A) dividend income tax.

B) social insurance tax.

C) value added tax.

D) capital gains tax.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the most difficult issues associated with trying to structure a tax policy to satisfy horizontal equity is determining

A) whether or not a taxpayer falls within the highest income quintile.

B) the level of transfer payments made to low-income groups.

C) the source of income for taxpayers.

D) what differences are relevant to a family's ability to pay.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

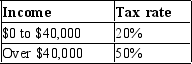

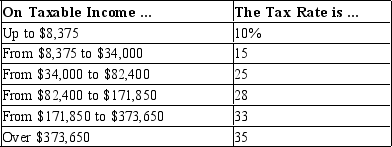

Table 12-3  -Refer to Table 12-3. What is the marginal tax rate for a person who makes $60,000?

-Refer to Table 12-3. What is the marginal tax rate for a person who makes $60,000?

A) 20%

B) 30%

C) 40%

D) 50%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As tax laws become more complex,

A) the administrative burden of taxes will increase.

B) compliance costs are likely to decrease.

C) the government will collect more in tax revenue.

D) the amount of tax revenue lost to tax evasion will decrease.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

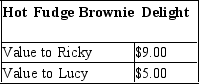

Table 12-2  -Refer to Table 12-2. Suppose that the government imposes a $2 tax on delights, causing the price to increase from $4.00 to $6.00. Total consumer surplus

-Refer to Table 12-2. Suppose that the government imposes a $2 tax on delights, causing the price to increase from $4.00 to $6.00. Total consumer surplus

A) falls by less than the tax revenue generated.

B) falls by more than the tax revenue generated.

C) falls by the same amount as the tax revenue generated.

D) will not fall since Jennifer will no longer be in the market.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

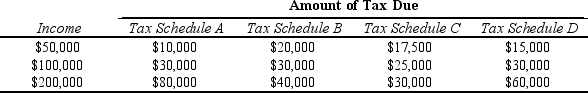

Table 12-20

The following table presents the total tax liability for an unmarried taxpayer under four different tax schedules for the income levels shown.  -Refer to Table 12-20. Which tax schedules are proportional?

-Refer to Table 12-20. Which tax schedules are proportional?

A) Tax Schedule B only

B) Tax Schedule B and Tax Schedule C

C) Tax Schedule D only

D) Tax Schedule A and Tax Schedule B

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because taxes distort incentives, they typically result in

A) deadweight losses.

B) reductions in consumer surplus.

C) reductions in producer surplus.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes on specific goods such as cigarettes, gasoline, and alcoholic beverages are called

A) sales taxes.

B) excise taxes.

C) social insurance taxes.

D) consumption taxes.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

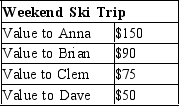

Table 12-1  -Refer to Table 12-1. Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing. What is the value of the surplus that accrues to all four skiers from their weekend trip?

-Refer to Table 12-1. Assume that the price of a weekend ski pass is $45 and that the price reflects the actual unit cost of providing a weekend of skiing. What is the value of the surplus that accrues to all four skiers from their weekend trip?

A) $75

B) $105

C) $185

D) $215

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Vertical and horizontal equity are widely accepted and applying them to evaluate a tax system is always straightforward.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A person's tax obligation divided by her income is called her

A) marginal social tax rate.

B) marginal private tax rate.

C) marginal tax rate.

D) average tax rate.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lump-sum taxes are rarely used in the real world because

A) while lump-sum taxes have low administrative burdens, they have high deadweight losses.

B) while lump-sum taxes have low deadweight losses, they have high administrative burdens.

C) lump-sum taxes are often viewed as unfair because they take the same amount of money from both poor and rich.

D) lump-sum taxes are very inefficient.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If revenue from a gasoline tax is used to build and maintain public roads, the gasoline tax may be justified on the basis of

A) the benefits principle.

B) the ability-to-pay principle.

C) vertical equity.

D) horizontal equity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If we want to gauge the sacrifice made by a taxpayer, we should use the

A) average tax rate.

B) marginal tax rate.

C) lump-sum tax rate.

D) sales tax rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) All states have state income taxes, but the percentages vary widely.

B) Sales taxes and property taxes are important revenue sources for state and local governments.

C) Medicare spending has increased because the percentage of the population that is elderly and the cost of healthcare have both increased.

D) A budget deficit occurs when government spending exceeds government receipts.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

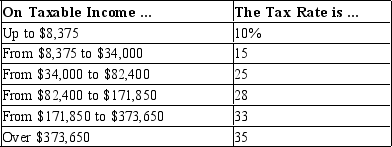

Table 12-10  -Refer to Table 12-10. If Si has $100,000 in taxable income, his average tax rate is

-Refer to Table 12-10. If Si has $100,000 in taxable income, his average tax rate is

A) 13.7%.

B) 15.2%.

C) 21.7%.

D) 28.3%.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate profits are

A) included in payroll taxes.

B) exempt from taxes.

C) taxed twice, once as profit and once as dividends.

D) taxed to pay for Medicare.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

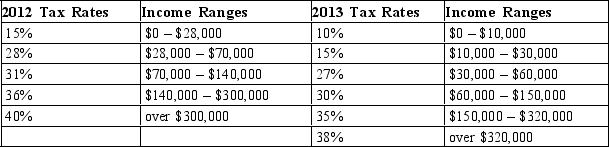

Table 12-9

United States Income Tax Rates for a Single Individual, 2012 and 2013.  -Refer to Table 12-9. Ruby Sue is a single person whose taxable income is $100,000 a year. What is her marginal tax rate in 2012?

-Refer to Table 12-9. Ruby Sue is a single person whose taxable income is $100,000 a year. What is her marginal tax rate in 2012?

A) 15%

B) 28%

C) 31%

D) 36%

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Table 12-10  -Refer to Table 12-10. If Si has $100,000 in taxable income, his tax liability will be

-Refer to Table 12-10. If Si has $100,000 in taxable income, his tax liability will be

A) $838.

B) $3,844.

C) $12,100.

D) $21,709.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose Luke values a scoop of Italian gelato at $4. Leia values a scoop of Italian gelato at $6. The pre-tax price of a scoop of Italian gelato is $2. The government imposes a "fat tax" of $3 on each scoop of Italian gelato, and the price rises to $5. The deadweight loss from the tax is

A) $1.

B) $2.

C) $3.

D) $4.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 549

Related Exams