A) $458.11

B) $641.11

C) $789.11

D) $1,100.11

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price on a Treasury bond is 104.3625, with a yield to maturity of 3.45%. The price on a comparable maturity corporate bond is 103.75, with a yield to maturity of 4.59%. What is the approximate percentage value of the credit risk of the corporate bond?

A) 1.14%

B) 3.45%

C) 4.59%

D) 8.04%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Analysis of bond returns over a multiyear horizon based on forecasts of the bond's yield to maturity and reinvestment rate of coupons is called ________.

A) multiyear analysis

B) horizon analysis

C) maturity analysis

D) reinvestment analysis

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

TIPS offer investors inflation protection by ________ by the inflation rate each year.

A) increasing only the coupon rate

B) increasing only the par value

C) increasing both the par value and the coupon payment

D) increasing the promised yield to maturity

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A discount bond that pays interest semiannually will: I. Have a lower price than an equivalent annual payment bond II. Have a higher EAR than an equivalent annual payment bond III. Sell for less than its conversion value

A) I and II only

B) I and III only

C) II and III only

D) I, II, and III

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor pays $989.40 for a bond. The bond has an annual coupon rate of 4.8%. What is the current yield on this bond?

A) 4.8%

B) 4.85%

C) 9.6%

D) 9.7%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A Japanese firm issued and sold a pound-denominated bond in the United Kingdom. A U.S. firm issued bonds denominated in dollars but sold the bonds in Japan. Which one of the following statements is correct?

A) Both bonds are examples of Eurobonds.

B) The Japanese bond is a Eurobond, and the U.S. bond is termed a foreign bond.

C) The U.S. bond is a Eurobond, and the Japanese bond is termed a foreign bond.

D) Neither bond is a Eurobond.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds with coupon rates that fall when the general level of interest rates rise are called ________.

A) asset-backed bonds

B) convertible bonds

C) inverse floaters

D) index bonds

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The invoice price of a bond is the ________.

A) stated or flat price in a quote sheet plus accrued interest

B) stated or flat price in a quote sheet minus accrued interest

C) bid price

D) average of the bid and ask price

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A coupon bond that pays interest of 4% annually has a par value of $1,000, matures in 5 years, and is selling today at $785. The actual yield to maturity on this bond is ________.

A) 7.24%

B) 8.82%

C) 9.12%

D) 9.62%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You can be sure that a bond will sell at a premium to par when ________.

A) its coupon rate is greater than its yield to maturity

B) its coupon rate is less than its yield to maturity

C) its coupon rate is equal to its yield to maturity

D) its coupon rate is less than its conversion value

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Floating-rate bonds have a ________ that is adjusted with current market interest rates.

A) maturity date

B) coupon payment date

C) coupon rate

D) dividend yield

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price of a bond (with par value of $1,000) at the beginning of a period is $980 and at the end of the period is $975. What is the holding-period return if the annual coupon rate is 4.5%?

A) 4.08%

B) 4.5%

C) 5.1%

D) 5.6%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You buy a 10-year $1,000 par value 4% annual-payment coupon bond priced to yield 6%. You do not sell the bond at year-end. If you are in a 15% tax bracket, at year-end you will owe taxes on this investment equal to ________.

A) $9.10

B) $4.25

C) $7.68

D) $5.20

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider a 7-year bond with a 9% coupon and a yield to maturity of 12%. If interest rates remain constant, 1 year from now the price of this bond will be ________.

A) higher

B) lower

C) the same

D) indeterminate

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the liquidity preference theory of the term structure of interest rates. On average, one would expect investors to require ________.

A) a higher yield on short-term bonds than on long-term bonds

B) a higher yield on long-term bonds than on short-term bonds

C) the same yield on both short-term bonds and long-term bonds

D) none of these options (The liquidity preference theory cannot be used to make any of the other statements.)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

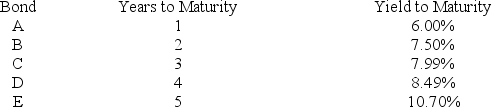

$1,000 par value zero-coupon bonds (ignore liquidity premiums)

The expected 2-year interest rate 3 years from now should be ________.

The expected 2-year interest rate 3 years from now should be ________.

A) 9.55%

B) 11.74%

C) 14.89%

D) 13.73%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

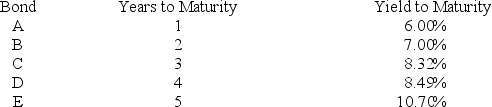

Consider the following $1,000 par value zero-coupon bonds:

The expected 1-year interest rate 3 years from now should be ________.

The expected 1-year interest rate 3 years from now should be ________.

A) 7%

B) 8%

C) 9%

D) 10%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Serial bonds are associated with ________.

A) staggered maturity dates

B) collateral

C) coupon payment dates

D) conversion features

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Yields on municipal bonds are generally lower than yields on similar corporate bonds because of differences in ________.

A) marketability

B) risk

C) taxation

D) call protection

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 96

Related Exams