A) geometric average

B) arithmetic average

C) IRR

D) dollar-weighted

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to historical data, over the long run which of the following assets has the best chance to provide the best after-inflation, after-tax rate of return?

A) long-term Treasury bonds

B) corporate bonds

C) common stocks

D) preferred stocks

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A portfolio with a 25% standard deviation generated a return of 15% last year when T-bills were paying 4.5%. This portfolio had a Sharpe ratio of ________.

A) .22

B) .60

C) .42

D) .25

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Consider the following two investment alternatives: First, a risky portfolio that pays a 20% rate of return with a probability of 60% or a 5% rate of return with a probability of 40%. Second, a Treasury bill that pays 6%. If you invest $50,000 in the risky portfolio, your expected profit after one year would be ________.

A) $3,000

B) $7,000

C) $7,500

D) $10,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you pay $9,800 for a $10,000 par Treasury bill maturing in 2 months. What is the annual percentage rate of return for this investment?

A) 2.04%

B) 12 %

C) 12.24%

D) 12.89%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your investment has a 40% chance of earning a 15% rate of return, a 50% chance of earning a 10% rate of return, and a 10% chance of losing 3%. What is the standard deviation of this investment?

A) 5.14%

B) 7.59%

C) 9.29%

D) 8.43%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury bills are paying a 4% rate of return. A risk-averse investor with a risk aversion of A = 3 should invest entirely in a risky portfolio with a standard deviation of 24% only if the risky portfolio's expected return is at least ________.

A) 8.67%

B) 9.84%

C) 21.28%

D) 14.68%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rate of return on ________ is known at the beginning of the holding period, while the rate of return on ________ is not known until the end of the holding period.

A) risky assets; Treasury bills

B) Treasury bills; risky assets

C) excess returns; risky assets

D) index assets; bonds

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the 1926-2013 period the geometric mean return on small-firm stocks was ________.

A) 5.31%

B) 5.56%

C) 9.34%

D) 11.82%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor invests 70% of her wealth in a risky asset with an expected rate of return of 15% and a variance of 5%, and she puts 30% in a Treasury bill that pays 5%. Her portfolio's expected rate of return and standard deviation are ________ and ________ respectively.

A) 10%; 6.7%

B) 12%; 22.4%

C) 12%; 15.7%

D) 10%; 35%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One method of forecasting the risk premium is to use the ________.

A) coefficient of variation of analysts' earnings forecasts

B) variations in the risk-free rate over time

C) average historical excess returns for the asset under consideration

D) average abnormal return on the index portfolio

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two assets have the following expected returns and standard deviations when the risk-free rate is 5%: Asset A E(rA) = 10% σA = 20% Asset B E(rB) = 15% σB = 27% An investor with a risk aversion of A = 3 would find that ________ on a risk-return basis.

A) only asset A is acceptable

B) only asset B is acceptable

C) neither asset A nor asset B is acceptable

D) both asset A and asset B are acceptable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

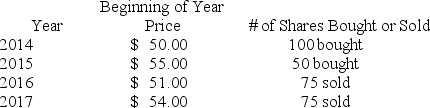

You have the following rates of return for a risky portfolio for several recent years. Assume that the stock pays no dividends.

What is the geometric average return for the period?

What is the geometric average return for the period?

A) 2.87%

B) .74%

C) 2.6%

D) 2.21%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In calculating the variance of a portfolio's returns, squaring the deviations from the mean results in: I. Preventing the sum of the deviations from always equaling zero II. Exaggerating the effects of large positive and negative deviations III. A number for which the unit is percentage of returns

A) I only

B) I and II only

C) I and III only

D) I, II, and III

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Published data on past returns earned by mutual funds are required to be ________.

A) dollar-weighted returns

B) geometric returns

C) excess returns

D) index returns

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You put up $50 at the beginning of the year for an investment. The value of the investment grows 4% and you earn a dividend of $3.50. Your HPR was ________.

A) 4%

B) 3.5%

C) 7%

D) 11%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following arguments supporting passive investment strategies is (are) correct? I. Active trading strategies may not guarantee higher returns but guarantee higher costs. II. Passive investors can free-ride on the activity of knowledge investors whose trades force prices to reflect currently available information. III. Passive investors are guaranteed to earn higher rates of return than active investors over sufficiently long time horizons.

A) I only

B) I and II only

C) II and III only

D) I, II, and III

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You invest all of your money in 1-year T-bills. Which of the following statements is (are) correct? I. Your nominal return on the T-bills is riskless. II. Your real return on the T-bills is riskless. III. Your nominal Sharpe ratio is zero.

A) I only

B) I and III only

C) II only

D) I, II, and III

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If you believe you have a 60% chance of doubling your money, a 30% chance of gaining 15%, and a 10% chance of losing your entire investment, what is your expected return?

A) 5%

B) 15%

C) 54.5%

D) 114.5%

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market risk premium is defined as ________.

A) the difference between the return on an index fund and the return on Treasury bills

B) the difference between the return on a small-firm mutual fund and the return on the Standard & Poor's 500 Index

C) the difference between the return on the risky asset with the lowest returns and the return on Treasury bills

D) the difference between the return on the highest-yielding asset and the return on the lowest-yielding asset

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 89

Related Exams