A) $1,000

B) $884

C) $933

D) $980

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

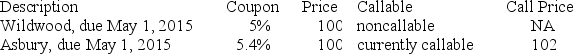

On May 1, 2007, Joe Hill is considering one of the following newly issued 10-year AAA corporate bonds.

Suppose market interest rates decline by 100 basis points (i.e., 1%) . The effect of this decline would be ________.

Suppose market interest rates decline by 100 basis points (i.e., 1%) . The effect of this decline would be ________.

A) the price of the Wildwood bond would decline by more than the price of the Asbury bond

B) the price of the Wildwood bond would decline by less than the price of the Asbury bond

C) the price of the Wildwood bond would increase by more than the price of the Asbury bond

D) the price of the Wildwood bond would increase by less than the price of the Asbury bond

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

TIPS are an example of ________.

A) Eurobonds

B) convertible bonds

C) indexed bonds

D) catastrophe bonds

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflation-indexed Treasury securities are commonly called ________.

A) PIKs

B) CARs

C) TIPS

D) STRIPS

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In regard to bonds, convexity relates to the ________.

A) shape of the bond price curve with respect to interest rates

B) shape of the yield curve with respect to maturity

C) slope of the yield curve with respect to liquidity premiums

D) size of the bid-ask spread

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming semiannual compounding, a 20-year zero coupon bond with a par value of $1,000 and a required return of 12% would be priced at ________.

A) $97.22

B) $104.49

C) $364.08

D) $732.14

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You buy a TIPS at issue at par for $1,000. The bond has a 3% coupon. Inflation turns out to be 2%, 3%, and 4% over the next 3 years. The total annual coupon income you will receive in year 3 is ________.

A) $30

B) $33

C) $32.78

D) $30.90

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The yield to maturity on a bond is: I. Above the coupon rate when the bond sells at a discount and below the coupon rate when the bond sells at a premium II. The discount rate that will set the present value of the payments equal to the bond price III. Equal to the true compound return on investment only if all interest payments received are reinvested at the yield to maturity

A) I only

B) II only

C) I and II only

D) I, II, and III

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following yield curves generally implies a normal healthy economy?

A) positive slope

B) negative slope

C) flat

D) hump-shaped curve

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond was purchased at a premium and is now selling at a discount because of a change in market interest rates. If the bond pays a 4% annual coupon, what is the likely impact on the holding-period return if an investor decides to sell now?

A) increased

B) decreased

C) stayed the same

D) The answer cannot be determined from the information given.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following rates represents a bond's annual interest payment per dollar of par value?

A) holding period return

B) coupon rate

C) IRR

D) YTM

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporate bond has a 10-year maturity and pays interest semiannually. The quoted coupon rate is 6%, and the bond is priced at par. The bond is callable in 3 years at 110% of par. What is the bond's yield to call?

A) 6.72%

B) 9.17%

C) 4.49%

D) 8.98%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which type of risk is most significant for bonds?

A) maturity risk

B) default risk

C) interest rate risk

D) reinvestment rate risk

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You buy an 8-year $1,000 par value bond today that has a 6% yield and a 6% annual payment coupon. In 1 year promised yields have risen to 7%. Your 1-year holding-period return was ________.

A) .61%

B) −5.39%

C) 1.28%

D) −3.25%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You buy a bond with a $1,000 par value today for a price of $875. The bond has 6 years to maturity and makes annual coupon payments of $75 per year. You hold the bond to maturity, but you do not reinvest any of your coupons. What was your effective EAR over the holding period?

A) 10.4%

B) 9.57%

C) 7.45%

D) 8.78%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ bonds represent a novel way of obtaining insurance from capital markets against specified disasters.

A) Asset-backed bonds

B) TIPS

C) Catastrophe

D) Pay-in-kind

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

A ________ bond gives the bondholder the right to cash in the bond before maturity at a specific price after a specific date.

A) callable

B) coupon

C) puttable

D) Treasury

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A coupon bond that pays interest annually has a par value of $1,000, matures in 5 years, and has a yield to maturity of 12%. If the coupon rate is 9%, the intrinsic value of the bond today will be ________.

A) $856.04

B) $891.86

C) $926.47

D) $1,000

F) B) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

Which of the following possible provisions of a bond indenture is designed to ease the burden of principal repayment by spreading it out over several years?

A) callable feature

B) convertible feature

C) subordination clause

D) sinking fund

F) B) and D)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Consider the expectations theory of the term structure of interest rates. If the yield curve is downward-sloping, this indicates that investors expect short-term interest rates to ________ in the future.

A) increase

B) decrease

C) not change

D) change in an unpredictable manner

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 96

Related Exams