A) unique risk

B) beta

C) the standard deviation of returns

D) the variance of returns

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The variance of the return on the market portfolio is .04 and the expected return on the market portfolio is 20%. If the risk-free rate of return is 10%, the market degree of risk aversion, A, is ________.

A) .5

B) 2.5

C) 3.5

D) 5

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A stock has a beta of 1.3. The systematic risk of this stock is ________ the stock market as a whole.

A) higher than

B) lower than

C) equal to

D) indeterminable compared to

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the capital asset pricing model, in equilibrium ________.

A) all securities' returns must lie below the capital market line

B) all securities' returns must lie on the security market line

C) the slope of the security market line must be less than the market risk premium

D) any security with a beta of 1 must have an excess return of zero

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Standard deviation of portfolio returns is a measure of ________.

A) total risk

B) relative systematic risk

C) relative nonsystematic risk

D) relative business risk

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are assumptions of the simple CAPM model? I. Individual trades of investors do not affect a stock's price. II. All investors plan for one identical holding period. III. All investors analyze securities in the same way and share the same economic view of the world. IV. All investors have the same level of risk aversion.

A) I, II, and IV only

B) I, II, and III only

C) II, III, and IV only

D) I, II, III, and IV

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two investment advisers are comparing performance. Adviser A averaged a 20% return with a portfolio beta of 1.5, and adviser B averaged a 15% return with a portfolio beta of 1.2. If the T-bill rate was 5% and the market return during the period was 13%, which adviser was the better stock picker?

A) Advisor A was better because he generated a larger alpha.

B) Advisor B was better because she generated a larger alpha.

C) Advisor A was better because he generated a higher return.

D) Advisor B was better because she achieved a good return with a lower beta.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk-free rate is 4%. The expected market rate of return is 11%. If you expect stock X with a beta of .8 to offer a rate of return of 12%, then you should ________.

A) buy stock X because it is overpriced

B) buy stock X because it is underpriced

C) sell short stock X because it is overpriced

D) sell short stock X because it is underpriced

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the multifactor APT with two factors. Portfolio A has a beta of .5 on factor 1 and a beta of 1.25 on factor 2. The risk premiums on the factor 1 and 2 portfolios are 1% and 7%, respectively. The risk-free rate of return is 7%. The expected return on portfolio A is ________ if no arbitrage opportunities exist.

A) 13.5%

B) 15%

C) 16.25%

D) 23%

F) B) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Assume that both X and Y are well-diversified portfolios and the risk-free rate is 8%. Portfolio X has an expected return of 14% and a beta of 1. Portfolio Y has an expected return of 9.5% and a beta of .25. In this situation, you would conclude that portfolios X and Y ________.

A) are in equilibrium

B) offer an arbitrage opportunity

C) are both underpriced

D) are both fairly priced

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Security A has an expected rate of return of 12% and a beta of 1.1. The market expected rate of return is 8%, and the risk-free rate is 5%. The alpha of the stock is ________.

A) -1.7%

B) 3.7%

C) 5.5%

D) 8.7%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the capital asset pricing model. The market degree of risk aversion, A, is 3. The risk premium is 2.25%. If the risk-free rate of return is 4%, the expected return on the market portfolio is ________.

A) 6.75%

B) 9%

C) 10.75%

D) 12%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You consider buying a share of stock at a price of $25. The stock is expected to pay a dividend of $1.50 next year, and your advisory service tells you that you can expect to sell the stock in 1 year for $28. The stock's beta is 1.1, rf is 6%, and E[rm] = 16%. What is the stock's abnormal return?

A) 1%

B) 2%

C) -1%

D) -2%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Security X has an expected rate of return of 13% and a beta of 1.15. The risk-free rate is 5%, and the market expected rate of return is 15%. According to the capital asset pricing model, security X is ________.

A) fairly priced

B) overpriced

C) underpriced

D) none of these answers

F) C) and D)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

The expected return of the risky-asset portfolio with minimum variance is ________.

A) the market rate of return

B) zero

C) the risk-free rate

D) The answer cannot be determined from the information given.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider two stocks, A and B. Stock A has an expected return of 10% and a beta of 1.2. Stock B has an expected return of 14% and a beta of 1.8. The expected market rate of return is 9% and the risk-free rate is 5%. Security ________ would be considered the better buy because ________.

A) A; it offers an expected excess return of .2%

B) A; it offers an expected excess return of 2.2%

C) B; it offers an expected excess return of 1.8%

D) B; it offers an expected return of 2.4%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the capital asset pricing model, fairly priced securities have ________.

A) negative betas

B) positive alphas

C) positive betas

D) zero alphas

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

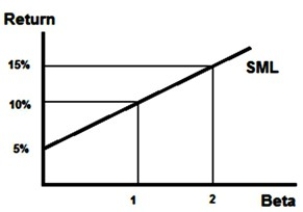

What is the expected return on the market?

What is the expected return on the market?

A) 0%

B) 5%

C) 10%

D) 15%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If all investors become more risk averse, the SML will ________ and stock prices will ________.

A) shift upward; rise

B) shift downward; fall

C) have the same intercept with a steeper slope; fall

D) have the same intercept with a flatter slope; rise

F) A) and D)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The CAPM ________.

A) predicts the relationship between risk and expected return of an asset

B) provides a benchmark rate of return for evaluating possible investments

C) helps us make an educated guess as to expected return on assets that have not yet traded in the marketplace

D) All of the options.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 89

Related Exams