equity to offset declining operating cash flows.

III. Financing activities have been increasingly important for this firm's operations, at least in the short run.

A) I only

B) II and III only

C) II only

D) I and II only

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

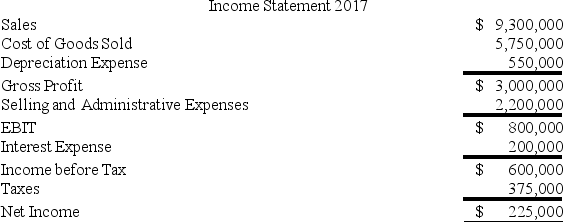

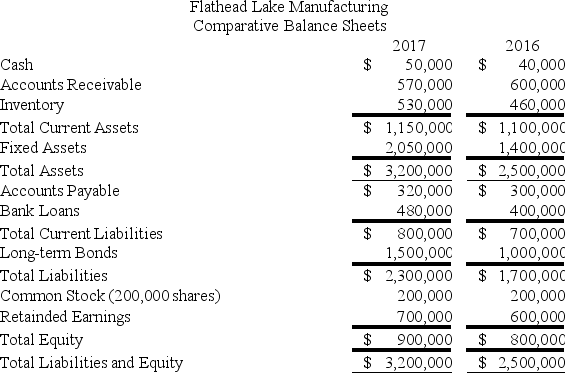

The financial statements of Flathead Lake Manufacturing Company are shown below.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's debt-to-equity ratio for 2017 is ________.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's debt-to-equity ratio for 2017 is ________.

A) 2.13

B) 2.44

C) 2.56

D) 2.89

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has an ROE of 20% and a market-to-book ratio of 2.38. Its P/E ratio is ________.

A) 8.4

B) 11.9

C) 17.62

D) 47.6

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You find that a firm that uses debt has a compound leverage factor less than 1. This tells you that ________.

A) the firm's use of financial leverage is positively contributing to ROE

B) the firm's use of financial leverage is negatively contributing to ROE

C) the firm's use of operating leverage is positively contributing to ROE

D) the firm's use of operating leverage is negatively contributing to ROE

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the biggest impediments to a global capital market has been ________.

A) volatile exchange rates

B) the lack of common accounting standards

C) lower disclosure standards in the United States than abroad

D) the lack of transparent reporting standards across the EU

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a ratio used in the DuPont analysis?

A) Interest burden

B) Profit margin

C) Asset turnover

D) Earnings yield ratio

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The firm's leverage ratio is 1.2, interest-burden ratio is 0.81, and profit margin is 0.24, and its asset turnover is 1.25. What is the firm's ROA?

A) 0.25

B) 0.3

C) 0.335

D) 0.372

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following transactions will result in a decrease in cash flow from operations?

A) increase in accounts receivable

B) decrease in inventories

C) increase in taxes payable.

D) decrease in bonds outstanding

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of Burnaby Mountain Trading Company are shown below.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's times-interest-earned ratio for 2017 is ________.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's times-interest-earned ratio for 2017 is ________.

A) 2.8

B) 6

C) 9

D) 11.11

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Operating ROA is calculated as ________, while ROE is calculated as ________.

A) EBIT/total assets; net profit/total assets

B) net profit/total assets; EBIT/total assets

C) EBIT/total assets; net profit/equity

D) net profit/EBIT; sales/total assets

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The net income of the company is $120. Accounts payable increase by $20, depreciation is $15, and equipment is purchased for $40. If the firm issued $110 in new bonds, what is the total change in cash for the firm for all activities?

A) increase of $225

B) increase of $130

C) decrease of $195

D) decrease of $110

F) A) and D)

Correct Answer

verified

A

Correct Answer

verified

Multiple Choice

The term quality of earnings refers to ________.

A) how well reported earnings conform to GAAP

B) the realism and sustainability of reported earnings

C) whether actual earnings matched expected earnings

D) how well reported earnings fit a trend line of earnings growth

F) C) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Economic value added (EVA) is

A) the difference between the return on assets and the opportunity cost of capital times the capital base.

B) ROA × ROE.

C) a measure of the firm's abnormal return.

D) largest for high-growth firms.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Depreciation expense is in what broad category of expenditures?

A) operating expenses

B) general and administrative expenses

C) debt interest expense

D) tax expenditures

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When choosing a benchmark, it is best to use ________.

A) numerous firms in the same industry

B) your number one competitor

C) the aspirational firm you wish to emulate

D) standards established by the FASB

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm's ratio of stockholders' equity/total assets is lower than the industry average and its ratio of long-term debt/stockholders' equity is also lower than the industry average, this would suggest that the firm ________.

A) has more current liabilities than the industry average

B) has more leased assets than the industry average

C) will be less profitable than the industry average

D) has more current assets than the industry average

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quick ratio is a measure of a firm's ________.

A) asset turnover

B) market valuation

C) liquidity

D) interest burden

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a firm has a positive tax rate and a positive operating ROA, and the interest rate on debt is the same as the operating ROA, then operating ROA will be ________.

A) greater than zero, but it is impossible to determine how operating ROA will compare to ROE

B) equal to ROE

C) greater than ROE

D) less than ROE

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 88

Related Exams