A) $40,000.

B) $28,000.

C) $18,000.

D) $44,000.

E) $12,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

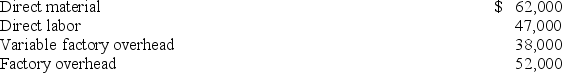

Frederick Co. is thinking about having one of its products manufactured by an outside supplier. Currently, the cost of manufacturing 5,000 units is:

If Frederick can buy 5,000 units from an outside supplier for $130,000, it should:

If Frederick can buy 5,000 units from an outside supplier for $130,000, it should:

A) Make the product because current factory overhead is less than $130,000.

B) Make the product because the cost of direct material plus direct labor of manufacturing is less than $130,000.

C) Make the product because factory overhead is a sunk cost.

D) Buy the product because total fixed and variable manufacturing costs are greater than $130,000.

E) Buy the product because the total incremental costs of manufacturing are greater than $130,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chang Industries has 2,000 defective units of product that already cost $14 each to produce. A salvage company will purchase the defective units as is for $5 each. Chang's production manager reports that the defects can be corrected for $6 per unit, enabling them to be sold at their regular market price of $21. The $14 per unit is a:

A) Incremental cost.

B) Sunk cost.

C) Out-of-pocket cost.

D) Opportunity cost.

E) Period cost.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Significant sunk costs are relevant to decisions about the future.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If the cost to buy a part is less than the direct material, direct labor, and incremental overhead cost of making the part, the company should buy the part.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

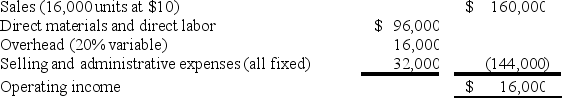

Benjamin Company had the following results of operations for the past year:  A foreign company offers to buy 4,000 units at $7.50 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $600 and selling and administrative costs by $300. Assuming Benjamin's productive capacity is 16,000 units per year and it accepts the offer, its profits will:

A foreign company offers to buy 4,000 units at $7.50 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $600 and selling and administrative costs by $300. Assuming Benjamin's productive capacity is 16,000 units per year and it accepts the offer, its profits will:

A) Decrease by $10,000.

B) Decrease by $10,900.

C) Decrease by $6,000.

D) Increase by $9,100.

E) Increase by $4,300.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bricktan Inc. makes three products, basic, classic, and deluxe. The maximum Bricktan can sell is 715,000 units of basic, 420,000 units of classic, and 120,000 units of deluxe. Bricktan has limited production capacity of 90,000 hours. It can produce 10 units of basic, 8 units of classic, and 4 units of deluxe per hour. Contribution margin per unit is $15 for the basic, $25 for the classic, and $55 for the deluxe. What is the most profitable sales mix for Bricktan Inc.?

A) 71,500 basic, 420,000 classic and 240,000 deluxe.

B) 150,000 basic, 120,000 classic and 240,000 deluxe.

C) 300,000 basic, 240,000 classic and 120,000 deluxe.

D) 600,000 basic, 0 classic and 120,000 deluxe.

E) 75,000 basic, 420,000 classic and 120,000 deluxe.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has the choice of either selling 1,000 unfinished units as is or completing them. The company could sell the unfinished units as is for $4.00 per unit. Alternatively, it could complete the units with incremental costs of $1.00 per unit for direct materials, $2.00 per unit for direct labor, and $1.50 per unit for overhead, and then sell the finished units for $8.00 each. What should the company do?

A) Sell the units as is.

B) Finish the units.

C) It does not matter because both alternatives have the same result.

D) Neither sell nor finish because both alternatives produce a loss. Instead, the company should store the units permanently.

E) Donate the units.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Valdez Company is considering eliminating its kitchen division, which reported an operating loss of $53,000 for the past year. Kitchen division sales for the year were $1,040,000, and its variable costs were $775,000. The fixed costs of the division were $318,000. If the kitchen division is dropped, 60% of the fixed costs allocated to it could be eliminated. The impact on Valdez's operating income from eliminating this business segment would be:

A) $74,200 decrease

B) $265,000 increase

C) $274,200 decrease

D) $74,200 increase

E) $265,000 decrease

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a company has the capacity to produce either 10,000 units of Product A or 10,000 units of Product B; assuming fixed costs are the same, production restrictions are the same for both products, and the markets for both products are unlimited; the company should commit 100% of its capacity to the product that has the higher contribution margin per unit of operating capacity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What decision rule should be followed when deciding if a business segment should be eliminated?

A) Segments generating a net loss should always be eliminated.

B) Segments with revenues that are more than avoidable expenses should be considered for elimination.

C) Segments with revenues that are more than unavoidable expenses should be considered for elimination.

D) Segments with revenues that are less than avoidable expenses should be considered for elimination.

E) Segments with revenues that are less than unavoidable expenses should be considered for elimination.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

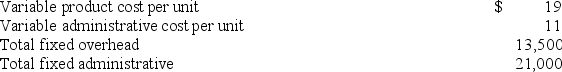

Pauley Company needs to determine a markup for a new product. Pauley expects to sell 15,000 units and wants a target profit of $22 per unit. Additional information is as follows:  Using the variable cost method, what markup percentage to variable cost should be used?

Using the variable cost method, what markup percentage to variable cost should be used?

A) 71%

B) 76%

C) 92%

D) 81%

E) 80%

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bluebird Mfg. has received a special one-time order for 15,000 bird feeders at $3 per unit. Bluebird currently produces and sells 75,000 units at $7.00 each. This level represents 80% of its capacity. These bird feeders would be marketed under the wholesaler's name and would not affect Bluebird's sales through its normal channels. Production costs for these units are $3.50 per unit, which includes $2.25 variable cost and $1.25 fixed cost. If Bluebird accepts this additional business, the effect on net income will be:

A) $45,000 increase.

B) $11,250 increase.

C) $33,750 increase.

D) $7,500 decrease.

E) $33,750 decrease.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

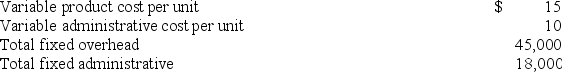

Jaybird Company operates in a highly competitive market where the market price for its product is $50 per unit. Jaybird desires a $15 profit per unit. Jaybird expects to sell 5,000 units. Additional information is as follows:  To achieve the target cost per unit, Jaybird must reduce total expenses by how much?

To achieve the target cost per unit, Jaybird must reduce total expenses by how much?

A) $14,500

B) $3,500

C) $23,000

D) $20,000

E) $13,000

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

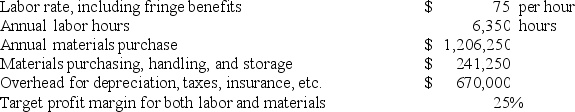

Shale Remodeling uses time and materials pricing. It is setting prices for next year using the following information:  What should Shale set as the materials markup per dollar of materials used?

What should Shale set as the materials markup per dollar of materials used?

A) 25%.

B) 45%.

C) 40%.

D) 20%.

E) 50%.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Soar Incorporated is considering eliminating its mountain bike division, which reported an operating loss for the recent year of $3,000. The division sales for the year were $1,050,000 and the variable costs were $860,000. The fixed costs of the division were $193,000. If the mountain bike division is dropped, 30% of the fixed costs allocated to that division could be eliminated. The impact on operating income for eliminating this business segment would be:

A) $57,900 decrease

B) $132,100 decrease

C) $54,900 decrease

D) $190,000 increase

E) $190,000 decrease

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

iSooky has a spotter truck with a book value of $40,000 and a remaining useful life of five years. At the end of the five years the spotter truck will have a zero salvage value. The market value of the spotter truck is currently $32,000. iSooky can purchase a new spotter truck for $120,000 and receive $31,000 in return for trading in its old spotter truck. The new spotter truck will reduce variable manufacturing costs by $25,000 per year over the five-year life of the new spotter truck. The total increase or decrease in income by replacing the current spotter truck with the new truck (ignoring the time value of money) is:

A) $31,000 decrease

B) $31,000 increase

C) $36,000 decrease

D) $120,000 decrease

E) $36,000 increase

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Additional costs incurred if a company pursues a certain course of action are sunk costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Additional power for operating machines, extra supplies, and added cleanup costs are examples of incremental overhead costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Janko Wellspring Inc. has a pump with a book value of $24,000 and a four-year remaining life. A new, more efficient pump, is available at a cost of $45,000. Janko can also receive $8,000 for trading in the old pump. The new pump will reduce variable costs by $10,000 per year over its four-year life. The costs not relevant to the decision of whether or not to replace the pump are:

A) $40,000.

B) $8,000.

C) $10,000.

D) $24,000.

E) $16,000.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 145

Related Exams