A) $68,000.

B) $78,000.

C) $96,000.

D) $98,000.

E) $100,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wheeler Company can produce a product that incurs the following costs per unit: direct materials, $10; direct labor, $24, and overhead, $16. An outside supplier has offered to sell the product to Wheeler for $45. If Wheeler buys from the supplier, it will still incur 45% of its overhead cost. Compute the net incremental cost or savings of buying.

A) $4.00 savings per unit.

B) $4.00 cost per unit.

C) $2.20 cost per unit.

D) $3.80 cost per unit.

E) $2.20 savings per unit.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Short Answer

________ revenues are the additional revenue generated by selecting a certain course of action over another..

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chang Industries has 2,000 tables that cost $115 each to produce. Each table can be sold as is for $221 or finished with a stain or paint. The cost to add a finish to each table is $75. Finished tables can be sold for $310. Chang should:

A) Finish the table for incremental cost of $190 per table.

B) Sell the unfinished tables for profit of $195 per table.

C) Finish the table for profit of $89 per table.

D) Sell unfinished tables for $106 incremental revenue per table.

E) Finish the table for profit of $14 per table.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Short Answer

A(n) ________ requires a future outlay of cash and is relevant for current and future decision making.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

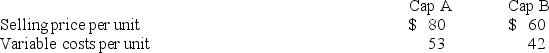

The Mad Hatter Company owns a machine that manufactures two types of chimney caps. Production time is .20 hours for cap A and .40 hours for cap B. The machine's capacity is 2,000 hours per year. Both products are sold to a single customer who has agreed to buy all of the company's output up to a maximum of 1,000 units of cap A and 6,000 units of cap B. Selling prices and variable costs per unit are shown below. Based on this information, what is Mad Hatter's most profitable sales mix?

A) 10,000 units of cap A.

B) 5,000 units of cap B.

C) 1,000 units of cap A and 5,000 units of cap B.

D) 1,000 units of cap A and 6,000 units of cap B.

E) 1,000 units of cap A and 4,500 units of cap B.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Elliot Company can sell all of its products A and Z that it can produce, but it has limited production capacity. It can produce 8 units of A per hour or 10 units of Z per hour, and it has 20,000 production hours available. Contribution margin per unit is $12 for A and $10 for Z. What is the most profitable sales mix for Elliot Company?

A) 84,000 units of A and 60,000 units of Z.

B) 48,000 units of A and 80,000 units of Z.

C) 60,000 units of A and 100,000 units of Z.

D) 120,000 units of A and 0 units of Z.

E) 0 units of A and 200,000 units of Z.

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A sunk cost arises from a past decision and cannot be avoided or changed.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sunk costs are irrelevant to future decisions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

JK Company can sell all of the plush and supreme products it can produce, but it has limited production capacity. It can produce 4 plush units per hour or 2 supreme units per hour, and it has 2,000 production hours available. Contribution margin per unit is $214 for the plush product and $300 for the supreme product. What is the most profitable sales mix for JK Company?

A) 0 plush units and 4,000 supreme units.

B) 4,000 plush units and 4,000 supreme units.

C) 8,000 plush units and 0 supreme units.

D) 8,000 plush units and 4,000 supreme units.

E) 4,000 plush units and 2,000 supreme units.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

In a make or buy decision, management should focus on costs that are the same under the two alternatives.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

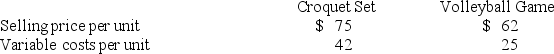

Bandy Corporation owns a machine that manufactures lawn game sets. Production time for the croquet set is 10 units per hour and for the volleyball set is 8 units per hour. The machine's capacity is 1,500 hours per year. Both products are sold to a single customer who has agreed to buy all of the company's output up to a maximum of 4,000 croquet sets and 10,000 volleyball sets. Selling prices and variable costs per unit are shown below. Based on this information, what is Bandy Corporation's most profitable sales mix?

A) 15,000 croquet sets.

B) 12,000 volleyball sets.

C) 4,000 croquet sets and 10,000 volleyball sets.

D) 4,000 croquet sets and 8,800 volleyball sets.

E) 2,500 croquet sets and 10,000 volleyball sets.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To determine a product selling price based on the total cost method, management should include:

A) Total production and nonproduction costs plus a markup.

B) Total production and nonproduction costs only.

C) Total production costs plus a markup.

D) Total nonproduction costs plus a markup.

E) Only a markup.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Logan Company can sell all of the standard and premier products they can produce, but it has limited production capacity. It can produce 6 standard units per hour or 4 premier units per hour, and it has 36,000 production hours available. Contribution margin per unit is $24 for the standard product and $30 for the premier product. What is the total contribution margin if Logan chooses the most profitable sales mix?

A) $7,280,000.

B) $8,800,000.

C) $4,960,000.

D) $5,184,000.

E) $6,704,000.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume markup percentage equals desired profit divided by total costs. What is the correct calculation to determine the dollar amount of the markup per unit?

A) Total cost times markup percentage.

B) Total cost per unit times markup percentage per unit.

C) Total cost per unit divided by markup percentage per unit.

D) Markup percentage per unit divided by total cost per unit.

E) Markup percentage divided by total cost.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

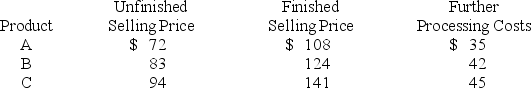

A company has already incurred a $55,000 cost in partially producing its three products. Their selling prices when partially and fully processed are shown in the following table with the additional costs necessary to finish their processing. Based on this information, should any products be processed further?

A) All of these products should be processed further.

B) None of these products should be processed further.

C) Products A and B should be processed further.

D) Products B and C should be processed further.

E) Products A and C should be processed further.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Short Answer

The process of buying goods or services from an external supplier is called ________.

Correct Answer

verified

Correct Answer

verified

True/False

Incremental costs are also called out-of-pocket costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Product A requires 5 machine hours per unit to be produced, Product B requires only 3 machine hours per unit, and the company's productive capacity is limited to 240,000 machine hours. Product A sells for $16 per unit and has variable costs of $6 per unit. Product B sells for $12 per unit and has variable costs of $5 per unit. Assuming the company can sell as many units of either product it produces, the company should:

A) Produce only Product A.

B) Produce only Product B.

C) Produce equal amounts of A and B.

D) Produce A and B in the ratio of 62.5% A to 37.5% B.

E) Produce A and B in the ratio of 40% A and 60% B.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company has the choice of either selling 600 apples or processing them into applesauce. The company could sell the apples as is for $2.00 per unit. Alternatively, each apple could be made into one unit of applesauce with incremental costs of $0.60 per unit for direct materials, $1.00 per unit for direct labor, and $0.80 per unit for overhead, and then sold for $5.00 each. What is the amount of incremental revenue from processing the apples into applesauce?

A) $3.00 per unit.

B) $5.00 per unit.

C) $7.00 per unit.

D) $2.40 per unit.

E) $0.60 per unit.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 145

Related Exams