A) $857

B) $894

C) $835

D) $821

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the price of a $10,000 par Treasury bond is $10,237.50, the quote would be listed in the newspaper as ________.

A) 102.237

B) 102.102

C) 102.375

D) 102.750

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Everything else equal, the ________ the maturity of a bond and the ________ the coupon, the greater the sensitivity of the bond's price to interest rate changes.

A) longer; higher

B) longer; lower

C) shorter; higher

D) shorter; lower

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 6% coupon U.S. Treasury note pays interest on May 31 and November 30 and is traded for settlement on August 10. The accrued interest on the $100,000 face amount of this note is ________.

A) $581.97

B) $1,170.33

C) $2,327.87

D) $3,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds issued in the currency of the issuer's country but sold in other national markets are called ________.

A) Eurobonds

B) Yankee bonds

C) Samurai bonds

D) foreign bonds

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

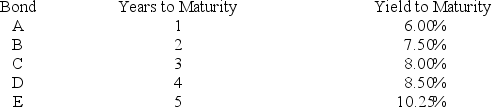

Consider the following $1,000 par value zero-coupon bonds:

The expected 1-year interest rate 2 years from now should be ________.

The expected 1-year interest rate 2 years from now should be ________.

A) 7%

B) 8%

C) 9%

D) 10%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the lowest grade a bond can receive and still be considered investment grade?

A) AAA

B) A

C) BBB

D) BB

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds rated ________ or better by Standard & Poor's are considered investment grade.

A) AA

B) BBB

C) BB

D) CCC

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A mortgage bond is ________.

A) secured by other securities held by the firm

B) secured by equipment owned by the firm

C) secured by property owned by the firm

D) unsecured

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A debenture is ________.

A) secured by other securities held by the firm

B) secured by equipment owned by the firm

C) secured by property owned by the firm

D) unsecured

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One-, two-, and three-year maturity, default-free, zero-coupon bonds have yields to maturity of 7%, 8%, and 9%, respectively. What is the implied 1-year forward rate 1 year from today?

A) 2.07%

B) 8.03%

C) 9.01%

D) 11.12%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ of a bond is computed as the ratio of the annual coupon payment to the market price.

A) nominal yield

B) current yield

C) yield to maturity

D) yield to call

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A coupon bond that pays interest semiannually has a par value of $1,000, matures in 8 years, and has a yield to maturity of 6%. If the coupon rate is 7%, the intrinsic value of the bond today will be ________.

A) $1,000

B) $1,062.81

C) $1,081.82

D) $1,100.03

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond pays a semiannual coupon, and the last coupon was paid 61 days ago. If the annual coupon payment is $75, what is the accrued interest? (Assume 182 days in the 6-month period.)

A) $13.21

B) $12.57

C) $15.44

D) $16.32

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the quote for a Treasury bond is listed in the newspaper as 98.2812 bid, 98.4062 ask, the actual price at which you can purchase this bond given a $10,000 par value is ________.

A) $9,828.12

B) $9,809.38

C) $9,840.62

D) $9,813.42

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A convertible bond has a par value of $1,000, but its current market price is $950. The current price of the issuing company's stock is $19, and the conversion ratio is 40 shares. The bond's conversion premium is ________.

A) $50

B) $190

C) $200

D) $240

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the liquidity preference theory of the term structure of interest rates, an increase in the yield on long-term corporate bonds versus short-term bonds could be due to ________.

A) declining liquidity premiums

B) an expectation of an upcoming recession

C) a decline in future inflation expectations

D) an increase in expected interest rate volatility

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary difference between Treasury notes and bonds is ________.

A) maturity at issue

B) default risk

C) coupon rate

D) tax status

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond has a par value of $1,000, a time to maturity of 10 years, and a coupon rate of 8% with interest paid annually. If the current market price is $750, what is the capital gain yield of this bond over the next year?

A) .72%

B) 1.85%

C) 2.58%

D) 3.42%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ is the document that defines the contract between the bond issuer and the bondholder.

A) indenture

B) covenant agreement

C) trustee agreement

D) collateral statement

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 96

Related Exams