A) 17.5%

B) 19.67%

C) 23.83%

D) 25.75%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The bulk of most initial public offerings (IPOs) of equity securities goes to ________.

A) institutional investors

B) individual investors

C) the firm's current shareholders

D) day traders

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An investor buys $8,000 worth of a stock priced at $40 per share using 50% initial margin. The broker charges 6% on the margin loan and requires a 30% maintenance margin. In 1 year the investor has interest payable and gets a margin call. At the time of the margin call the stock's price must have been less than ________.

A) $20

B) $29.77

C) $30.29

D) $32.45

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

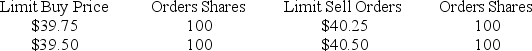

Consider the following limit order book of a specialist. The last trade in the stock occurred at a price of $40. If a market buy order for 100 shares comes in, at what price will it be filled?

A) $39.75

B) $40.25

C) $40.375

D) $40.25 or less

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The inside quotes on a limit order book can be found ________.

A) at the top of the list

B) at the bottom of the list

C) by taking the averages of the bid and ask prices on the list

D) only by direct contact with the specialist who maintains the book

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term inside quotes refers to ________.

A) the difference between the lowest bid price and the highest ask price in the limit order book.

B) the difference between the highest bid price and the lowest ask price in the limit order book.

C) the difference between the lowest bid price and the lowest ask price in the limit order book.

D) the difference between the highest bid price and the highest ask price in the limit order book.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a firm decides to sell securities it must first ensure ________.

A) the preliminary registration statement is approved by the SEC

B) the IPO is complete

C) the offering is seasoned

D) the lockup period expires

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Level 3 NASDAQ subscribers ________.

A) are registered market makers

B) can post bid and ask prices

C) have the fastest execution of trades

D) all of these options

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ price is the price at which a dealer is willing to purchase a security.

A) bid

B) ask

C) clearing

D) settlement

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The NYSE has lost market share to ECNs in recent years. Part of the NYSE's response to the growth of ECNs has been to: I. Purchase Archipelago, a major ECN, and rename it NYSE Arca II. Enable automatic trade execution through its new Market Center III. Impose a tighter limit on bid-ask spreads

A) I only

B) II and III only

C) I and II only

D) I, II, and III

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to multiple studies by Ritter, initial public offerings tend to exhibit ________ performance initially and ________ performance over the long term.

A) bad; good

B) bad; bad

C) good; good

D) good; bad

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ________ price is the price at which a dealer is willing to sell a security.

A) bid

B) ask

C) clearing

D) settlement

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is (are) true about dark pools? I. They allow anonymity in trading. II. They often involve large blocks of stocks. III. Trades made through them might not be reported.

A) I and II only

B) II and III only

C) I and III only

D) I, II, and III

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The fully automated trade-execution system installed on the NYSE is called ________.

A) FAX

B) Direct +

C) NASDAQ

D) SUPERDOT

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Underwriting is one of the services provided by ________.

A) the SEC

B) investment bankers

C) publicly traded companies

D) FDIC

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What was the result of high-frequency traders' leaving the market during the flash crash of 2010?

A) Market liquidity decreased.

B) Market liquidity increased.

C) Market volatility decreased.

D) Trading frequency increased.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The CFA Institute Standards of Professional Conduct require that members ________.

A) place their clients' interests before their own

B) disclose conflicts of interest to clients

C) inform their employers that they are obligated to comply with the Standards of Professional Conduct

D) all of these options

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The over-the-counter securities market is a good example of ________.

A) an auction market

B) a brokered market

C) a dealer market

D) a direct search market

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What happened to the effective spread on trades when the SEC allowed the minimum tick size to move from one-eighth of a dollar to one-sixteenth of a dollar in 1997 and from one-sixteenth of a dollar to one cent in 2001?

A) The effective spread increased in 1997 but decreased in 2001.

B) The effective spread increased in both cases.

C) The effective spread decreased in 1997 but increased in 2001.

D) The effective spread decreased in both cases.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average depth of the limit order book is ________.

A) lower for the large stocks in the S&P 500 Index than for the smaller stocks in the Russell 2000 Index

B) higher for the large stocks in the S&P 500 Index than for the smaller stocks in the Russell 2000 Index

C) about the same for both the large stocks in the S&P 500 Index and the smaller stocks in the Russell 2000 Index

D) unrelated to the sizes of the stocks in the indexes

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 94

Related Exams