A) Are those individuals involved in managing and operating the company.

B) Include internal auditors and consultants.

C) Are not directly involved in operating the company.

D) Make strategic decisions for a company.

E) Make operating decisions for a company.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The background on a company, its industry, and its economic setting is usually included in which of the following sections of a financial statement analysis report?

A) Executive summary.

B) Analysis overview.

C) Evidential conclusions.

D) Factor analysis.

E) Inferences.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Vertical analysis is the comparison of a company's financial condition and performance across time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The common-size percent is computed by:

A) Dividing the analysis amount by the base amount.

B) Dividing the base amount by the analysis amount.

C) Dividing the analysis amount by the base amount and multiplying the result by 100.

D) Dividing the base amount by the analysis amount and multiplying the result by 1,000.

E) Subtracting the base amount from the analysis amount and multiplying the result by 100.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following selected financial information from Hansen's, LLC. Compute the company's times interest earned for Year 2.

A) 6.9.

B) 4.8.

C) 5.8.

D) 14.0.

E) 7.9.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Horizontal analysis is the comparison of a company's financial condition and performance to a base amount.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial statements with data for two or more successive accounting periods placed in columns side by side, sometimes with changes shown in dollar amounts and percents, are referred to as:

A) Period-to-period statements.

B) Controlling statements.

C) Successive statements.

D) Comparative statements.

E) Serial statements.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

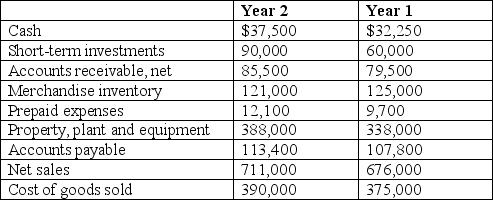

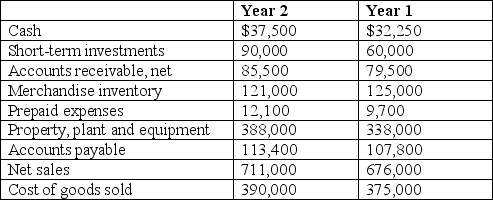

Use the following selected information from Farris, LLC to determine the Year 2 and Year 1 trend percents for cost of goods sold using Year 1 as the base.

A) 36.4% for Year 2 and 41.1% for Year 1.

B) 55.0% for Year 2 and 56.0% for Year 1.

C) 119.4% for Year 2 and 100.0% for Year 1.

D) 117.2% for Year 2 and 100.0% for Year 1.

E) 65.1% for Year 2 and 64.6% for Year 1.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Ratios, like other analysis tools, are only historically oriented.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

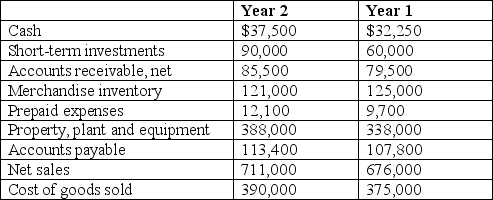

Refer to the following selected financial information from Fennie's, LLC. Compute the company's days' sales in inventory for Year 2.

A) 43.9.

B) 42.3.

C) 46.2.

D) 80.0.

E) 113.3.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following selected financial information from Fennie's, LLC. Compute the company's accounts receivable turnover for Year 2.

A) 8.32.

B) 8.62.

C) 8.94.

D) 5.78.

E) 7.90.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Liquidity and efficiency are considered to be building blocks of financial statement analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to the following selected financial information from Fennie's, LLC. Compute the company's current ratio for Year 2.

A) 2.26.

B) 1.98.

C) 2.95.

D) 3.05.

E) 1.88.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Measures taken from a selected competitor or a group of competitors are often excellent standards of comparison for analysis.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Three of the most common tools of financial analysis are:

A) Financial reporting, ratio analysis, vertical analysis.

B) Ratio analysis, horizontal analysis, financial reporting.

C) Horizontal analysis, vertical analysis, ratio analysis.

D) Trend analysis, financial reporting, ratio analysis.

E) Vertical analysis, political analysis, horizontal analysis.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation reported cash of $14,000 and total assets of $178,300. Its common-size percent for cash equals:

A) .0785%.

B) 7.85%.

C) 12.73%.

D) 1273%.

E) 7850%.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Net sales divided by average total assets is the:

A) Profit margin.

B) Total asset turnover.

C) Current ratio.

D) Sales return ratio.

E) Return on total assets.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Intracompany analysis is based on comparisons with competitors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following selected information from Farris, LLC to determine the Year 2 and Year 1 common size percents for cost of goods sold using Year 1 net sales as the base.

A) 36.4% for Year 2 and 41.1% for Year 1.

B) 55.0% for Year 2 and 56.0% for Year 1.

C) 119.4% for Year 2 and 100.0% for Year 1.

D) 117.2% for Year 2 and 100.0% for Year 1.

E) 65.1% for Year 2 and 64.6% for Year 1.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ability to generate positive market expectations is called:

A) Liquidity and efficiency.

B) Liquidity and solvency.

C) Profitability.

D) Market prospects.

E) Creditworthiness.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 182

Related Exams