B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In preparing financial budgets:

A) The budgeted balance sheet is usually prepared last.

B) The cash budget is usually not prepared.

C) The budgeted income statement is usually not prepared.

D) The capital expenditures budget is usually prepared last.

E) The budgeted income statement is usually prepared last.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following budgets is not a budget that a manufacturer would include in its master budget?

A) Sales budget.

B) Direct materials budget.

C) Production budget.

D) Merchandise purchases budget.

E) Cash budget.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In preparing a budgeted balance sheet, the dollar amount of Accounts Receivable can be derived from:

A) The purchases budget and schedule of cash payments.

B) The sales budget and the schedule of cash receipts.

C) The capital expenditures budget and purchases budget.

D) The budgeted income statement and budgeted balance sheet.

E) The selling expenses budget and the schedule of cash receipts.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Essay

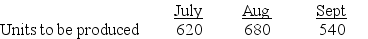

The production budget for Greski Company shows the following production volume for the months of July-September. Each unit produced requires 2.5 hours of direct labor. The direct labor rate is predicted to be $16 per hour in all months. Prepare a direct labor budget for Greski Company for July-September.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A quantity of inventory that provides protection against lost sales caused by unfulfilled demands from customers is called:

A) Just-in-time inventory.

B) Budgeted stock.

C) Continuous inventory.

D) Capital stock.

E) Safety stock.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A sporting goods manufacturer budgets production of 45,000 pairs of ski boots in the first quarter and 30,000 pairs in the second quarter of the upcoming year. Each pair of boots requires 2 kilograms (kg) of a key raw material. The company aims to end each quarter with ending raw materials inventory equal to 20% of the following quarter's material needs. Beginning inventory for this material is 18,000 kg and the cost per kg is $8. What is the budgeted materials purchases cost for the first quarter?

A) $720,000.

B) $672,000.

C) $576,000.

D) $729,600.

E) $864,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following factors is least likely to be considered in preparing a sales budget?

A) Business capacity.

B) Forecasted economic and market conditions.

C) Prediction of unit sales.

D) The capital expenditures budget.

E) Proposed selling expenses, such as advertising.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ratchet Manufacturing anticipates total sales for August, September, and October of $200,000, $210,000, and $220,500 respectively. Cash sales are normally 25% of total sales and the remaining sales are on credit. All credit sales are collected in the first month after the sale. Compute the amount of accounts receivable to be reported on the company's budgeted balance sheet for August.

A) $150,000.

B) $50,000.

C) $157,500.

D) $52,500.

E) $200,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trago Company manufactures a single product and has a JIT policy that ending inventory must equal 5% of the next month's sales. It estimates that May's ending inventory will consist of 14,000 units. June and July sales are estimated to be 280,000 and 290,000 units, respectively. Compute the number of units to be produced in June.

A) 290,000.

B) 294,500.

C) 280,500.

D) 280,000.

E) 266,000.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a bottom-up process of budget development, which of the following should be initially responsible for developing sales estimates?

A) The budget committee.

B) The accounting department.

C) The sales department.

D) Top management.

E) The marketing department.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

Groundworks Company budgeted the following credit sales during the current year: September, $90,000; October, $123,000; November, $105,000; December, $111,000. Experience has shown that cash from credit sales is received as follows: 10% in the month of sale, 50% in the first month after sale, 35% in the second month after sale, and 5% is uncollectible. How much cash should Groundworks Company expect to collect in November from its current and past credit sales?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If budgeted beginning inventory is $8,300, budgeted ending inventory is $9,400, and budgeted cost of goods sold is $10,260, budgeted purchases should be:

A) $860

B) $1,100

C) $1,960

D) $9,160

E) $11,360

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Zhang Industries sells a product for $700 per unit. Unit sales for May were 400, and each month's unit sales are expected to grow by 3%. Zhang pays a sales manager a monthly salary of $3,000 and a commission of 2% of sales. Compute the budgeted selling expense for the manager for the month ended June 30.

A) $8,600.

B) $11,652.

C) $8,652.

D) $5,768.

E) $8,768.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Essay

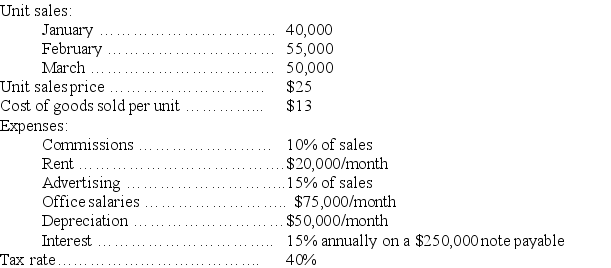

Argenta, Inc. is preparing its master budget for the first quarter ending March 31. The following forecasted data relate to the first quarter:

Prepare a budgeted income statement for the first quarter.

Prepare a budgeted income statement for the first quarter.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On its December 31, 2017, balance sheet, Calgary Industries reports equipment of $370,000 and accumulated depreciation of $74,000. During 2018, the company plans to purchase additional equipment costing $80,000 and expects depreciation expense of $30,000. Additionally, it plans to dispose of equipment that originally cost $42,000 and had accumulated depreciation of $5,600. The balances for equipment and accumulated depreciation, respectively, on the December 31, 2018 budgeted balance sheet are:

A) $328,000; $74,000.

B) $450,000; $98,400.

C) $450,000; $104,000.

D) $408,000; $104,000.

E) $408,000; $98,400.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A plan that lists the types and amounts of selling expenses expected during the budget period is called a(n) :

A) Sales budget.

B) General and administrative budget.

C) Capital expenditures budget.

D) Selling expense budget.

E) Purchases budget.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Budget preparation is best done in a top-down managerial approach.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Webster Corporation's monthly projected general and administrative expenses include $5,000 administrative salaries, $2,400 of other cash administrative expenses, $1,350 of depreciation expense on the administrative equipment, and 0.5% monthly interest on an outstanding bank loan of $10,000. Compute the total budgeted general and administrative expenses budget per month.

A) $17,400.

B) $7,400.

C) $8,750.

D) $5,050.

E) $8,800.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The financial statement effects of the budgeting process are summarized on the cash budget and the capital expenditures budget.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 215

Related Exams