A) 6.5%

B) 26.5%

C) 33.4%

D) 38%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

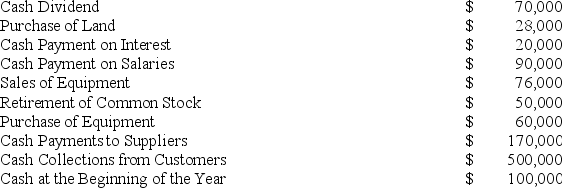

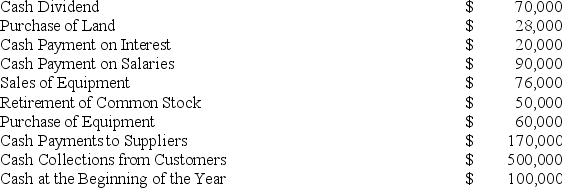

Use the following cash flow data of Haven Hardware for the year ended December 31, 2017.

What is the net cash provided by operating activities of Haven Hardware?

What is the net cash provided by operating activities of Haven Hardware?

A) −$30,000

B) $220,000

C) $320,000

D) $780,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

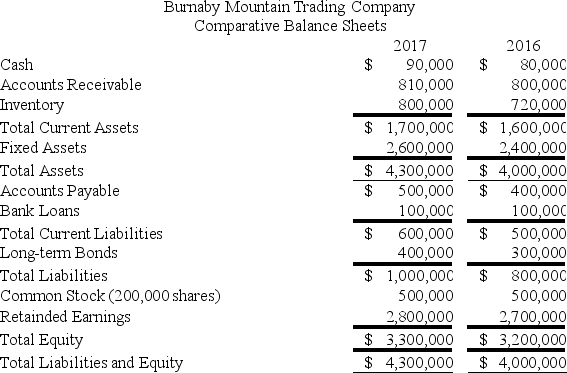

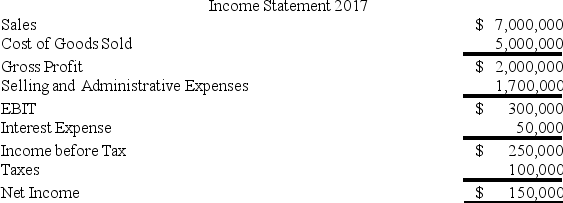

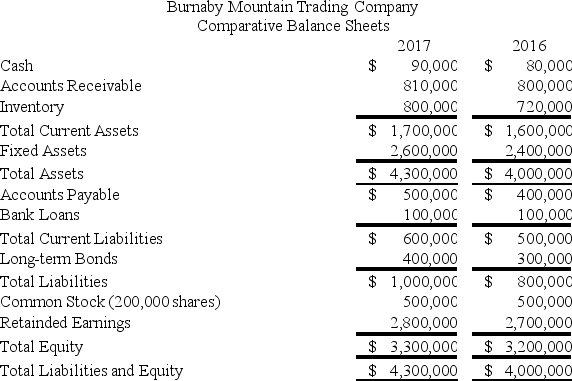

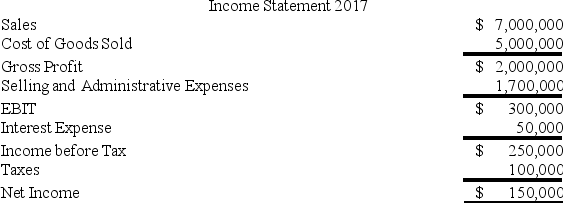

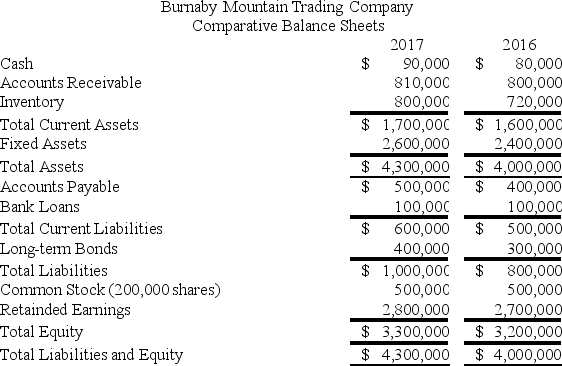

The financial statements of Burnaby Mountain Trading Company are shown below.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's asset turnover ratio for 2017 is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's asset turnover ratio for 2017 is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

A) 1.3

B) 1.5

C) 1.69

D) 2.83

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of Burnaby Mountain Trading Company are shown below.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's P/E ratio for 2017 is ________.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's P/E ratio for 2017 is ________.

A) 2.8

B) 3.6

C) 6

D) 11.11

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process of decomposing ROE into a series of component ratios is called ________.

A) DuPont analysis

B) technical analysis

C) comparative analysis

D) liquidity analysis

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following assets is most liquid?

A) cash equivalents

B) receivables

C) inventories

D) plant and equipment

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following cash flow data of Haven Hardware for the year ended December 31, 2017.

What is the net increase or decrease in cash for Haven Hardware for 2017?

What is the net increase or decrease in cash for Haven Hardware for 2017?

A) −$94,000

B) −$88,000

C) $88,000

D) $188,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The tax burden of the firm is 0.5, the interest burden is 0.55, the profit margin is 0.25, the asset turnover is 1.5, and the leverage ratio is 1.65. What is the ROE of the firm?

A) 1.88%

B) 6.68%

C) 12.15%

D) 17.02%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of Burnaby Mountain Trading Company are shown below.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's fixed-asset turnover ratio for 2017 is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's fixed-asset turnover ratio for 2017 is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

A) 2.8

B) 6

C) 9

D) 11.11

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Benjamin Graham thought that the benefits from detailed analysis of a firm's financial statements had ________ over his long professional life.

A) increased greatly

B) increased slightly

C) remained constant

D) decreased

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According the Financial Accounting Standards Board's Statement No. 157 on fair value accounting, Level 3 assets ________.

A) must be reduced to book value

B) must be compared to market valuations

C) are hardest to value

D) are easiest to value

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true concerning economic value added?

A) A growing number of firms tie managers' compensation to EVA.

B) A profitable firm will always have a positive EVA.

C) EVA recognizes that the cost of capital is not a real cost.

D) If a firm has positive present value of growth opportunities, it will have positive EVA.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following cash flow data of Haven Hardware for the year ended December 31, 2017.

What is the net cash provided by or used in financing activities of Haven Hardware?

What is the net cash provided by or used in financing activities of Haven Hardware?

A) −$10,000

B) −$120,000

C) $10,000

D) $120,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

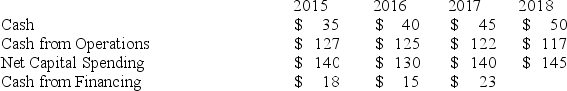

Cash Flow Data for Interceptors, Inc.

What must cash flow from financing have been in 2018 for Interceptors, Inc.?

What must cash flow from financing have been in 2018 for Interceptors, Inc.?

A) $5

B) $28

C) $30

D) $33

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Another term for EVA is ________.

A) net income

B) operating income

C) residual income

D) market-based income

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The major difference between IFRS and GAAP is that U.S. standards are ________ and IFRS standards are ________.

A) strictly enforced; weakly enforced

B) rules-based; principles-based

C) evolutionary; devolutionary

D) based on government standards; based on corporate practice

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has a tax burden of 0.7, a leverage ratio of 1.3, an interest burden of 0.8, and a return-on-sales ratio of 10%. The firm generates $2.28 in sales per dollar of assets. What is the firm's ROE?

A) 12.4%

B) 14.5%

C) 16.6%

D) 17.8%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

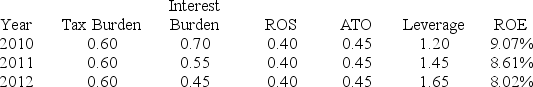

The table below shows some data for Key Biscuit Company:

What must have caused the firm's ROE to drop?

What must have caused the firm's ROE to drop?

A) The firm began using more debt as a percentage of financing.

B) The firm began using less debt as a percentage of financing.

C) The compound leverage ratio was less than 1.

D) The operating ROA was declining.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

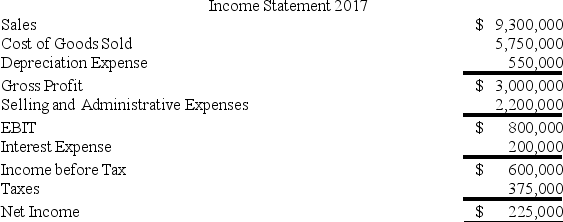

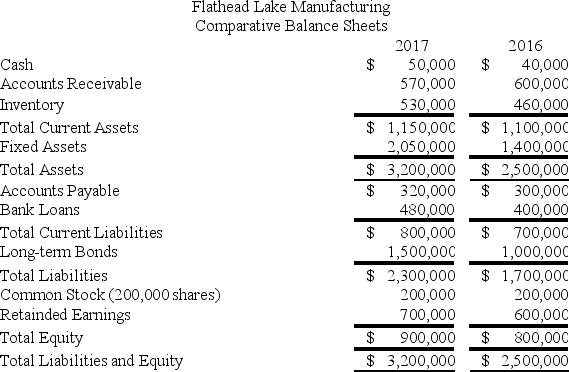

The financial statements of Flathead Lake Manufacturing Company are shown below.

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's total asset turnover for 2017 is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

Note: The common shares are trading in the stock market for $15 per share.

Refer to the financial statements of Flathead Lake Manufacturing Company. The firm's total asset turnover for 2017 is ________. (Please keep in mind that when a ratio involves both income statement and balance sheet numbers, the balance sheet numbers for the beginning and end of the year must be averaged.)

A) 3.56

B) 3.26

C) 3.14

D) 3.02

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of Burnaby Mountain Trading Company are shown below.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's market-to-book value for 2017 is ________.

Note: The common shares are trading in the stock market for $27 each.

Refer to the financial statements of Burnaby Mountain Trading Company. The firm's market-to-book value for 2017 is ________.

A) 0.1708

B) 0.1529

C) 0.1462

D) 0.1636

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 88

Related Exams